Third Point Re Reports First Quarter 2017 Earnings Results

PR Newswire

HAMILTON, Bermuda, May 4, 2017

HAMILTON, Bermuda, May 4, 2017 /PRNewswire/ -- Third Point Reinsurance Ltd. ("Third Point Re" or the "Company") (NYSE:TPRE) today announced results for its first quarter ended March 31, 2017.

Third Point Re reported net income of $104.2 million, or $0.98 per diluted common share, for the first quarter of 2017, compared to a net loss of $51.1 million, or $(0.49) per diluted common share, for the first quarter of 2016.

For the three months ended March 31, 2017, diluted book value per share increased by $0.88 per share, or 6.7%, to $14.04 per share as of March 31, 2017, from $13.16 per share as of December 31, 2016.

"We are very pleased with our first quarter performance, which resulted in a return on beginning shareholders' equity of 7.4% for the quarter. This was primarily driven by strong investment returns of 5.8% in the period," commented Rob Bredahl, President and Chief Executive Officer. "Reinsurance underwriting conditions remain challenging, and we have continued to maintain our underwriting discipline. As a result, our gross premiums written were $146.4 million in the first quarter, which represented a 25.8% decrease compared to the prior year's first quarter. Our combined ratio for the quarter was 106.3%, which was in line with expectations given current market conditions and the lines of business on which we focus. We finished the quarter with an asset leverage ratio of 1.52, which is within our target range and allows us to remain selective in our underwriting without diminishing our potential for solid book value growth with continued investment performance."

"Our first quarter performance demonstrates the strength of our total return model. Although reinsurance market conditions remain very difficult, we generated strong results due to solid performance from Third Point LLC, our investment manager. The management transitions we announced during the quarter have gone smoothly and Rob and I look forward to continuing to work closely together with the team to ensure the ongoing success of Third Point Re," commented John Berger, Chairman of the Board of Directors.

The following table shows certain key financial metrics for the three months ended March 31, 2017 and 2016:

| | 2017 | | 2016 | ||||

| | ($ in millions, except for per share data and ratios) | ||||||

| Gross premiums written | $ | 146.4 | | $ | 197.2 | ||

| Net premiums earned | $ | 138.0 | | $ | 136.8 | ||

| Net underwriting loss (1) | $ | (8.7) | | $ | (6.6) | ||

| Combined ratio (1) | 106.3% | | 104.9% | ||||

| Net investment return on investments managed by Third Point LLC | 5.8% | | (2.0)% | ||||

| Net investment income (loss) | $ | 128.5 | | $ | (40.1) | ||

| Net investment income (loss) on float (2) | $ | 36.1 | | $ | (8.3) | ||

| Net income (loss) | $ | 104.2 | | $ | (51.1) | ||

| Diluted earnings (loss) per common share | $ | 0.98 | | $ | (0.49) | ||

| Change in diluted book value per share (2) | 6.7% | | (3.7)% | ||||

| Return on beginning shareholders' equity (2) | 7.4% | | (3.7)% | ||||

| Net investments managed by Third Point LLC (3) | $ | 2,279.6 | | $ | 2,191.6 | ||

| | | | | | | | |

| (1) | See the accompanying Segment Reporting for a calculation of net underwriting loss and combined ratio. |

| (2) | Net investment income on float, change in diluted book value per share and return on beginning shareholders' equity are non-GAAP financial measures. There are no comparable GAAP measures. See the accompanying Reconciliation of Non-GAAP Measures and Key Performance Indicators for an explanation and calculation of net investment income (loss) on float, diluted book value per share and return on beginning shareholders' equity. |

| (3) | Prior year comparatives represent amounts as of December 31, 2016. |

Segment Highlights

Property and Casualty Reinsurance Segment

Gross premiums written decreased by $50.8 million, or 25.8%, to $146.4 million for the three months ended March 31, 2017 from $197.2 million for the three months ended March 31, 2016.

The decrease in the three months ended March 31, 2017 compared to the prior year period was primarily due to one contract that did not renew as a result of underlying terms and conditions, partially offset by contracts renewed in the quarter that did not have comparable premiums in the prior year period and new contracts bound in the quarter.

Net premiums earned for the three months ended March 31, 2017 were consistent with the three months ended March 31, 2016.

For the three months ended March 31, 2017, we incurred $1.6 million, or 1.1 percentage points, of net favorable prior years' reserve development. The $1.6 million of net favorable prior years' reserve development for the three months ended March 31, 2017 was accompanied by net increases of $1.6 million in acquisition costs, resulting in minimal impact in net underwriting loss.

For the three months ended March 31, 2016, we incurred $0.1 million, or 0.1 percentage points, of net favorable prior years' reserve development. The net $0.1 million of net favorable prior years' reserve development was accompanied by net decreases of $0.1 million in acquisition costs, resulting in a net decrease of $0.2 million in net underwriting loss, or 0.2 percentage points.

Investments

The return on investments managed by Third Point LLC by asset class for the three months ended March 31, 2017 and 2016 was as follows:

| | 2017 | | 2016 | ||

| Long/short equities | 5.2% | | (1.1)% | ||

| Credit | 0.2% | | —% | ||

| Other | 0.4% | | (0.9)% | ||

| | 5.8% | | (2.0)% | ||

For the three months ended March 31, 2017, each investment strategy contributed to returns. Within equities, gains were led by investments in the healthcare and industrials portfolios and each sector generated positive results. The gains in our long equity portfolio were partially offset by losses in our short equity positions, which included market hedges. Performance in the credit strategy was driven by modest returns in our corporate credit portfolio. The other strategy was also positive as returns from currency and arbitrage investments more than offset losses from macroeconomic hedges.

Share Repurchase Program

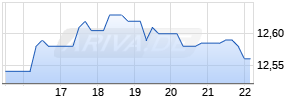

During the three months ended March 31, 2017, we repurchased 1,532,871 of our common shares in the open market for an aggregate cost of $18.9 million at a weighted average cost, including commissions, of $12.32 per share. Common shares repurchased by the Company were not canceled and are classified as treasury shares.

As of March 31, 2017, the Company may repurchase up to an aggregate of $73.7 million of additional common shares under its share repurchase program.

Conference Call Details

The Company will hold a conference call to discuss its first quarter 2017 results at 8:30 a.m. Eastern Time on May 5, 2017. The call will be webcast live over the Internet from the Company's website at www.thirdpointre.bm under "Investors". Participants should follow the instructions provided on the website to download and install any necessary audio applications. The conference call is also available by dialing 1-877-407-0789 (domestic) or 1-201-689-8562 (international). Participants should ask for the Third Point Reinsurance Ltd. first quarter earnings conference call.

A replay of the live conference call will be available approximately three hours after the call. The replay will be available on the Company's website or by dialing 1-844-512-2921 (domestic) or 1-412-317-6671 (international) and entering the replay passcode 13660643. The telephonic replay will be available until 11:59 p.m. (Eastern Time) on May 12, 2017.

Safe Harbor Statement Regarding Forward-Looking Statements

This press release includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond the Company's control. The Company cautions you that the forward-looking information presented in this press release is not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking information contained in this press release. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "plan," "seek," "comfortable with," "will," "expect," "intend," "estimate," "anticipate," "believe" or "continue" or the negative thereof or variations thereon or similar terminology. Actual events, results and outcomes may differ materially from the Company's expectations due to a variety of known and unknown risks, uncertainties and other factors. Although it is not possible to identify all of these risks and factors, they include, among others, the following: (i) fluctuation in results of operations; (ii) more established competitors; (iii) losses exceeding reserves; (iv) downgrades or withdrawal of ratings by rating agencies; (v) dependence on key executives; (vi) dependence on letter of credit facilities that may not be available on commercially acceptable terms; (vii) dependence on financing available through our investment accounts to secure letters of credit and collateral for reinsurance contracts; (viii) potential inability to pay dividends; (ix) inability to service our indebtedness; (x) limited cash flow and liquidity due to our indebtedness; (xi) unavailability of capital in the future; (xii) fluctuations in market price of our common shares; (xiii) dependence on clients' evaluations of risks associated with such clients' insurance underwriting; (xiv) suspension or revocation of our reinsurance licenses; (xv) potentially being deemed an investment company under U.S. federal securities law; (xvi) potential characterization of Third Point Reinsurance Ltd. and/or Third Point Re as a passive foreign investment company; (xvii) future strategic transactions such as acquisitions, dispositions, merger or joint ventures; (xviii) dependence on Third Point LLC to implement our investment strategy; (xix) termination by Third Point LLC of our investment management agreements; (xx) risks associated with our investment strategy being greater than those faced by competitors; (xxi) increased regulation or scrutiny of alternative investment advisers affecting our reputation; (xxii) Third Point Reinsurance Ltd. and/or Third Point Re potentially becoming subject to U.S. federal income taxation; (xxiii) potentially becoming subject to U.S. withholding and information reporting requirements under the Foreign Account Tax Compliance Act; (xxiv) changes in Bermuda or other law and regulation that may have an adverse impact on our operations; and (xxv) other risks and factors listed under "Risk Factors" in our most recent Annual Report on Form 10-K and other periodic and current disclosures filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date made and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Mehr Nachrichten zur SiriusPoint Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.