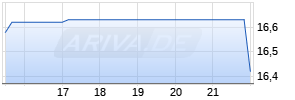

Silvercrest Asset Management Group Inc. Reports Q1 2017 Results

PR Newswire

NEW YORK, May 4, 2017

NEW YORK, May 4, 2017 /PRNewswire/ -- Silvercrest Asset Management Group Inc. (NASDAQ: SAMG) (the "Company" or "Silvercrest") today reported the results of its operations for the quarter ended March 31, 2017.

Business Update

Silvercrest has begun 2017 by continuing its history of strong organic growth by adding $230 million in new assets, primarily from ultra-high net worth families. The first quarter of 2017 was one of the strongest quarters for new commitments over the past few years.

Beneficial market conditions, combined with Silvercrest's organic growth, increased discretionary assets by approximately $537 million during the first quarter of 2017 to a total of $14.3 billion as of March 31, 2017, representing a 17% increase in discretionary assets under management since the first quarter of 2016, and a new high for discretionary assets at the firm. Importantly, the firm achieved this growth while maintaining its fee basis for assets under management, bucking industry trends. The firm also has maintained its Adjusted EBITDA margins while continuing to invest in the business for future growth and to better serve our clients.

Silvercrest's proprietary value equity strategies continue to perform well and we maintain our optimism about growing our high quality institutional relationships, in contrast to many competitors who actively manage assets on behalf of their clients.

Finally, Silvercrest and its partners celebrated 15 years as an independent firm last month. We are extraordinarily proud of the legacy we are building; we are grateful for the long trust placed in our firm by our clients; and we are as excited about our firm's future growth as at any point in our history.

On May 2, 2017, the Company's Board of Directors declared a quarterly dividend of $0.12 per share of Class A common stock. The dividend will be paid on or about June 20, 2017 to shareholders of record as of the close of business on June 13, 2017.

First Quarter 2017 Highlights

- Total Assets Under Management ("AUM") of $19.3 billion, inclusive of discretionary AUM of $14.3 billion and non-discretionary AUM of $5.0 billion at March 31, 2017.

- Revenue of $22.0 million.

- U.S. Generally Accepted Accounting Principles ("GAAP") consolidated net income and net income attributable to Silvercrest of $3.3 million and $1.7 million, respectively.

- Basic and diluted net income per share of $0.21.

- Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization ("Adjusted EBITDA")1 of $6.5 million

- Adjusted net income1 of $3.0 million.

- Adjusted basic and diluted earnings per share1 of $0.23 and $0.22, respectively.

The table below presents a comparison of certain GAAP and non-GAAP ("adjusted") financial measures and AUM.

| | | For the Three Months | | |||||

| (in thousands except as indicated) | | 2017 | | | 2016 | | ||

| Revenue | | $ | 21,951 | | | $ | 19,263 | |

| Income before other income (expense), net | | $ | 4,747 | | | $ | 3,624 | |

| Net income | | $ | 3,300 | | | $ | 2,496 | |

| Net income attributable to Silvercrest | | $ | 1,687 | | | $ | 1,307 | |

| Net income per basic and diluted share | | $ | 0.21 | | | $ | 0.16 | |

| Adjusted EBITDA1 | | $ | 6,493 | | | $ | 5,255 | |

| Adjusted EBITDA margin1 | | | 29.6 | % | | | 27.3 | % |

| Adjusted net income1 | | $ | 2,997 | | | $ | 2,262 | |

| Adjusted basic earnings per share1, 2 | | $ | 0.23 | | | $ | 0.18 | |

| Adjusted diluted earnings per share1, 2 | | $ | 0.22 | | | $ | 0.17 | |

| Assets under management at period end (billions) | | $ | 19.3 | | | $ | 17.0 | |

| Average assets under management (billions)3 | | $ | 19.0 | | | $ | 17.6 | |

| Discretionary assets under management (billions) | | $ | 14.3 | | | $ | 12.2 | |

| __________ | |

| 1 | Adjusted measures are non-GAAP measures and are explained and reconciled to the comparable GAAP measures in Exhibits 2 and 3. |

| 2 | Adjusted basic and diluted earnings per share measures for the three months ended March 31, 2017 are based on the number of shares of Class A common stock and Class B common stock outstanding as of March 31, 2017. Adjusted diluted earnings per share are further based on the addition of unvested restricted stock units to the extent dilutive at the end of the reporting period. |

| 3 | We have computed average AUM by averaging AUM at the beginning of the applicable period and AUM at the end of the applicable period. |

AUM at $19.3 billion

Silvercrest's discretionary assets under management increased by $2.1 billion, or 17.2%, to $14.3 billion at March 31, 2017 from $12.2 billion at March 31, 2016. Silvercrest's total AUM increased by $2.3 billion, or 13.5%, to $19.3 billion at March 31, 2017 from $17.0 billion at March 31, 2016. The increase in total AUM was attributable to net client inflows of $1.6 billion and market appreciation of $0.8 billion.

Silvercrest's discretionary assets under management increased by $0.5 billion, or 3.6%, to $14.3 billion at March 31, 2017 from $13.8 billion at December 31, 2016. Silvercrest's total AUM increased by $0.7 billion, or 3.8%, to $19.3 billion at March 31, 2017 from $18.6 billion at December 31, 2016. The increase in total AUM was attributable to market appreciation of $0.5 billion and net client inflows of $0.2 billion.

Our total assets under management exclude approximately $16.6 billion of non-discretionary assets of a public treasurers' office for which we became advisor in connection with the acquisition of Jamison, Eaton & Wood, Inc. (the "Jamison acquisition"), which closed on June 30, 2015. Silvercrest provides advisory services to this office with a fee cap of $825 thousand per annum. We exclude these assets because they are related to a unique client relationship for which the fee cap is significantly disproportionate to the related assets under management. This fee arrangement is not indicative of our average fee rate.

First Quarter 2017 vs. First Quarter 2016

Revenue increased by $2.7 million, or 14.0%, to $22.0 million for the three months ended March 31, 2017, from $19.3 million for the three months ended March 31, 2016. This increase was driven by growth in our management and advisory fees as a result of increased assets under management.

Total expenses increased by $1.6 million, or 10.0%, to $17.2 million for the three months ended March 31, 2017 from $15.6 million for the three months ended March 31, 2016. Compensation and benefits expense increased by $1.7 million, or 14.3%, to $13.1 million for the three months ended March 31, 2017 from $11.4 million for the three months ended March 31, 2016. The increase was primarily attributable to an increase in the accrual for bonuses of $1.3 million, an increase in salaries expense of $0.3 million primarily as a result of merit-based increases and an increase in equity-based compensation of $0.1 million due to the granting of restricted stock units in August 2015 and May 2016. General and administrative expenses decreased by $0.1 million, or 1.7%, to $4.1 million for the three months ended March 31, 2017 from $4.2 million for the three months ended March 31, 2016. The decrease was primarily attributable to a decrease in investment research costs of $0.1 million mainly due to a reduction in accrued soft dollar-related research costs, a decrease in sub-advisory and referral fees of $0.1 million due to a decrease in sub-advisory revenue, a decrease in telephone expense of $0.1 million and a decrease in client reimbursements of $0.1 million, partially offset by an increase in professional fees of $0.1 million mainly due to an enhanced documentation project related to our operations group.

Consolidated net income was $3.3 million. Net income attributable to Silvercrest was $1.7 million, or $0.21 per basic and diluted share for the three months ended March 31, 2017. Our Adjusted Net Income1 was $3.0 million, or $0.23 per adjusted basic share and $0.22 per adjusted diluted share1, 2 for the three months ended March 31, 2017.

Adjusted EBITDA1 was $6.5 million or 29.6% of revenue for the three months ended March 31, 2017 as compared to $5.3 million or 27.3% of revenue for the same period in the prior year.

Liquidity and Capital Resources

Cash and cash equivalents were approximately $22.7 million at March 31, 2017, compared to $37.5 million at December 31, 2016. Silvercrest L.P. had notes payable of $2.4 million at March 31, 2017 and $2.5 million at December 31, 2016. As of March 31, 2017, no amount had been drawn down on our term loan and there was nothing outstanding on our revolving credit facility with City National Bank.

Total stockholders' equity was $48.1 million at March 31, 2017. We had 8,100,205 shares of Class A common stock outstanding and 4,840,295 shares of Class B common stock outstanding at March 31, 2017.

Mehr Nachrichten zur Silvercrest Asset Management Group Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.