Vaisala Corporation Interim Report January-September 2017

Vaisala Corporation Interim Report October 23, 2017 at 2.00 p.m. (EEST)

Vaisala Corporation Interim Report January-September 2017

Third-quarter orders received were strong and operating result was 16.9% of net sales

Third quarter 2017 highlights

- Orders received EUR 100.1 (76.6) million, increase 31%

- Order book at the end of the period EUR 145.0 (114.8) million, increase 26%

- Net sales EUR 87.1 (81.8) million, increase 6%

- Gross margin 52.8% (53.9%)

- Operating result (EBIT) EUR 14.7 (5.3) million, 16.9% (6.5%) 0f net sales. Third quarter included EUR 0.8 million cost related to transformation in Digital Solutions business in Weather and Environment Business Area. Comparison period included EUR 10.5 million write-down of intangible assets.

- Earnings per share EUR 0.59 (0.21)

- Cash flow from operating activities EUR 14.9 (10.0) million

- Business outlook for 2017 unchanged: Vaisala estimates its full-year 2017 net sales to be in the range of EUR 310-340 million and its operating result (EBIT) to be in the range of EUR 32-42 million.

January-September 2017 highlights

- Orders received EUR 262.9 (218.3) million, increase 20%

- Net sales EUR 230.3 (226.0) million, increase 2%

- Gross margin 52.2% (51.4%)

- Operating result (EBIT) EUR 22.4 (7.7) million, 9.7% (3.4%) of net sales. Third quarter included EUR 0.8 million cost related to transformation in Digital Solutions business in Weather and Environment Business Area. Comparison period included EUR 10.5 million write-down of intangible assets.

- Earnings per share EUR 0.86 (0.26)

- Cash flow from operating activities EUR 26.2 (17.1) million

- Cash and cash equivalents at the end of the period EUR 72.3 (49.9) million, increase 45%

Vaisala's President and CEO Kjell Forsén comments on the third quarter 2017

"In the third quarter, orders received were strong and exceeded one hundred million euros for the first time in Vaisala's history. We entered the last quarter of this year with a 26% higher order book than a year ago. In Weather and Environment Business Area, third-quarter order intake growth was outstanding at 50% year-on-year and included several large project orders. Finally, following almost ten years of negotiations, we were able to book the first project phase amounting to EUR 6.3 million of the Vietnamese contract announced in February 2016. Deliveries started during the third quarter, and Vietnam is expected to allocate budget funds for the second phase still this year. Demand was exceptionally strong in meteorology customer segment, and we signed among others several contracts for automatic radiosonde launching systems. In transportation and renewable energy customer segments demand did not improve. In Industrial Measurements Business Area, order intake slightly decreased compared to strong previous year due to slowness in Americas. However, orders continued to increase in APAC, and order book remained above ten million euros.

Third-quarter net sales increased by 6%. The increase came mainly from Weather and Environment Business Areas's project deliveries, which increased by 51% compared to previous year. Industrial Measurements Business Areas's net sales were all time high on quarterly level, even though year-on-year growth was modest 2%. Vaisala's operating result was 16.9% of net sales, which is seasonally good as usually in third quarter. Industrial Measurements Business Area reached excellent operating result of 29.0% of net sales and Weather and Environment Business Area 12.3%.

In Weather and Environment Business Area's Digital Solutions unit, our long-term target is to exceed 10% annual net sales growth. In order to reach this target, we have launched a new organization, reviewed the strategy and started infrastructure transition to cloud based solutions. Third-quarter operating result included EUR 0.8 million cost related to this transformation.

I am confident with our full-year outlook and we continue to estimate our full-year net sales to be in the range of EUR 310-340 million and the operating result (EBIT) in the range of EUR 32-42 million."

| Key Figures | |||||

| 7-9/2017 | 7-9/2016 | 1-9/2017 | 1-9/2016 | 1-12/2016 | |

| Orders received, EUR million | 100.1 | 76.6 | 262.9 | 218.3 | 311.3 |

| Order book, EUR million | 145.0 | 114.8 | 145.0 | 114.8 | 118.0 |

| Net sales, EUR million | 87.1 | 81.8 | 230.3 | 226.0 | 319.1 |

| Gross profit, EUR million | 46.0 | 44.1 | 120.3 | 116.3 | 164.8 |

| Gross margin, % | 52.8 | 53.9 | 52.2 | 51.4 | 51.6 |

| Operating expenses, EUR million | 30.5 | 40.1 | 97.8 | 107.3 | 141.5 |

| Operating result, EUR million | 14.7 | 5.3 | 22.4 | 7.7 | 22.3 |

| Operating result, % | 16.9 | 6.5 | 9.7 | 3.4 | 7.0 |

| Profit (loss) before taxes, EUR million | 13.8 | 4.6 | 20.0 | 5.8 | 22.1 |

| Profit (loss) for the period, EUR million | 10.6 | 3.8 | 15.4 | 4.7 | 18.8 |

| Earnings per share, EUR | 0.59 | 0.21 | 0.86 | 0.26 | 1.05 |

| Return on equity, % | 11.7 | 3.6 | 10.5 | ||

| Capital expenditure, EUR million | 2.8 | 2.3 | 6.6 | 6.2 | 7.7 |

| Depreciation, EUR million | 2.2 | 14.1 | 7.5 | 21.3 | 24.1 |

| Cash flow from operating activities, EUR million | 14.9 | 10.0 | 26.2 | 17.1 | 41.8 |

| Cash and cash equivalents, EUR million | 72.3 | 49.9 | 72.4 |

Market situation in the third quarter 2017

During the third quarter 2017, global economic growth remained solid and Vaisala achieved all time high order intake during one single quarter. Order intake was strong especially in Weather and Environment Business Area.

In Weather and Environment Business Area, growth in order intake came from all regions. Demand was particularly strong in meteorological customer segment. In addition to the good overall business activity, some large contracts were signed. Demand from transportation and renewable energy customer segments did not improve.

During the third quarter, order intake for industrial measurement solutions was slightly lower than during the first half of the year. However, orders continued to grow in APAC. Customers' interest towards power transmission products remained strong, and Vaisala received first commercial orders.

Third quarter 2017

Orders received

| EUR million | 7-9/2017 | 7-9/2016 | Change, % | 2016 |

| Weather and Environment | 72.5 | 48.5 | 50 | 206.0 |

| Industrial Measurements | 27.6 | 28.1 | -2 | 105.3 |

| Total | 100.1 | 76.6 | 31 | 311.3 |

In the third quarter 2017, Vaisala's orders received increased by 31% compared to previous year and were EUR 100.1 (76.6) million. The increase was strong in all geographical areas. Orders received included several large project orders. EUR 6.3 million, the first phase, of the Vietnamese contract announced in February 2016 was booked in the third quarter.

In the third quarter 2017, Weather and Environment Business Area's orders received increased by 50% compared to previous year and were EUR 72.5 (48.5) million. Orders received included several large project orders. The increase was strong in all regions. EUR 6.3 million, the first phase, of the Vietnamese contract announced in February 2016 was booked in the third quarter.

In the third quarter 2017, Industrial Measurements Business Area's orders received decreased by 2% compared to strong previous year and were EUR 27.6 (28.1) million. The decrease came from Americas.

Order book

| EUR million | Sep 30, 2017 | Sep 30, 2016 | Change,% | Dec 31, 2016 |

| Weather and Environment | 134.3 | 106.4 | 26 | 109.4 |

| Industrial Measurements | 10.7 | 8.3 | 28 | 8.6 |

| Total | 145.0 | 114.8 | 26 | 118.0 |

At the end of September 2017, Vaisala's order book was EUR 145.0 (114.8) million and increased by 26% compared to previous year. Order book increased in all geographical areas. EUR 66.1 (53.7) million of the order book is scheduled to be delivered in 2017.

At the end of September 2017, Weather and Environment Business Area's order book was EUR 134.3 (106.4) million and increased by 26% compared to previous year. The increase came from all regions. EUR 57.7 (47.2) million of the order book is scheduled to be delivered in 2017.

At the end of September 2017, Industrial Measurements Business Area's order book was EUR 10.7 (8.3) million and increased by 28% compared to previous year. The increase came from all regions. EUR 8.4 (6.6) million of the order book is scheduled to be delivered in 2017.

Net sales by business area

| EUR million | 7-9/2017 | 7-9/2016 | Change, % | 2016 | |

| Weather and Environment | 58.3 | 53.4 | 9 | 215.4 | |

| Products | 29.7 | 30.4 | -2 | 115.5 | |

| Projects | 21.7 | 14.4 | 51 | 65.0 | |

| Services | 6.9 | 8.7 | -21 | 34.9 | |

| Industrial Measurements | 28.8 | 28.4 | 2 | 103.7 | |

| Products | 25.9 | 25.7 | 1 | 93.0 | |

| Services | 2.9 | 2.7 | 8 | 10.7 | |

| Total | 87.1 | 81.8 | 6 | 319.1 | |

| Net sales by geographical area | |||||

| EUR million | 7-9/2017 | 7-9/2016 | Change, % | 2016 | |

| EMEA | 29.6 | 23.1 | 28 | 92.0 | |

| Americas | 31.7 | 35.4 | -10 | 140.9 | |

| APAC | 25.8 | 23.3 | 11 | 86.2 | |

| Total | 87.1 | 81.8 | 6 | 319.1 | |

In the third quarter 2017, Vaisala's net sales increased by 6% compared to previous year and totaled EUR 87.1 (81.8) million. The increase came mainly from Weather and Environment Business Area's project deliveries. Net sales in EMEA were EUR 29.6 (23.1) million and increased by 28%, in the Americas EUR 31.7 (35.4) million and decreased by 10%. In APAC, net sales increased by 11% and totaled EUR 25.8 (23.3) million. At comparable exchange rates, the net sales would have been EUR 89.5 (81.8) million and increase would have been EUR 7.7 million or 9% from previous year. The negative exchange rate effect was EUR 2.4 million, which was mainly caused by USD and JPY exchange rate depreciation against EUR.

In the third quarter 2017, Weather and Environment Business Area's net sales increased by 9% compared to previous year and were EUR 58.3 (53.4) million. The increase came from project deliveries, whereas services sales decreased mainly due to Transportation field services. At comparable exchange rates, the net sales would have been EUR 59.4 (53.4) million and increase would have been EUR 6.0 million or 11% from previous year. The negative exchange rate effect was EUR 1.2 million, which was mainly caused by USD depreciation against EUR.

In the third quarter 2017, Industrial Measurements Business Area's net sales increased by 2% compared to strong previous year and were EUR 28.8 (28.4) million. The increase came from APAC and EMEA. At comparable exchange rates, the net sales would have been EUR 30.1 (28.4) million and increase would have been EUR 1.7 million or 6% from previous year. The negative exchange rate effect was EUR 1.3 million, which was mainly caused by USD and JPY depreciation against EUR.

Gross margin and operating result

| 7-9/2017 | 7-9/2016 | 2016 | |

| Gross margin, % | 52.8 | 53.9 | 51.6 |

| Weather and Environment | 47.1 | 50.7 | 47.3 |

| Industrial Measurements | 64.2 | 60.3 | 60.8 |

| Operating result, EUR million | 14.7 | 5.3 | 22.3 |

| Weather and Environment | 7.1 | -3.3 | 3.4 |

| Industrial Measurements | 8.3 | 7.4 | 21.6 |

| Other | -0.8 | 1.2 | -2.7 |

| Operating result, % | 16.9 | 6.5 | 7.0 |

| Weather and Environment | 12.3 | -6.1 | 1.6 |

| Industrial Measurements | 29.0 | 26.2 | 20.8 |

In the third quarter 2017, Vaisala's operating result increased by EUR 9.4 million compared to previous year and was EUR 14.7 (5.3) million, 16.9% (6.5%) of net sales. Third quarter included EUR 0.8 million cost related to transformation in Digital Solutions in Weather and Environment Business Area. Comparison period included EUR 10.5 million write-down of intangible assets in Weather and Environment Business Area. Gross margin was 52.8% (53.9%) and decreased mainly due to exceptionally low gross margins in few project deliveries in Weather and Environment Business Area. Operating expenses decreased by 24% compared to previous year due to the write-down of intangible assets in the comparison period and were EUR 30.5 (40.1) million.

In the third quarter 2017, Weather and Environment Business Area's operating result increased by EUR 10.4 million compared to previous year and was EUR 7.1 (-3.3) million, 12.3% (-6.1%) of net sales. Third quarter included EUR 0.8 million cost related to transformation in Digital Solutions. Comparison period included EUR 10.5 million write-down of intangible assets. Gross margin was 47.1% (50.7%) and decreased mainly due to exceptionally low gross margins in few project deliveries. Operating expenses decreased by 33% compared to previous year due to the write-down of intangible assets in the comparison period and were EUR 20.4 (30.3) million.

In the third quarter 2017, Industrial Measurements Business Area's operating result increased by EUR 0.9 million compared to previous year and was EUR 8.3 (7.4) million, 29.0% (26.2%) of net sales. Gross margin was 64.2% (60.3%) and improved both in product and service businesses and especially in calibration and repair services. Operating expenses increased by 5% compared to previous year and were EUR 10.1 (9.7) million. The increase came from R&D, sales and marketing expenses according to plan.

In the third quarter 2017, financial income and expenses were EUR -0.9 (-0.7) million. This was mainly a result of valuation of USD denominated receivables.

In the third quarter 2017, profit/loss before taxes was EUR 13.8 (4.6) million. Income taxes were EUR -3.2 (-0.8) million. Net result was EUR 10.6 (3.8) million.

In the third quarter 2017, earnings per share were EUR 0.59 (0.21).

January-September 2017

Orders received

| EUR million | 1-9/2017 | 1-9/2016 | Change, % | 2016 |

| Weather and Environment | 177.6 | 139.5 | 27 | 206.0 |

| Industrial Measurements | 85.3 | 78.8 | 8 | 105.3 |

| Total | 262.9 | 218.3 | 20 | 311.3 |

In January-September 2017, Vaisala's orders received increased by 20% compared to previous year and were EUR 262.9 (218.3) million. The increase came from both business areas and all geographical areas. EUR 6.3 million, the first phase, of the Vietnamese contract announced in February 2016 was booked in the third quarter.

In January-September 2017, Weather and Environment Business Area's orders received increased by 27% compared to previous year and were EUR 177.6 (139.5) million. The increase came from all regions. EUR 6.3 million, the first phase, of the Vietnamese contract announced in February 2016 was booked in the third quarter.

In January-September 2017, Industrial Measurements Business Area's orders received increased by 8% compared to previous year and were EUR 85.3 (78.8) million. The increase came from all regions and was strongest in APAC.

Order book

| EUR million | Sep 30, 2017 | Sep 30, 2016 | Change, % | Dec 31, 2016 |

| Weather and Environment | 134.3 | 106.4 | 26 | 109.4 |

| Industrial Measurements | 10.7 | 8.3 | 28 | 8.6 |

| Total | 145.0 | 114.8 | 26 | 118.0 |

At the end of September 2017, Vaisala's order book was EUR 145.0 (114.8) million and increased by 26% compared to previous year. Order book increased in all geographical areas. EUR 66.1 (53.7) million of the order book is scheduled to be delivered in 2017.

At the end of September 2017, Weather and Environment Business Area's order book was EUR 134.3 (106.4) million and increased by 26% compared to previous year. The increase came from all regions. EUR 57.7 (47.2) million of the order book is scheduled to be delivered in 2017.

At the end of September 2017, Industrial Measurements Business Area's order book was EUR 10.7 (8.3) million and increased by 28% compared to previous year. The increase came from all regions. EUR 8.4 (6.6) million of the order book is scheduled to be delivered in 2017.

Net sales by business area

| EUR million | 1-9/2017 | 1-9/2016 | Change, % | 2016 | |

| Weather and Environment | 147.9 | 148.7 | -1 | 215.4 | |

| Products | 80.2 | 81.2 | -1 | 115.5 | |

| Projects | 43.7 | 41.3 | 6 | 65.0 | |

| Services | 24.0 | 26.2 | -9 | 34.9 | |

| Industrial Measurements | 82.4 | 77.3 | 7 | 103.7 | |

| Products | 73.7 | 69.3 | 6 | 93.0 | |

| Services | 8.7 | 8.1 | 7 | 10.7 | |

| Total | 230.3 | 226.0 | 2 | 319.1 | |

| Net sales by geographical area | |||||

| EUR million | 1-9/2017 | 1-9/2016 | Change, % | 2016 | |

| EMEA | 71.5 | 67.7 | 6 | 92.0 | |

| Americas | 91.1 | 94.8 | -4 | 140.9 | |

| APAC | 67.7 | 63.5 | 7 | 86.2 | |

| Total | 230.3 | 226.0 | 2 | 319.1 | |

In January-September 2017, Vaisala's net sales increased by 2 % compared to previous year and totaled EUR 230.3 (226.0). Net sales in EMEA were EUR 71.5 (67.7) million and increased by 6%, and in the Americas net sales decreased by 4% and were EUR 91.1 (94.8) million. In APAC, net sales increased by 7% and totaled EUR 67.7 (63.5) million. Operations outside Finland accounted for 98% (98%) of net sales. At comparable exchange rates, the net sales would have been EUR 231.4 (226.0) million and increase would have been EUR 5.4 million or 2% from previous year. The negative exchange rate effect was EUR 1.1 million, which was mainly caused by GBP and CNY exchange rate depreciation against EUR.

In January-September 2017, Weather and Environment Business Area's net sales decreased by 1% compared to previous year and were EUR 147.9 (148.7) million. The decrease came from Transportation field services following divestiture in 2016. At comparable exchange rates, the net sales would have been EUR 148.4 (148.7) million and decrease would have been EUR 0.3 million or 0% from previous year. The negative exchange rate effect was EUR 0.5 million, which was mainly caused by GBP depreciation against EUR.

In January-September 2017, Industrial Measurements Business Area's net sales increased by 7% compared to previous year and were EUR 82.4 (77.3) million. The increase came from all regions and was strongest in APAC. At comparable exchange rates, the net sales would have been EUR 83.0 (77.3) million and increase would have been EUR 5.7 million or 7% from previous year. The negative exchange rate effect was EUR 0.6 million, which was mainly caused by CNY, GBP and JPY depreciation against EUR.

Gross margin and operating result

| 1-9/2017 | 1-9/2016 | 2016 | |

| Gross margin, % | 52.2 | 51.4 | 51.6 |

| Weather and Environment | 46.4 | 46.9 | 47.3 |

| Industrial Measurements | 62.8 | 60.4 | 60.8 |

| Operating result, EUR million | 22.4 | 7.7 | 22.3 |

| Weather and Environment | 4.2 | -6.1 | 3.4 |

| Industrial Measurements | 18.5 | 16.7 | 21.6 |

| Other | -0.3 | -2.9 | -2.7 |

| Operating result, % | 9.7 | 3.4 | 7.0 |

| Weather and Environment | 2.8 | -4.1 | 1.6 |

| Industrial Measurements | 22.4 | 21.6 | 20.8 |

In January-September 2017, Vaisala's operating result increased by EUR 14.7 million compared to previous year and totaled EUR 22.4 (7.7) million, 9.7% (3.4%) of net sales. Net sales growth and improved gross margin in Industrial Measurements Business Area increased operating profit. Comparison period included EUR 10.5 million write-down of intangible assets. Gross margin was 52.2% (51.4%). Operating expenses decreased by 9% compared to previous year due to the write-down of intangible assets in the comparison period and totaled EUR 97.8 (107.3) million.

In January-September 2017, Weather and Environment Business Area's operating result increased by EUR 10.3 million compared to previous year and was EUR 4.2 (-6.1) million, 2.8% (-4.1%) of net sales. Comparison period included EUR 10.5 million write-down of intangible assets. Gross margin was 46.4% (46.9%). Operating expenses decreased by 15% compared to previous year due to the write-down of intangible assets in the comparison period and were EUR 64.7 (75.8) million.

In January-September 2017, Industrial Measurements Business Area's operating result increased by EUR 1.8 million compared to previous year and was EUR 18.5 (16.7) million, 22.4% (21.6%) of net sales. The increase came from higher net sales and gross margin. Gross margin was 62.8% (60.4%) and it improved both in product and service businesses. Operating expenses increased by 11% compared to previous year and were EUR 33.3 (30.0) million. The increase came from R&D, sales and marketing expenses according to plan.

In January-September 2017, financial income and expenses were EUR -2.3 (-1.9) million. This was a result of valuation of USD denominated receivables.

In January-September 2017, profit/loss before taxes was EUR 20.0 (5.8) million. Income taxes were

EUR -4.6 (-1.1) million. Net result was EUR 15.4 (4.7) million.

In January-September 2017, earnings per share were EUR 0.86 (0.26).

Statement of financial position and cash flow

Vaisala's financial position remained strong at the end of September 2017. Cash and cash equivalents increased to EUR 72.3 (49.9) million. Vaisala did not have any material interest bearing liabilities.

Following improved cash balance, financial statement total increased to EUR 251.7 (234.7) million. Trade and other payables increased mainly because of project business related accruals. Inventories decreased because of high level of project deliveries during third quarter.

In January-September 2017, Vaisala's cash flow from operating activities increased to EUR 26.2 (17.1) million mainly because of increased EBITDA (earnings before interest, taxes, depreciation and amortization) and positive working capital development.

During January-September 2017, Vaisala repurchased 23,173 Company's series A shares with EUR 0.8 million. Purchases were completed on February 24, 2017. In the second quarter, Vaisala paid dividend EUR 17.8 million.

Capital expenditure and divestments

In January-September 2017, gross capital expenditure totaled EUR 6.6 (6.2) million. Capital expenditure was mainly related to investments in machinery and equipment to develop and maintain Vaisala's production and service operations.

Depreciation, amortization and write-downs were EUR 7.5 (21.3) million. The decrease in depreciation was mainly due to EUR 10.5 million write-down of intangible assets, booked in the third quarter of 2016.

Research and development

R&D by business area

| EUR million | 1-9/2017 | 1-9/2016 | Change, % | 2016 |

| Weather and Environment | 20.2 | 19.7 | 3 | 26.5 |

| Industrial Measurements | 9.0 | 8.2 | 10 | 11.5 |

| Total | 29.2 | 27.9 | 5 | 38.0 |

Industrial Measurements Business Area's R&D activity continued increasing according to plan.

R&D expenditure % of net sales

| 1-9/2017 | 1-9/2016 | 2016 | |

| Weather and Environment | 13.6 | 13.2 | 12.3 |

| Industrial Measurements | 11.0 | 10.6 | 11.1 |

| Total | 12.7 | 12.3 | 11.9 |

Personnel

The average number of personnel employed in Vaisala during January-September 2017 was 1,590 (1,598). At the end of September, the number of employees was 1,588 (1,574). 70% (68%) of employees were located in EMEA, 22% (23%) in the Americas and 9% (9%) in APAC. 63% (61%) of employees were based in Finland.

Strategy and business area names

In May, Vaisala's Board of Directors confirmed strategy for 2017-2021. Vaisala continues to drive profitable growth through implementation of strategic priorities. Consequently, Vaisala decided to rename its business areas to better describe their current and future business focus. Controlled Environment Business Area was renamed to Industrial Measurements Business Area and Weather Business Area was renamed to Weather and Environment Business Area.

Industrial Measurements Business Area continues to further accelerate growth through product leadership strategy. Business Area's strategic priorities are to achieve strong foothold in power transmission and life science markets, to continuously create new winning products by discovering customers' needs, and to seek new business opportunities in industrial applications.

Weather and Environment Business Area drives profitability and growth through expansion of industry-leading products and digital solutions. Business Area's strategic priorities are: to systematically improve competitiveness by renewal of product offering; to grow through meteorological infrastructure improvement projects in developing countries; to expand digital solutions, which support decision-making in weather critical operations; as well as to build new business in environmental measurements with air quality as a spearhead.

Vaisala Operations continues to develop excellence in high mix low volume supply chain through further development of Vaisala Production System. Foundation of the Production System is creation of a culture, which engages everyone to systematic improvement. Operations has also strategic development priorities to increase productivity, to develop core production technologies, as well as sourcing and product life cycle management processes.

Long-term financial targets

Vaisala's objective is profitable growth with an average annual growth of 5%, and to achieve 15% operating profit margin (EBIT). In selected growth businesses, such as digital solutions, life science and power transmission, the target is to exceed 10% annual growth.

Vaisala does not consider the long-term financial targets as market guidance for any given year.

Management Group

Vaisala's Management Group members are

- Kjell Forsén, President and CEO, Chairman of the Management Group

- Marja Happonen, Executive Vice President, Human Resources

- Sampsa Lahtinen, Executive Vice President, Industrial Measurements Business Area

- Kaarina Muurinen, Chief Financial Officer

- Vesa Pylvänäinen, Executive Vice President, Operations

- Jarkko Sairanen, Executive Vice President, Weather and Environment Business Area

- Katriina Vainio, Executive Vice President, Group General Counsel

Decisions by Vaisala Corporation's Annual General Meeting

Vaisala Corporation's Annual General Meeting was held on March 28, 2017. The meeting approved the financial statements and discharged the members of the Board of Directors and the President and CEO from liability for the financial period January 1-December 31, 2016.

Dividend

The Annual General Meeting decided a dividend of EUR 1.00 per share, corresponding to the total of EUR 17.8 million. The record date for the dividend payment was March 30, 2017 and the payment date was April 6, 2017.

Board of Directors

The Annual General Meeting confirmed that the number of Board members is eight. Petra Lundström, Yrjö Neuvo, Mikko Niinivaara, Kaarina Ståhlberg, Pertti Torstila, Raimo Voipio and Ville Voipio will continue as members of the Board of Directors. Petri Castrén was elected as a new member of the Board of Directors.

The Annual General Meeting confirmed that the annual fee payable to the Chairman of the Board of Directors is EUR 45,000 and each Board member EUR 35,000 per year. Approximately 40 percent of the annual remuneration will be paid in Vaisala Corporation's A shares acquired from the market and the rest in cash. In addition, the Annual General Meeting confirmed that the compensation for the Chairman of the Audit Committee would be EUR 1,500 per attended meeting and EUR 1,000 for each member of the Audit Committee and Chairman and each member of the Remuneration and HR Committee and any other committee established by the Board of Directors for a term until the close of the Annual General Meeting in 2018. The meeting compensation fees are paid in cash.

Auditor

The Annual General Meeting re-elected Deloitte & Touche Oy as the auditor of the Company and APA Merja Itäniemi will act as the auditor with the principal responsibility. The Auditors are reimbursed according to invoice presented to the Company.

Authorization for the directed repurchase of own A shares

The Annual General Meeting authorized the Board of Directors to decide on the directed repurchase of a maximum of 200,000 of the Company's own A shares in one or more instalments with funds belonging to the Company's unrestricted equity. This authorization is valid until the closing of the next Annual General Meeting, however, no longer than September 28, 2018, and it replaced the previous authorization for directed repurchase of own A shares.

Authorization on the issuance of the Company's own A shares

The Annual General Meeting authorized the Board of Directors to decide on the issuance of a maximum of 568,344 Company's own A shares. The issuance of own shares may be carried out in deviation from the shareholders' pre-emptive rights (directed issue). The subscription price of the shares can instead of cash also be paid in full or in part as contribution in kind. This authorization is valid until March 28, 2022, and it replaced the previous authorization for issuance of own A shares.

Resolution on the forfeiture of shares entered in the Vaisala Corporation joint book-entry account and of the rights attached to such shares

The Annual General Meeting decided in accordance with the proposal by the Board of Directors that, regarding the shares entered in the Vaisala joint book-entry account, the right to shares incorporated in the book-entry system and the rights such shares carry are forfeited, and authorized the Board of Directors to take all actions required by said decision.

The forfeiture of shareholder rights concerns shares that are in the joint book-entry account, i.e. 4,820 shares of which 4,800 are series A-shares and 20 series K-shares. The shares, whose registration of shareholder rights to the shareholder's book-entry account were requested prior to the commencement of the Annual General Meeting, and which will entered in the shareholder's book-entry account by June 30, 2017, will not be subject to the forfeiture of rights referred to above.

The organizing meeting of the Board of Directors

At its organizing meeting held after the Annual General Meeting, the Board elected Raimo Voipio to continue as the Chairman of the Board of Directors and Yrjö Neuvo to continue as the Vice Chairman.

The composition of the Board committees was decided to be as follows:

Kaarina Ståhlberg was elected as the Chairman and Petri Castrén and Mikko Niinivaara as members of the Audit Committee. The Chairman and all members of the Audit Committee are independent both of the Company and of significant shareholders.

Raimo Voipio was elected as the Chairman and Yrjö Neuvo, Mikko Niinivaara and Pertti Torstila as members of the Remuneration and HR Committee. The Chairman and all members of the Remuneration and HR Committee are independent both of the Company and of significant shareholders.

Vaisala's shares and shareholders

Vaisala's share capital totaled EUR 7,660,808 on September 30, 2017. Vaisala had 18,218,364 shares, of which 3,389,331 were series K shares and 14,829,033 were series A shares. The number of series K shares decreased by 20 and number of series A shares increased by 20 as the Board of Directors decided that 20 series K shares held by the Company will be converted to series A shares. This conversion was registered into the Trade Register on August 24, 2017. The series K shares and series A shares are differentiated by the fact that each series K share entitles its owner to 20 votes at a General Meeting of Shareholders while each series A share entitles its owner to 1 vote. The series A shares represent 81.4% of the total number of shares and 17.9% of the total votes. The series K shares represent 18.6% of the total number of shares and 82.1% of the total votes.

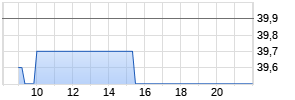

Trading in shares on the Nasdaq Helsinki Ltd

In January-September 2017, a total of 1,751,278 (1,561,606) Vaisala series A shares with a value totaling EUR 69.3 (42.4) million were traded on the Nasdaq Helsinki Ltd. The closing price of the series A share on the Nasdaq Helsinki stock exchange was EUR 43.50 (31.50). Shares registered a high of EUR 48.55 (34.81) and a low of EUR 31.88 (21.81). The volume-weighted average share price was EUR 39.09 (27.16).

The market value of Vaisala's series A shares on September 30, 2017 was EUR 628.9 (456.7) million, excluding the Company's treasury shares. Valuing the series K shares - which are not traded on the stock market - at the rate of the series A share's closing price on the last trading day of September, the total market value of all the series A and series K shares together was EUR 776.3 (563.4) million, excluding the Company's treasury shares.

At the end of September, 2017 Vaisala Corporation had 7,768 (7,494) registered shareholders. Ownership outside of Finland and nominee registrations represented 15.7% (14.5%) of the company's shares. Households owned 40.1% (40.7%), private companies 14.9% (14.3%), financial and insurance institutions 13.1% (12.8%), non-profit organizations 11.2% (11.7%) and public sector organizations owned 5.0% (6.0%).

Flagging notifications

In January-September 2017, Nordea Funds Ltd. informed Vaisala of the following change in ownership:

On September 13, 2017, Nordea Funds Ltd's aggregate holding in Vaisala increased above the 5 percent threshold and amounted to 911,662 shares or 5.004% of Vaisala's shares and 1.103% of total votes.

Treasury shares and their authorizations

The Annual General Meeting held on April 5, 2016 authorized the Board of Directors to decide on the directed repurchase of a maximum of 200,000 of the Company's series A shares. This authorization was valid until the closing of the Annual General Meeting held on March 28, 2017.

In April 2016, the Board of Directors resolved to commence repurchases of shares under this authorization. During May 2-December 30, 2016 Vaisala acquired a total of 176,827 Company's series A shares at an average price of EUR 29.96 and the total cost of the acquired shares was EUR 5,297,463.80. During January 2-February 24, 2017 Vaisala acquired a total of 23,173 Company's series A shares at an average price of EUR 34.03 and the total cost of the acquired shares was EUR 788,522.13.

The Annual General Meeting held on April 5, 2016, authorized the Board of Directors to decide on the issuance of a maximum of 391,550 Company's series A shares. This authorization was valid until the closing of the Annual General Meeting held on March 28, 2017.

In March 2017, the Board of Directors decided to transfer shares under this authorization. A total of 22,506 Company's series A shares were transferred to the 22 key employees participating on the Share-based incentive plan 2014 and Restricted share-based incentive plan 2016 under the terms and conditions of the plans.

Vaisala Corporation's General Meeting, held on March 28, 2017 decided, that regarding the shares entered in the Vaisala joint book-entry account, the right to shares incorporated in the book-entry system and the rights such shares carry are forfeited, and authorized the Board of Directors to take all actions required by said decision after June 3o, 2017. The forfeiture of shareholder rights concerned shares that were in the joint book-entry account, i.e. 4,820 shares of which 4,800 were series A shares and 20 series K shares.

Vaisala's Board of Directors decided on July 20, 2017, that the shares entered in the Vaisala joint book-entry account will become own shares of Vaisala, and that the above-mentioned 20 series K shares will be converted to series A shares.

At the end of September 2017, Vaisala held a total of 372,364 (331,380) Company's series A shares, which represented 2.5% (2.2%) of all series A shares and 2.0% (1.8 %) of all shares.

More information about Vaisala's shares and shareholders are presented on the website, www.vaisala.com/investors.

Near-term risks and uncertainties

Uncertainties in political situation and governmental customers' budgetary constraints may reduce demand for Vaisala's products and services or slow down customer projects.

Delay in developing applications for digital solutions as well as acquiring and in building related competences for sales and business operations may slow down growth in Weather and Environment Business Area. Closing of infrastructure projects in Weather and Environment Business Area may be postponed by budgetary constraints, complex customer decision making processes, changes in scope, and financing. Thus, Vaisala's financial performance may vary significantly over time.

Prolonged new product ramp-ups, market acceptances and regulatory certifications of new offering, such as power transformer monitoring products, supplementary air quality network sensors, and continuous monitoring systems, may postpone the realization of Vaisala's growth plans. Weakness in introducing new technologies and applications may result in erosion of price premium or loss of cost competitiveness and market position.

Long interruption in production or test equipment or disruption in suppliers' and subcontractors' delivery capability or product quality may impact significantly Vaisala's net sales and profitability. Cyber risk and downtime of IT systems may impact operations, delivery of information services or internet-based services, or cause financial loss.

Vaisala's capability to successfully complete investments, acquisitions, divestments and restructurings on a timely basis and to achieve related financial and operational targets may include uncertainties and risks, which may negatively impact net sales and profitability.

Further information about risk management and risks are available on the company website at www.vaisala.com/investors, Corporate Governance and www.vaisala.com/investors, Vaisala as an Investment.

Market outlook 2017

Vaisala is expecting moderate improvement for weather observation market compared to previous year, and as typical, deliveries are expected to improve seasonally towards the end of the year. While the budgetary constraints restrict purchasing power in many countries, the importance of improvements in weather observation and forecasting capabilities continue to drive demand. Compared to previous year, growth in new orders and deliveries is expected in particular in Europe and Asia Pacific. Growth is driven by meteorology customer segment. Market development with transportation customer segment looks overall stable and demand for digital solutions is expected to grow modestly compared to previous year. Industrial measurement market outlook continues to be favorable.

Business outlook for 2017

Vaisala continues t0 estimate its full-year 2017 net sales to be in the range of EUR 310-340 million and its operating result (EBIT) to be in the range of EUR 32-42 million.

Financial Calendar 2018

Financial Statements Release 2017, February 7, 2018

Annual Review 2017, by the end of week 9

Interim Report January-March 2018, April 25, 2018

Half Year Financial Report 2018, July 20, 2018

Interim Report January-September 2018, October 23, 2018

Vantaa, October 23, 2017

Vaisala Corporation

Board of Directors

Mehr Nachrichten zur Vaisala Oy A Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.