The Andersons, Inc. Reports Second Quarter Results

PR Newswire

MAUMEE, Ohio, Aug. 3, 2016

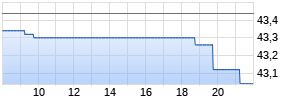

MAUMEE, Ohio, Aug. 3, 2016 /PRNewswire/ -- The Andersons, Inc. (NASDAQ: ANDE) announces financial results for the second-quarter ended June 30, 2016.

- Company reports second quarter net income of $14.4 million, $0.51 per diluted share

- Grain Group pre-tax loss of $13 million, showing improvement over Q1

- Ethanol Group returned to profitability driven by strong seasonal demand

- Plant Nutrient Group volumes grew year over year while margins remained soft

- Rail Group pre-tax income of $6.6 million, down from prior year primarily due to the large lease settlement recorded in second quarter of 2015

The Company reported net income attributable to The Andersons Inc. of $14.4 million, or $0.51 per diluted share on revenues of $1.1 billion for the second quarter of 2016 compared to net income of $31.1 million or $1.09 per diluted share on revenues of $1.2 billion in the second quarter of 2015.

For the first six months of the year, the Company had a net loss of $273,000, or $0.01 per diluted share compared to net income of $35.2 million or $1.23 per diluted share during the same period last year.

"The first half of the year was challenging, in line with our expectations, due to the poor crop last fall in the Eastern Corn Belt," said CEO Pat Bowe. "While challenges in our Grain Group persisted, we did begin to see positive impacts from a good wheat harvest, and are starting to capture benefits from our productivity initiatives.

"We were encouraged to see good volumes of specialty products in our Plant Nutrient business," he continued. "However, margins were disappointing in the face of oversupply of basic nutrients and low grain prices. The industry is starting to see production curtailments in certain products which should help bring supply and demand more into balance."

Second Quarter Segment Overview

Grain Group challenges persisted into the second quarter

The Grain Group reported a pre-tax loss of $13.0 million compared to pre-tax income of $3.1 million in the second quarter of 2015.

Grain Group Results

| | Second Quarter | First Six Months | ||||

| $ in MM | '16 | '15 | V PY | '16 | '15 | V PY |

| Base Grain | ($9.8) | $(4.3) | ($5.6) | $(23.1) | $(4.7) | $(18.4) |

| Grain Affiliates | ($3.2) | $7.4 | ($10.6) | $(7.3) | $8.6 | $(15.9) |

| Grain Group | ($13.0) | $3.1 | ($16.2) | $(30.4) | $3.9 | $(34.3) |

The Group's Base Grain operations continued to feel the pressure from both low carry and basis appreciation primarily due to the poor crop in the Eastern Corn Belt in 2015.

Affiliate earnings were lower due to losses in the Lansing Trade Group (LTG) while performance at Thompsons Limited remained steady. DDGS markets returned towards normal conditions during the quarter for LTG, however they were adversely impacted by trading positions during the quarter.

As previously announced during the quarter, the Company completed the sale of eight grain and agronomy locations in Western Iowa to MaxYield Cooperative of West Bend, Iowa. This transaction closed on May 1, 2016, and resulted in a nominal gain.

Ethanol Group rebounded

The Group returned to profitability in the second quarter and for the full first half of the year. Ethanol margins grew in the second quarter on the seasonal increase in demand from the summer driving season and steady export volumes.

Ethanol pre-tax income for the second quarter came in at $6.2 million, compared to the $9.7 million earned in the same quarter of 2015. This brings the year to date results back to positive income with the first six months generating $3.5 million compared to $14.9 million in the same period last year.

Factors impacting second quarter performance included:

- U.S. gasoline demand tracked above five year averages, strengthening as the driving season got into full gear.

- Margins were volatile during the quarter as corn prices moved lower and fuel prices continued to fluctuate.

- Industry production levels were at high levels throughout the quarter at times pressuring margins.

The Group's assets continue to perform well, achieving a new high for production versus comparable second quarters in prior years. The Albion, Michigan ethanol facility expansion remains on schedule for startup in the spring of 2017.

Plant Nutrient Group

Pre-tax income for the Group was $23.5 million, up from $18.9 million in same period last year. Nutrient volumes and margins continued to be negatively impacted by depressed grain prices and softening prices.

Plant Nutrient Group Results

| | Second Quarter | First Six Months | |||||||

| $ in MM, Tons in 000's | '16 | '15 | V PY | '16 | '15 | V PY | |||

| Basic Nutrients (Tons) | 549 | 537 | 12 | 2% | 761 | 716 | 45 | 6% | |

| Specialty Nutrients (Tons) | 208 | 129 | 79 | 62% | 327 | 216 | 110 | 51% | |

| Other (Tons) | 185 | 237 | (52) | (22%) | 314 | 363 | (50) | (14%) | |

| Total volume | 942 | 903 | 39 | 4% | 1,401 | 1,296 | 105 | 8% | |

| Pre-Tax Income | $23.5 Werbung Mehr Nachrichten zur Andersons Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||||