Shipping Tycoons and Financiers Converge, Converse and Transact at Marine Money's 30th Anniversary Marine Money Week in New York.

PR Newswire

STAMFORD, Conn., June 8, 2017

STAMFORD, Conn., June 8, 2017 /PRNewswire/ -- Marine Money International, the leading host of conferences focused on financing the international maritime industry ("Marine Money"), today announced a record attendance for the 30th annual Marine Money Week, the world's largest ship finance forum. The 30th annual Marine Money Week conference on June 19-21 at The Pierre Hotel, the former home of Aristotle Onassis, will attract more than 1,000 dealmakers who will come together to do just that - put transactions together.

With $300 billion in annual capital requirements, the international shipping industry is an enormous and steady user of capital. As traditional sources of ship finance dry up, the world's shipowners are increasingly turning to New York to fund their projects in the U.S. Capital Markets. "I don't think it's a stretch to say that in the future, it will be impossible to be a market leader in this capital intensive industry without access to the U.S. Capital Markets and that every Alpha-seeking investor will have a position in global shipping," said Matt McCleery, President of Marine Money and author of the novel The Shipping Man, which was featured on Bloomberg's "Summer Reading for the Tasteful and Preoccupied" list. McCleery added, "While syndicated loan volume has sagged to its lowest level in 10 years, capital markets activity, mergers and deals with hedge funds have sharply increased and hundreds of private equity funds, hedge funds and long-only investors are actively deploying capital in the global shipping industry."

While the U.S. Capital Markets remain the deepest pool of risk tolerant capital, Chinese leasing companies and Chinese banks, Far East export credit agencies and a healthy European Bond market all critically complement the U.S. Capital Markets and will be heavily present at The Pierre.

Presenting public companies include:

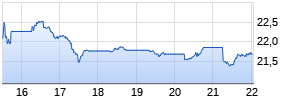

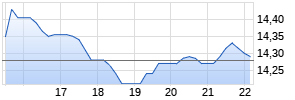

Tellurian Inc. (TELL)

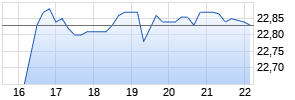

GasLog Ltd. (GLOG)

Flex LNG

Höegh LNG

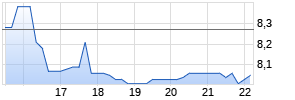

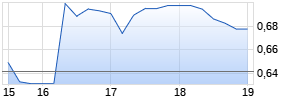

American Shipping (ASCJF)

KNOT Offshore Partners UK LLC (KNOP)

Scorpio Tankers (STNG)

International Seaways

Stolt-Nielsen (SNI)

Ardmore Shipping (ASC)

Tsakos Energy Navigation

Euroseas

Ship Finance International (SFL)

Genco Shipping & Trading Limited (GNK)

Navios

Songa Bulk (SBULK)

Star Bulk Carriers Corporation (SBLK)

Eagle Bulk

Nordic American Tankers

DHT

Euronav NV (EURN)

Tanker Investments Limited

Team Tankers International Ltd. (TEAM)

Ocean Yield (OYIEF)

Contact:

Julia Hull

jhull@marinemoney.com

ARIVA.DE Börsen-Geflüster

Kurse

|

|

|

|

|

|

|

|

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/shipping-tycoons-and-financiers-converge-converse-and-transact-at-marine-moneys-30th-anniversary-marine-money-week-in-new-york-300471420.html

SOURCE Marine Money International

Mehr Nachrichten zur Tellurian Inc. Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.