Universal Health Services, Inc. Reports 2017 Second Quarter Financial Results And Revises 2017 Full Year Earnings Guidance

PR Newswire

KING OF PRUSSIA, Pa., July 25, 2017

KING OF PRUSSIA, Pa., July 25, 2017 /PRNewswire/ -- Universal Health Services, Inc. (NYSE: UHS) announced today that its reported net income attributable to UHS was $185.4 million, or $1.91 per diluted share, during the second quarter of 2017 as compared to $185.6 million, or $1.89 per diluted share, during the comparable quarter of 2016.

Net revenues increased 7.5% to $2.61 billion during the second quarter of 2017 as compared to $2.43 billion during the second quarter of 2016. As calculated on attached Schedule of Non-GAAP Supplemental Information ("Supplemental Schedule"), our earnings before interest, taxes, depreciation & amortization ("EBITDA") increased 3.2% to $438.3 million during the second quarter of 2017 as compared to $424.8 million during the second quarter of 2016.

For the three-month period ended June 30, 2017, our adjusted net income attributable to UHS, as calculated on the attached Supplemental Schedule, was $188.1 million, or $1.94 per diluted share, as compared to $191.1 million, or $1.94 per diluted share, during the second quarter of 2016. As reflected on the Supplemental Schedule, included in our reported results during the second quarter of 2017, is a net aggregate unfavorable after-tax impact of $2.7 million, or $.03 per diluted share, consisting of: (i) a favorable after-tax impact of $1.4 million, or $.01 per diluted share, resulting from our January 1, 2017 adoption of ASU 2016-09, "Compensation – Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting" ("ASU 2016-09"), as discussed below, offset by; (ii) an unfavorable after tax impact of $4.0 million, or $.04 per diluted share, related to the depreciation and amortization expense recorded in connection with the implementation of electronic health records ("EHR") applications at our acute care hospitals. Included in our reported results during the second quarter of 2016 is an unfavorable after tax impact of $5.5 million, or $.05 per diluted share, related to the depreciation and amortization expense recorded in connection with the implementation of EHR applications at our acute care hospitals.

Consolidated Results of Operations, As Reported and As Adjusted – Six-month periods ended June 30, 2017 and 2016:

Reported net income attributable to UHS was $391.4 million, or $4.03 per diluted share, during the first six months of 2017 as compared to $376.3 million, or $3.81 per diluted share, during the comparable period of 2016.

Net revenues increased 7.1% to $5.23 billion during the first six months of 2017 as compared to $4.88 billion during the first six months of 2016. As calculated on attached Supplemental Schedule, our EBITDA increased 4.5% to $898.6 million during the six-month period ended June 30, 2017 as compared to $860.2 million during the comparable six-month period of 2016.

For the six-month period ended June 30, 2017, our adjusted net income attributable to UHS, as calculated on the attached Supplemental Schedule, was $392.4 million, or $4.04 per diluted share, as compared to $387.0 million, or $3.92 per diluted share, during the first six months of 2016. As reflected on the Supplemental Schedule, included in our reported results during the six-month period ended June 30, 2017, is a net aggregate unfavorable after-tax impact of $1.0 million, or $.01 per diluted share, consisting of: (i) a favorable after-tax impact of $8.1 million, or $.08 per diluted share, resulting from our January 1, 2017 adoption of ASU 2016-09, offset by; (ii) an unfavorable after tax impact of $9.1 million, or $.09 per diluted share, related to the depreciation and amortization expense recorded in connection with the implementation of EHR applications at our acute care hospitals. Included in our reported results during the six-month period ended June 30, 2016 is an unfavorable after tax impact of $10.7 million, or $.11 per diluted share, related to the depreciation and amortization expense recorded in connection with the implementation of EHR applications at our acute care hospitals.

Acute Care Services – Three and six-month periods ended June 30, 2017 and 2016:

During the second quarter of 2017, at our acute care hospitals owned during both periods ("same facility basis"), adjusted admissions (adjusted for outpatient activity) increased 6.0% and adjusted patient days increased 2.7%, as compared to the second quarter of 2016. Net revenues from our acute care services increased 5.1% during the second quarter of 2017 as compared to the comparable quarter of the prior year. At these facilities, net revenue per adjusted admission remained unchanged while net revenue per adjusted patient day increased 3.2% during the second quarter of 2017 as compared to the comparable quarter of 2016.

During the six-month period ended June 30, 2017, at our acute care hospitals on a same facility basis, adjusted admissions increased 5.5% and adjusted patient days increased 2.2%, as compared to the first six months of 2016. Net revenues from our acute care services increased 4.9% during the first six months of 2017 as compared to the comparable period of the prior year. At these facilities, net revenue per adjusted admission decreased 0.2% while net revenue per adjusted patient day increased 3.1% during the first six months of 2017 as compared to the comparable six-month period of 2016.

We provide care to patients who meet certain financial or economic criteria without charge or at amounts substantially less than our established rates. Because we do not pursue collection of amounts determined to qualify as charity care, they are not reported in net revenues or in accounts receivable, net. Our acute care hospitals provided charity care and uninsured discounts, based on gross charges, amounting to approximately $485 million and $339 million during the three-month periods ended June 30, 2017 and 2016, respectively, and $901 million and $684 million during the six-month periods ended June 30, 2017 and 2016, respectively. The provision for doubtful accounts at our acute care hospitals amounted to approximately $187 million and $179 million during the three-month periods ended June 30, 2017 and 2016, respectively, and $368 million and $319 million during the six-month periods ended June 30, 2017 and 2016, respectively.

Behavioral Health Care Services – Three and six-month periods ended June 30, 2017 and 2016:

During the second quarter of 2017, at our behavioral health care facilities on a same facility basis, adjusted admissions increased 3.7% while adjusted patient days increased 1.4% as compared to the second quarter of 2016. At these facilities, net revenue per adjusted admission decreased 1.4% while net revenue per adjusted patient day increased 0.9% during the second quarter of 2017 as compared to the comparable quarter in 2016. On a same facility basis, our behavioral health care services' net revenues increased 2.2% during the second quarter of 2017 as compared to the second quarter of 2016.

During the six-month period ended June 30, 2017, at our behavioral health care facilities on a same facility basis, adjusted admissions increased 3.1% while adjusted patient days increased 0.8% as compared to the first six months of 2016. At these facilities, net revenue per adjusted admission decreased 1.2% while net revenue per adjusted patient day increased 1.0% during the first six months of 2017 as compared to the comparable six-month period of 2016. On a same facility basis, our behavioral health care services' net revenues increased 1.8% during the first six months of 2017 as compared to the comparable period of 2016.

Net Cash Provided by Operating Activities and Share Repurchase Program:

For the six months ended June 30, 2017, our net cash provided by operating activities decreased to $534 million from $836 million generated during the comparable six-month period of 2016. The $302 million decrease was caused primarily by a $217 million unfavorable change in other working capital accounts resulting primarily from changes in accrued compensation and accounts payable due to timing of disbursements, and a $92 million unfavorable change in cash flows from foreign currency forward exchange contracts related to our investments in the U.K.

In February of 2016, our Board of Directors authorized a $400 million increase to our stock repurchase program, which increased the aggregate authorization to $800 million from the previous $400 million authorization approved during the third quarter of 2014. Pursuant to this program, we may purchase shares of our Class B Common Stock, from time to time as conditions allow, on the open market or in negotiated private transactions.

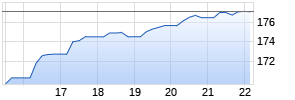

In conjunction with this program, during the second quarter of 2017, we have repurchased 983,900 shares at an aggregate cost of $115.9 million (approximately $118 per share). During the first six months of 2017, we have repurchased approximately 1.1 million shares at an aggregate cost of approximately $127.1 million (approximately $117 per share). Since inception of the program through June 30, 2017, we have repurchased approximately 5.47 million shares at an aggregate cost of approximately $641.2 million (approximately $117 per share).

Revision of 2017 Full Year Earnings Guidance Range:

Based upon the operating trends and financial results experienced during the first six months of 2017, we are revising our estimated range of adjusted net income attributable to UHS for the year ended December 31, 2017 to $7.50 to $8.00 per diluted share from the previously provided range of $7.70 to $8.20 per diluted share. This revised guidance range decreases both the lower and upper end of the previously provided range by approximately 2.5%.

This revised guidance excludes the expected EHR unfavorable impact of $.15 per diluted share for the year, as well as the impact on our provision for income taxes and net income attributable to UHS resulting from of our January 1, 2017 adoption of ASU 2016-09, which as discussed below, we are unable to estimate at this time. This guidance range also excludes the impact of future items, if applicable, that are nonrecurring or non-operational in nature including items such as, but not limited to, gains/losses on sales of assets and businesses, costs related to extinguishment of debt, reserves for settlements, legal judgments and lawsuits, impairments of long-lived assets, impact of share repurchases and other material amounts that may be reflected in our financial statements that relate to prior periods. It is also subject to certain conditions including those as set forth below in General Information, Forward-Looking Statements and Risk Factors and Non-GAAP Financial Measures.

Adoption of ASU 2016-09:

Effective January 1, 2017, we adopted ASU 2016-09, "Compensation – Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting", which amends the accounting for employee share-based payment transactions to require recognition of the tax effects resulting from the settlement of stock-based awards as income tax expense or benefit in the income statement in the reporting period in which they occur. In connection with the adoption of ASU 2016-09, during the three and six-month periods ended June 30, 2017, we recorded reductions to our provision for income taxes of $1.4 million and $8.1 million, respectively, which resulted in a corresponding increases in our net income attributable to UHS of $1.4 million, or $.01 per diluted share, during the second quarter of 2017 and $8.1 million, or $.08 per diluted share, during the first six months of 2017.

Since the impact of ASU 2016-09 on our future financial statements is dependent upon the timing of stock option exercises, and the market price of our stock at the time of exercise, we are unable to estimate the impact this adoption will have on our future provision for income taxes and net income attributable to UHS. This reporting change is applied prospectively, effective as of January 1, 2017, with the exception of the change in the presentation of the excess income tax benefits related to stock-based compensation in the Statement of Cash Flows, which was applied retrospectively.

Conference call information:

We will hold a conference call for investors and analysts at 9:00 a.m. eastern time on Wednesday, July 26, 2017. The dial-in number is 1-877-648-7971.

A live broadcast of the conference call will be available on our website at www.uhsinc.com. A replay of the call will be available following the conclusion of the live call and will be available for one full year.

General Information, Forward-Looking Statements and Risk Factors and Non-GAAP Financial Measures:

Universal Health Services, Inc. ("UHS") is one of the nation's largest hospital companies operating through its subsidiaries acute care hospitals, behavioral health facilities and ambulatory centers located throughout the United States, the United Kingdom, Puerto Rico and the U.S. Virgin Islands. It acts as the advisor to Universal Health Realty Income Trust, a real estate investment trust (NYSE:UHT). For additional information on the Company, visit our web site: http://www.uhsinc.com.

This press release contains forward-looking statements based on current management expectations. Numerous factors, including those disclosed herein, those related to healthcare industry trends and those detailed in our filings with the Securities and Exchange Commission (as set forth in Item 1A-Risk Factors and in Item 7-Forward-Looking Statements and Risk Factors in our Form 10-K for the year ended December 31, 2016 and in Item 2-Forward-Looking Statements and Risk Factors in our Form 10-Q for the quarterly period ended March 31, 2017), may cause the results to differ materially from those anticipated in the forward-looking statements. Many of the factors that will determine our future results are beyond our capability to control or predict. These statements are subject to risks and uncertainties and therefore actual results may differ materially. Readers should not place undue reliance on such forward-looking statements which reflect management's view only as of the date hereof. We undertake no obligation to revise or update any forward-looking statements, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

We believe that adjusted net income attributable to UHS, adjusted net income attributable to UHS per diluted share, EBITDA and adjusted EBITDA, which are non-GAAP financial measures ("GAAP" is Generally Accepted Accounting Principles in the United States of America), are helpful to our investors as measures of our operating performance. In addition, we believe that, when applicable, comparing and discussing our financial results based on these measures, as calculated, is helpful to our investors since it neutralizes the effect in each year of material items that are nonrecurring or non-operational in nature including, but not limited to, costs/benefits related to the impact on our provision for income taxes and net income attributable to UHS resulting from our January 1, 2017 adoption of ASU 2016-09, the implementation of EHR applications at our acute care hospitals, extinguishment of debt, gains/losses on sales of assets and businesses, reserves for settlements, legal judgments and lawsuits, impairments of long-lived assets, and other items and other material amounts that may be reflected in the current or prior year financial statements that relate to prior periods.

To obtain a complete understanding of our financial performance these measures should be examined in connection with net income, determined in accordance with GAAP, as presented in the condensed consolidated financial statements and notes thereto in this report or in our other filings with the Securities and Exchange Commission including our Report on Form 10-K for the year ended December 31, 2016 and our Report on Form 10-Q for the quarterly period ended March 31, 2017. Since the items included or excluded from these measures are significant components in understanding and assessing financial performance under GAAP, these measures should not be considered to be alternatives to net income as a measure of our operating performance or profitability. Since these measures, as presented, are not determined in accordance with GAAP and are thus susceptible to varying calculations, they may not be comparable to other similarly titled measures of other companies. Investors are encouraged to use GAAP measures when evaluating our financial performance.

| Universal Health Services, Inc. | |||||||

| Consolidated Statements of Income | |||||||

| (in thousands, except per share amounts) | |||||||

| (unaudited) | |||||||

| | | | | | | | |

| | Three months | | Six months | ||||

| | ended June 30, | | ended June 30, | ||||

| | 2017 | | 2016 | | 2017 | | 2016 |

| | | | | | | | |

| Net revenues before provision for doubtful accounts | $2,827,709 | | $2,638,848 | | $5,653,181 | | $5,258,441 |

| Less: Provision for doubtful accounts | 215,353 | | 207,993 | | 427,967 | | 377,788 |

| Net revenues | 2,612,356 | | 2,430,855 | | 5,225,214 | | 4,880,653 |

| | | | | | | | |

| Operating charges: | | | | | | | |

| Salaries, wages and benefits | 1,236,294 | | 1,130,933 | | 2,474,258 | | 2,279,072 |

| Other operating expenses | 632,193 | | 585,995 | | 1,239,553 | | 1,147,579 |

| Supplies expense | 274,539 | | 254,422 | | 552,153 | | 509,672 |

| Depreciation and amortization | 113,112 | | 101,411 | | 223,910 | | 205,460 |

| Lease and rental expense | 26,027 | | 24,806 | | 51,216 | | 49,258 |

| | 2,282,165 | | 2,097,567 | | 4,541,090 | | 4,191,041 |

| | | | | | | | |

| Income from operations | 330,191 | | 333,288 | | 684,124 | | 689,612 |

| | | | | | | | |

| Interest expense, net | 35,920 | | 30,442 Werbung Mehr Nachrichten zur Universal Health Services Inc. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||