Sun Life Financial Reports Fourth Quarter and Full Year 2017 Results

PR Newswire

TORONTO, Feb. 14, 2018

The information in this document is based on the unaudited interim financial results of Sun Life Financial Inc. for the period ended December 31, 2017. Sun Life Financial Inc., its subsidiaries and, where applicable, its joint ventures and associates are collectively referred to as "the Company", "Sun Life Financial", "we", "our", and "us". Unless otherwise noted, all amounts are in Canadian dollars. Beginning in the first quarter of 2017, we stopped reporting operating net income and its related measures, operating earnings per share ("EPS") and operating return on equity ("ROE"). The adjustments previously used to derive operating net income will continue to be used to derive underlying net income.

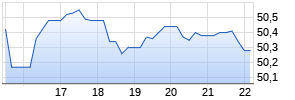

TORONTO, Feb. 14, 2018 /PRNewswire/ - Sun Life Financial Inc. (TSX: SLF) (NYSE: SLF) today announced its results for the fourth quarter ended December 31, 2017. Fourth quarter reported net income was $207 million and underlying net income(1) was $641 million.

| | | Quarterly results | Full Year | |||||||||||||

| | | Q4'17 | Q4'16 | 2017 ARIVA.DE Börsen-GeflüsterWerbung Weiter aufwärts?

Morgan Stanley

Den Basisprospekt sowie die Endgültigen Bedingungen und die Basisinformationsblätter erhalten Sie hier: ME3NJR,. Beachten Sie auch die weiteren Hinweise zu dieser Werbung. Der Emittent ist berechtigt, Wertpapiere mit open end-Laufzeit zu kündigen.

Kurse

| 2016 | |||||||||||

| Reported net income ($ millions) | | 207 | 728 | 2,149 | 2,485 | |||||||||||

| Underlying net income(1) ($ millions) | | 641 | 560 | 2,546 | 2,335 | |||||||||||

| | | | | | | |||||||||||

| Reported EPS(2) ($) | | 0.34 | 1.18 | 3.49 | 4.03 | |||||||||||

| Underlying EPS(1)(2) ($) | | 1.05 | 0.91 | 4.15 | 3.80 | |||||||||||

| | | | | | | |||||||||||

| Reported ROE(1) | | 4.1% | 14.8% | 10.7% | 13.0% | |||||||||||

| Underlying ROE(1) | | 12.7% | 11.4% | 12.7% | 12.2% | |||||||||||

- Minimum Continuing Capital and Surplus Requirements ("MCCSR")(4) ratio for Sun Life Assurance Company of Canada of 221%. The MCCSR ratio for Sun Life Financial Inc. was 246%, which includes cash and other liquid assets of $2.0 billion for Sun Life Financial Inc. and its wholly-owned holding companies(3)

- Insurance sales(1) were $1,106 million in the fourth quarter of 2017 ($1,071 million in the fourth quarter of 2016) and $3,042 million in 2017 ($2,758 million in 2016). Wealth sales(1) were $35.3 billion in the fourth quarter of 2017 ($37.3 billion in the fourth quarter of 2016) and $145.3 billion in 2017 ($138.3 billion in 2016)

- Global assets under management of $975 billion compared to $903 billion as at December 31, 2016

- Common share dividend declared of $0.455 per share

"2017 was a year of strong financial performance for Sun Life. We grew underlying net income 9% in the year to over $2.5 billion, raised our common share dividend 8% in the year, and generated a 12.7% underlying return on equity," said Dean Connor, President & CEO, Sun Life Financial.

"Our fourth quarter capped off a year of continued momentum on a number of fronts," said Connor. "We launched new digital offerings in Canada, improved the profitability of our U.S. Group Benefits business, continued building out our wealth and asset management businesses, and invested to grow our distribution capabilities in Asia."

| _________________ | |

| (1) | Represents a non-IFRS financial measure. See section J - Non-IFRS Financial Measures in this document. |

| (2) | All EPS measures refer to fully diluted EPS, unless otherwise stated. |

| (3) | For additional information, see section E - Financial Strength in this document. |

| (4) | For further information on the Life Insurance Capital Adequacy Test effective January 1, 2018, see section E - Financial strength |

"The year was also defined by a relentless focus on doing more for Clients. Sun Life teams around the world implemented hundreds of Client-focused changes – big and small. Taken together, we are making a difference in our Clients' lives, and there is so much more to do to help them achieve lifetime financial security and live healthier lives. An exciting initiative is our new partnership in the U.S. with Collective Health, an innovative technology company that serves as an alternative to traditional health plans for self-funded employers. Leveraging their advanced health benefits platform, together we intend to transform the benefits experience for self-funded employers and their employees by integrating stop-loss protection into Collective Health's enterprise benefits platform and collaborating on enhanced data analytics to serve these Clients better."

Financial and Operational Highlights

Our strategy is focused on four key pillars of growth, where we aim to be a leader in the markets in which we operate. We detail our continued progress in the four pillars below.

| ($ millions, unless otherwise noted) | ||||||||||||

| | Reported | Underlying | Insurance | Wealth | ||||||||

| | Q4'17 | Q4'16 | change | Q4'17 | Q4'16 | change | Q4'17 | Q4'16 | change | Q4'17 | Q4'16 | change |

| SLF Canada | 172 | 398 | (57)% | 232 | 243 | (5)% | 227 | 308 | (26)% | 3,183 | 4,701 | (32)% |

| SLF U.S. | (25) | 106 | nm(2) | 126 | 87 | 45% | 676 | 555 | 22% | — | — | |

| SLF Asset Management | 114 Werbung Mehr Nachrichten zur Sun Life Financial Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||||||