Stanley Black & Decker Reaffirms Guidance And Provides Strategic Update At 2017 Investor Day

PR Newswire

NEW BRITAIN, Conn., May 16, 2017

NEW BRITAIN, Conn., May 16, 2017 /PRNewswire/ -- Stanley Black & Decker (NYSE: SWK) reaffirmed its 2017 guidance and provided a strategic update, including an update on M&A and the company's recent acquisitions of the Craftsman brand and the Lenox and Irwin businesses. An audio webcast of the event will be available in the "Investors" section of the company's website at www.stanleyblackanddecker.com later today and will be available for 90 days.

"Our vision is to be a great industrial company – one that is both human-centered and committed to delivering top-quartile growth and profitability," said Jim Loree, Stanley Black & Decker's President and Chief Executive Officer. "We operate in strong, innovation-driven businesses in diverse, global markets, with an organization powered by a robust and pervasive operating system, SFS 2.0, and a strong value creation framework. We have an execution culture that is bold and agile yet thoughtful and disciplined that is centered around a clear purpose."

"We have a strong vision for where to take this company, with a goal of profitably doubling the size of the company to $22 billion in revenue by 2022. Three key themes will drive Stanley Black & Decker towards that goal, including an aspiration to be known as one of the world's most innovative companies powered by a digital transformation, a continued focus on delivering top-quartile performance, and an elevated commitment to corporate social responsibility," added Loree.

As it relates to M&A, Loree commented, "Our focus now is effectively integrating and leveraging our investments in the Craftsman, Lenox and Irwin tools brands to deliver the growth and value we expect and have committed to – we're on track to do just that. Any sizable new acquisitions we might pursue will have to wait for a few quarters and would likely be in the form of industrial bolt-ons or further expansion of the commercial electronic security business. That doesn't rule out the occasional small tool bolt-on that might come up in the next few quarters. It also doesn't preclude larger tool acquisitions in the coming years once the recent additions are firmly in place and performing well."

"A really exciting element of our overall M&A strategy is the notion of utilizing M&A to complement our breakthrough innovation projects and vice versa -- M&A to accelerate organic growth. Acquisition targets must meet key criteria, including solid returns, sound strategic logic and fit within our value creation model," added Loree.

2017 GUIDANCE REAFFIRMED

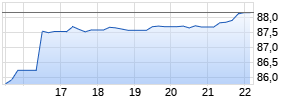

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Stanley Black & Decker | ||

|

ME4303

| Ask: 1,60 | Hebel: 4,65 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

In addition, the Company reaffirmed its updated full year 2017 guidance as provided on April 21, 2017. The Company continues to expect its 2017 EPS outlook to be $7.95 - $8.15 on a GAAP basis and to be $7.08 - $7.28 on an adjusted basis. The Company also reiterated its free cash flow conversion estimate of approximately 100%. The Company also reaffirmed that its 2018 financial vision from its prior Investor Day is achievable.

"Stanley Black & Decker's outlook for 2017 continues to remain positive, as we successfully navigate ongoing macroeconomic and geopolitical challenges," said Don Allan, Stanley Black & Decker's Executive Vice President and CFO. "Our SFS 2.0 operating system continues to enable us to deliver top-quartile results over the long term. Its five distinctive elements: breakthrough innovation, digital excellence, commercial excellence, core SFS and functional transformation, drive our differentiated performance in organic growth, margin expansion and asset efficiency. Importantly, it also provides the framework to differentiate us among industrials, all of whom are dealing with a world where the pace of change is relentlessly accelerating."

Stanley Black & Decker, an S&P 500 company, is a diversified global provider of hand tools, power tools and related accessories, electronic security solutions, healthcare solutions, engineered fastening systems, and more. Learn more at www.stanleyblackanddecker.com

| | | |

| Investor Contacts: | | Media Contacts: |

| | | |

| Greg Waybright | | Shannon Lapierre |

| Vice President, Investor Relations | | Vice President, Communications |

| | ||

| (860) 827-3833 | | (860) 827-3575 |

| | | |

| Michelle Hards | | Tim Perra |

| Director, Investor Relations | | Vice President, Communications |

| | ||

| (860) 827-3913 | | (860) 826-3260 |

| | | |

CAUTIONARY STATEMENTS

Under the Private Securities Litigation Reform Act of 1995

Statements in this press release that are not historical, including but not limited to those regarding the Company's ability to: (i) achieve full year 2017 diluted GAAP EPS of $7.95 - $8.15 and Adjusted EPS of $7.08 - $7.28; (ii) generate with the Craftsman Brand approximately $100 million average annual revenue growth over the next 10 years and accretion to earnings of approximate $0.08 per share in 2017 (excluding charges); (iii) achieve with the integration of Newell Tools, $80-$90 million in total cost synergies, significant potential revenue synergies, and accretion to earnings of approximately $0.24 per share in 2017 (excluding charges); (iv) generate 2017 free cash flow conversion approximating 100%; (v) achieve its objective of doubling the size of the Company by 2022 while expanding its margin rate; and (vi) bring its credit metric back in line by early 2018 and achieve its 2018 Financial Vision, (collectively, the "Results"); are "forward-looking statements" and subject to risk and uncertainty.

The Company's ability to deliver the Results as described above is based on current expectations and involves inherent risks and uncertainties, including factors listed below and other factors that could delay, divert, or change any of them, and could cause actual outcomes and results to differ materially from current expectations. In addition to the risks, uncertainties and other factors discussed in this press release, the risks, uncertainties and other factors that could cause or contribute to actual results differing materially from those expressed or implied in the forward-looking statements include, without limitation, those set forth under Item 1A Risk Factors of the Company's Annual Report on Form 10-K and any material changes thereto set forth in any subsequent Quarterly Reports on Form 10-Q, or those contained in the Company's other filings with the Securities and Exchange Commission, and those set forth below.

The Company's ability to deliver the Results is dependent, or based, upon: (i) continued improved results from the Company's Industrial Businesses; (ii) the Company's ability to invest in product, brand and commercialization of the Craftsman brand and to successfully integrate Newell Tools while remaining focused on its diversified industrial portfolio strategy; (iii) the Company's ability to deliver slightly higher overall organic growth of approximately an additional $0.08 per share; (iv) the Company's ability to achieve incremental cost and productivity actions of approximately $0.10 per share and limit the impact of higher environmental charges included in "Other, net" to approximately negative ($0.08) per share; (v) commodity inflation combined with foreign exchange headwinds being approximately $100-105 million in 2017; (vi) core (non M&A) restructuring charges being approximately $50 million in 2017 (inclusive of the 1Q 2017 approximately $13 million pension settlement), and 2017 tax rate relatively consistent with the 2016 levels; (vii) to identify, close and integrate appropriate acquisition opportunities, within desired timeframes at reasonable cost; (viii) successful integration of existing and any newly acquired businesses and formation of new business platforms; (ix) the continued acceptance of technologies used in the Company's products and services, including the new DEWALT FLEXVOLT™ product; (x) the Company's ability to manage existing Sonitrol franchisee and Mac Tools relationships; (xi) the Company's ability to minimize costs associated with any sale or discontinuance of a business or product line, including any severance, restructuring, legal or other costs; (xii) the proceeds realized with respect to any business or product line disposals; (xiii) the extent of any asset impairments with respect to any businesses or product lines that are sold or discontinued; (xiv) the success of the Company's efforts to manage freight costs, steel and other commodity costs as well as capital expenditures; (xv) the Company's ability to sustain or increase prices in order to, among other things, offset or mitigate the impact of steel, freight, energy, non-ferrous commodity and other commodity costs and any inflation increases and/or currency impacts; (xvi) the Company's ability to generate free cash flow and maintain a strong debt to capital ratio; (xvii) the Company's ability to identify and effectively execute productivity improvements and cost reductions, while minimizing any associated restructuring charges; (xviii) the Company's ability to obtain favorable settlement of tax audits; (xix) the ability of the Company to generate earnings sufficient to realize future income tax benefits during periods when temporary differences become deductible; (xx) the continued ability of the Company to access credit markets under satisfactory terms; (xxi) the Company's ability to negotiate satisfactory price and payment terms under which the Company buys and sells goods, services, materials and products; and (xxii) the Company's ability to successfully develop, market and achieve sales from new products and services.

The Company's ability to deliver the Results is also dependent upon: (i) the success of the Company's marketing and sales efforts, including the ability to develop and market new and innovative products at the right price points in both existing and new markets; (ii) the ability of the Company to maintain or improve production rates in the Company's manufacturing facilities, respond to significant changes in product demand and fulfill demand for new and existing products; (iii) the Company's ability to continue improvements in working capital through effective management of accounts receivable and inventory levels; (iv) the ability to continue successfully managing and defending claims and litigation; (v) the success of the Company's efforts to mitigate any adverse earnings impact resulting from, for example, increases in the cost of energy or significant Chinese Renminbi, Canadian Dollar, Euro, British Pound, Brazilian Real or other currency fluctuations; (vi) the geographic distribution of the Company's earnings; (vii) the commitment to and success of the Stanley Fulfillment System including, core innovation, breakthrough innovation, digital and commercial excellence and functional transformation; and (viii) successful implementation with expected results of cost reduction programs.

The Company's ability to achieve the Results will also be affected by external factors. These external factors include: challenging global geopolitical and macroeconomic environment, possibly including impact from "Brexit" or other similar actions from other EU member states; the economic environment of emerging markets, particularly Latin America, Russia, China and Turkey; pricing pressure and other changes within competitive markets; the continued consolidation of customers particularly in consumer channels; inventory management pressures on the Company's customers; the impact the tightened credit markets may have on the Company or its customers or suppliers; the extent to which the Company has to write-off accounts receivable or assets or experiences supply chain disruptions in connection with bankruptcy filings by customers or suppliers; increasing competition; changes in laws, regulations and policies that affect the Company, including, but not limited to trade, monetary, tax and fiscal policies and laws; the timing and extent of any inflation or deflation; the impact of poor weather conditions on sales; currency exchange fluctuations; the impact of dollar/foreign currency exchange and interest rates on the competitiveness of products and the Company's debt program; the strength of the U.S. and European economies; the extent to which world-wide markets associated with homebuilding and remodeling stabilize and rebound; the impact of events that cause or may cause disruption in the Company's supply, manufacturing, distribution and sales networks such as war, terrorist activities, and political unrest; and recessionary or expansive trends in the economies of the world in which the Company operates. The Company undertakes no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise after the date hereof.

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/stanley-black--decker-reaffirms-guidance-and-provides-strategic-update-at-2017-investor-day-300458706.html

SOURCE Stanley Black & Decker

Mehr Nachrichten zur Stanley Black & Decker Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.