U.S. Bank Signs Contract to Implement Black Knight Financial Services' LoanSphere Exchange Technology to Support Its Title and Closing Operations

PR Newswire

JACKSONVILLE, Fla., Aug. 2, 2016

JACKSONVILLE, Fla., Aug. 2, 2016 /PRNewswire/ -- Black Knight Financial Services, Inc. (NYSE: BKFS) announced today that U.S. Bank, the fifth largest commercial bank in the United States, has signed an agreement to implement LoanSphere Exchange, an open technology platform that provides integration, data management, decisioning support and workflow management through a 24/7 data exchange.

Delivered by RealEC Technologies, a division of Black Knight, Exchange is an innovative, online platform that electronically connects lenders with more than 20,000 of the mortgage industry's service and solution providers. Through Exchange, lenders gain a fast, secure way to aggregate data and centralize ordering of settlement services, such as title, closing, appraisal, credit, flood, fraud, verifications, fees and more. The platform offers event-based workflow and document services, including secure delivery, indexing and data extraction (OCR).

"Exchange offers us one powerful centralized resource to facilitate connections with our individual service providers and to eliminate paper and manual processes," said Mike Oakes, EVP Retail Operations of U.S. Bank. "By using Black Knight's Exchange technology, we hope to increase our operational efficiency, improve milestone tracking and provide for a better borrower experience."

"We are pleased to help U.S. Bank further streamline its mortgage origination process, standardize the user experience for all providers involved and help the bank reduce risk with Exchange's proven ability to support investor loan-quality requirements," said Dan Sogorka, president of the RealEC Technologies division.

U.S Bank also uses Black Knight's industry-leading loan servicing system, LoanSphere MSP, a scalable, innovative, end-to-end system used by financial institutions to manage all servicing processes, including loan setup and maintenance, escrow administration, investor reporting, regulatory requirements and more. In addition to MSP, U.S. Bank uses several of Black Knight's LoanSphere default solutions, including Bankruptcy and Foreclosure, an enterprise workflow application to support the bankruptcy and foreclosure processes; and Invoicing, a Web-based solution that streamlines billing and invoicing. Both of these default solutions are integrated with MSP.

About U.S. Bank

U.S. Bancorp (NYSE: USB) with $429 billion in assets as of March 31, 2016, is the parent company of U.S. Bank National Association, the fifth largest commercial bank in the United States. The company operates 3,129 banking offices in 25 states and 4,954 ATMs and provides a comprehensive line of banking, investment, mortgage, trust and payment services products to consumers, businesses and institutions. Visit U.S. Bancorp on the web at www.usbank.com.

About LoanSphere

LoanSphere is Black Knight's premier, end-to-end platform of integrated technology, data and analytics supporting the entire mortgage and home equity loan lifecycle – from origination to servicing to default. The platform delivers business process automation, workflow, rules and integrated data throughout the loan process, providing a better user experience, cost savings and support for changing regulatory requirements. By integrating lending functions and data, Black Knight's LoanSphere helps lenders and servicers reduce risk, improve efficiency and drive financial performance.

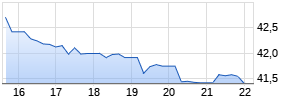

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in US Bancorp | ||

|

MB2ZX7

| Ask: 0,66 | Hebel: 5,87 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

|

|

About Black Knight Financial Services, Inc.

Black Knight Financial Services, Inc. (NYSE: BKFS), a Fidelity National Financial (NYSE:FNF) company, is a leading provider of integrated technology, data and analytics solutions that facilitate and automate many of the business processes across the mortgage lifecycle.

Black Knight Financial Services is committed to being a premier business partner that lenders and servicers rely on to achieve their strategic goals, realize greater success and better serve their customers by delivering best-in-class technology, services and insight with a relentless commitment to excellence, innovation, integrity and leadership. For more information on Black Knight Financial Services, please visit www.bkfs.com.

For more information:

Michelle Kersch

Black Knight Financial Services

904.854.5043

michelle.kersch@bkfs.com

Logo - http://photos.prnewswire.com/prnh/20150712/235391LOGO

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/us-bank-signs-contract-to-implement-black-knight-financial-services-loansphere-exchange-technology-to-support-its-title-and-closing-operations-300307496.html

SOURCE Black Knight Financial Services, Inc.

Mehr Nachrichten zur US Bancorp Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.