SunTrust: Americans Plan to Boost Savings with Tax Refunds

PR Newswire

ATLANTA, March 12, 2018

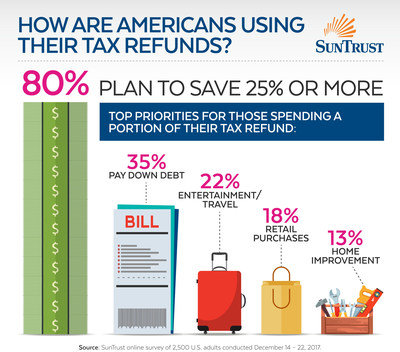

ATLANTA, March 12, 2018 /PRNewswire/ -- Eighty percent of Americans expecting a tax refund this year plan to save 25 percent or more, according to a new SunTrust Banks, Inc. (NYSE: STI) survey. Other plans for tax refunds include paying down debt (35 percent), travel/entertainment (22 percent), retail purchases (18 percent) and home improvement (13 percent).

"This may be the year consumers give themselves breathing room by building up their short-term savings," said Brian Nelson Ford, financial well-being executive at SunTrust. "We know from previous research that about half of Americans don't have $2,000 on hand to cover an emergency. It's a great time to break that statistic, reduce the stress of living paycheck-to-paycheck and build financial confidence."

According to IRS data, Americans qualifying for refunds received an average of $2,763 last year, an increase of roughly two percent over the previous year. To best manage a cash windfall, SunTrust suggests the following:

- Use the 50/30/20 formula. This year, consider applying 50 percent of a tax refund or bonus to savings; 30 percent to pay down debt; and 20 percent to spend. With some balance, there is nothing wrong with spending a little on you.

- Don't spend the money before it arrives. Whether you're looking forward to a tax refund or bonus, wait until the money is in your account before using the funds. You are more likely to make a smarter decision if the money is in your possession.

- Transfer your refund into a savings account. If your refund was deposited electronically into a checking account, don't let it sit there while you decide how to use it. Transfer the money to a savings account to earn higher interest – or even a six-month certificate of deposit (CD) – until you know how to divide it across saving, debt reduction and spending.

- Ask for advice. You may be a do-it-yourself type, but sometimes it's better to get an outsider's perspective. Set up a meeting with a personal banker who can help you decide whether it's better to save, invest or pay down debt – or all three.

- Anticipate future expenses. Recognize that 2018 will likely bring unexpected expenses that you won't be able to meet with your normal cash flow. Cars need repairs and roofs sometimes leak. Everybody deals with unwelcome expenses, so saving a good portion of your tax refund can help you stay ahead of the financial curve.

SunTrust is leading the onUp Movement across America to help people build financial confidence through healthy money habits. For additional tax savings strategies and inspiration, visit onUp.com/everyday.

This survey was conducted online within the United States by SunTrust from December 14 – 22, 2017, among 2,500 U.S. adults ages 18 and older. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated.

About SunTrust Banks, Inc.

SunTrust Banks, Inc. (NYSE: STI) is a purpose-driven company dedicated to Lighting the Way to Financial Well-Being for the people, businesses, and communities it serves. Headquartered in Atlanta, the Company has two business segments: Consumer and Wholesale. Its flagship subsidiary, SunTrust Bank, operates an extensive branch and ATM network throughout the high-growth Southeast and Mid-Atlantic states, along with 24-hour digital access. Certain business lines serve consumer, commercial, corporate, and institutional clients nationally. As of December 31, 2017, SunTrust had total assets of $206 billion and total deposits of $161 billion. The Company provides deposit, credit, trust, investment, mortgage, asset management, securities brokerage, and capital market services. SunTrust leads onUp, a national movement inspiring Americans to build financial confidence. Join the movement at onUp.com.

![]() View original content with multimedia:http://www.prnewswire.com/news-releases/suntrust-americans-plan-to-boost-savings-with-tax-refunds-300612057.html

View original content with multimedia:http://www.prnewswire.com/news-releases/suntrust-americans-plan-to-boost-savings-with-tax-refunds-300612057.html

SOURCE SunTrust Banks, Inc.

Mehr Nachrichten zur Suntrust Banks Inc Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.