Sampo Group's Results for January - September 2016

SAMPO PLC INTERIM STATEMENT 3 November 2016 at 9:45 am

SAMPO GROUP'S RESULTS FOR JANUARY - SEPTEMBER 2016

Sampo Group's profit before taxes for January - September 2016 amounted to EUR 1,343 million (1,475). The total comprehensive income for the period, taking changes in the market value of assets into account, rose to EUR 1,212 million (1,031).

-Earnings per share decreased to EUR 2.11 (2.31). Mark-to-market earnings per share rose to EUR 2.16 (1.84). The return on equity for the Group was 14.1 per cent (12.6) for January - September 2016. Net asset value per share on 30 September 2016 amounted to EUR 21.81 (23.79).

- Profit before taxes for the P&C insurance segment amounted to EUR 660 million (756). Combined ratio for January-September 2016 improved further to 84.0 per cent (84.6). Following a review of mortality tables by the Swedish insurance federation, EUR 72 million was released from the Swedish MTPL reserves in the first quarter of 2016. Excluding this release combined ratio was 86.3 per cent. Return on equity was 22.3 per cent (18.6). The contribution of Topdanmark's net profit for January-September 2016 amounted to EUR 35 million (37).

- Sampo's share of Nordea's net profit for January - September 2016 amounted to EUR 546 million (577). Operating profit excluding non-recurring items increased 11 per cent during the third quarter compared to the third quarter of 2015. The return on equity improved 1.2 percentage points to 11.6 per cent. Nordea Group's Basel III CET1 capital ratio increased to 17.9 per cent at the end of the third quarter of 2016. In segment reporting the share of Nordea's profit is included in the segment 'Holding'.

- Profit before taxes in life insurance operations amounted to EUR 157 million (132). Return on equity rose to 18.0 per cent (5.3). Premium income on own account decreased to EUR 669 million (838).

- As a result of the mandatory bid to the shareholders of Topdanmark A/S announced on 7 September 2016, Sampo plc acquired altogether 7,374,306 Topdanmark shares and held 41.1 per cent of all Topdanmark shares on 26 October 2016. Sampo intends to propose a change of distribution policy to the next Topdanmark AGM, whereby a dividend would be reinstated and the share buyback program discontinued. If approved, buybacks would end immediately after Topdanmark's 2017 AGM. For further information on the bid, see section Other Developments.

- Mandatum Life decided on 20 October 2016 not to prolong the agency agreement with Danske Bank as of 31 December 2016. According to the agreement Mandatum Life has the right to sell the insurance portfolio sold through Danske Bank's branch network in Finland, to Danske Bank. Mandatum Life decided on 27 October 2016 to use this option. For further information, see section Other Developments.

KEY FIGURES

| EURm | 1-9/2016 | 1-9/2015 | Change, % | 7-9/ 2016 | 7-9/ 2015 | Change, % |

| Profit before taxes | 1,343 | 1,475 | -9 | 450 | 460 | -2 |

| P&C insurance | 660 | 756 | -13 | 224 | 245 | -9 |

| Associate (Nordea) | 546 | 577 | -5 | 182 | 159 | 14 |

| Life insurance | 157 | 132 | 18 | 53 | 52 | 3 |

| Holding (excl. Nordea) | -19 | 12 | - | -9 | 5 | - |

| Profit for the period | 1,179 | 1,292 | -9 | 396 | 398 | -1 |

| Change | Change | |||||

| Earnings per share, EUR | 2.11 | 2.31 | -0.20 | 0.71 | 0.71 | 0 |

| EPS (incl. change in FVR) EUR | 2.16 | 1.84 | 0.32 | 1.08 | -0.21 | 1.29 |

| NAV per share, EUR *) | 21.81 | 23.79 | -1.98 | - | - | - |

| Average number of staff (FTE) | 6,769 | 6,739 | 30 | - | - | - |

| Group solvency ratio, % *) | 149 | 145 | 4 | - | - | - |

| RoE, % | 14.1 | 12.6 | 1.5 | - | - | - |

*) comparison figure from 31 December 2015

The figures in this report are not audited. Income statement items are compared on a year-on-year basis whereas comparison figures for balance sheet items are from 31 December 2015 unless otherwise stated.

Sampo follows the disclosure procedure enabled by the Finnish Financial Supervisory Authority and hereby publishes its Interim Statement attached as a PDF file to this stock exchange release. The Interim Statement is also available at www.sampo.com/result

| Exchange rates used in reporting | 1-9/2016 | 1-6/2016 | 1-3/2016 | 1-12/2015 | 1-9/2015 | |

| EUR 1 = SEK | ||||||

| Income statement (average) | 9.3712 | 9.3023 | 9.3241 | 9.3534 | 9.3709 | |

| Balance sheet (at end of period) | 9.6210 | 9.4242 | 9.2253 | 9.1895 | 9.4083 | |

| DKK 1 = SEK | ||||||

| Income statement (average) | 1.2586 | 1.2486 | 1.2501 | 1.2542 | 1.2567 | |

| Balance sheet (at end of period) | 1.2912 | 1.2668 | 1.2381 | 1.2314 | 1.2612 | |

| NOK 1 = SEK | ||||||

| Income statement (average) | 0.9998 | 0.9875 | 0.9790 | 1.0475 | 1.0646 | |

| Balance sheet (at end of period) | 1.0706 | 1.0133 | 0.9799 | 0.9570 | 0.9878 |

THIRD QUARTER 2016 IN BRIEF

Sampo Group's profit before taxes for the third quarter 2016 amounted to EUR 450 million (460). Earnings per share amounted to EUR 0.71 (0.71). Marked-to-market earnings per share increased to EUR 1.08 (-0.21).

Net asset value per share increased EUR 2.98 during the third quarter and was EUR 21.81. The increase was due to the positive development of Nordea's share price and strong capital market development in general.

Combined ratio in P&C operations for the third quarter was 84.6 per cent (83.8). Profit before taxes decreased to EUR 224 million (245). Share of the profits of the associated company Topdanmark amounted to EUR 17 million (13).

Sampo's share of Nordea's third quarter 2016 net profit rose to EUR 182 million (159).

Profit before taxes for the life insurance operations was EUR 53 million (52). Premiums written grew 9 per cent to EUR 177 million from EUR 162 million at the corresponding period a year ago.

BUSINESS AREAS

P&C insurance

Profit before taxes for January-September 2016 for the P&C insurance segment amounted to EUR 660 million (756). Combined ratio improved to 84.0 per cent (84.6) and risk ratio to 62.0 per cent (67.1). In the first quarter of 2016 EUR 72 million was released from the Swedish MTPL reserves, following a review of mortality tables by the Swedish insurance federation. This improved the combined ratio for January-September 2016 by 2.3 percentage points. The comparison figure contains two non-recurring items - the reform of the pension system in If Norway and the lowering of the interest rate used in discounting annuities in Finland from 2.0 per cent to 1.5 per cent. Their combined effect on combined ratio was 1.5 percentage points positive.

EUR 100 million, including the Swedish MTPL release, was released from technical reserves relating to prior year claims in January - September 2016. In the same period in 2015 the reserves were strengthened by EUR 83 million mainly explained by the lowering of the interest rate used in discounting annuities in Finland. Return on equity (RoE) rose to 22.3 per cent (18.6) and the fair value reserve at the end of September 2016 was EUR 482 million (391). The contribution of Topdanmark's net profit in January-September 2016 amounted to EUR 35 million (37).

Technical result amounted to EUR 514 million (522). Insurance margin (technical result in relation to net premiums earned) was 16.1 per cent (16.0).

The release from the Swedish MTPL reserves in the first quarter of 2016 affected the January-September 2016 result positively. The comparison figures for the Finnish business are burdened by the change in the Finnish discount rate in the second quarter of 2015. Large claims in BA Industrial were EUR 22 million better than expected in January-September 2016 and the total large claims for If P&C ended up EUR 30 million better than expected for the period.

Swedish discount rate used to discount the annuity reserves decreased to -0.31 per cent by the end of September 2016 and had a negative effect of EUR 49 million in January-September results. The negative effect on third quarter results amounted to EUR 10 million. The discount rate was 0.41 per cent at the end of 2015. In Finland the discount rate for annuities was unchanged at 1.5 per cent.

Gross written premiums amounted to EUR 3,565 million (3,659) in January-September 2016. Adjusted for currency, premium growth was -0.4 per cent. Growth was positive in business area Private, and negative in business areas Commercial, Industrial and Baltic. Operations in Sweden and Denmark showed growth but in Finland and Norway premiums decreased.

Cost ratio amounted to 22.1 per cent (17.6) while expense ratio was 16.6 per cent (11.8). The comparison figures are positively impacted, 4.7 percentage points, by the non-recurring reform of the pension system in If Norway. Excluding the non-recurring items the cost ratio for January-September 2016 was 0.2 per cent lower than in the corresponding period a year ago.

At the end of September 2016, the total investment assets of If P&C amounted to EUR 12.3 billion (11.4), of which fixed income investments constituted 76 per cent (74), money market 11 per cent (12) and equity 12 per cent (13). Net income from investments decreased to EUR 120 million (234). Investment return marked-to-market for January-September 2016 amounted to 2.4 per cent (0.9). Duration for interest bearing assets was 1.4 years (1.2) and average maturity 2.8 years (2.6). Fixed income running yield as at 30 September 2016 was 1.6 per cent (1.8).

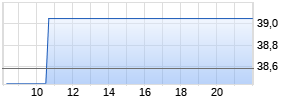

Associated company Nordea Bank AB

On 30 September 2016 Sampo plc held 860,440,497 Nordea shares corresponding to a holding of 21.2 per cent. The average price paid per share amounted to EUR 6.46 and the book value in the Group accounts was EUR 8.46 per share. The closing price at the end of September 2016 was EUR 8.85.

The third quarter was characterised by a stable environment with low volatility on financial markets but also continued low growth. Net interest income was down 4 per cent in local currencies compared to the third quarter of 2015, but is up 1 per cent from the previous quarter. Nordea continues to believe that the trough levels are now over.

Total income was down 3 per cent in local currencies (-4 per cent in EUR) from last year and operating profit was down 11 per cent in local currencies (-12 per cent in EUR) from last year excluding non-recurring items.

Negative rates have put pressure on deposit margins, which was partly offset by higher lending margins. Both average lending and deposit volumes in business areas increased 2 per cent in local currencies from last year.

Net fee and commission income decreased 1 per cent in local currencies (-2 per cent in EUR) from last year. Net result from items at fair value also decreased 2 per cent in local currencies (-1 per cent in EUR) from last year.

Costs are following the plan. Cost to income ratio excluding non-recurring items improved 1 percentage point from the last year to 48.1 per cent. Total expenses were up 4 per cent in local currencies (2 per cent in EUR) from the previous year and amounted to EUR 3,567 million.

Net profit decreased 4 per cent in local currencies (5 per cent in EUR) to EUR 2,666 million.

Nordea's credit quality remains solid with a loan loss level at the 10-year average. Net loan loss provisions increased to EUR 373 million, corresponding to a loan loss ratio of 15 bps (13 bps for the first nine months of 2015).

Currency fluctuations had a reducing effect of 1 percentage point on income and expenses and no effect on loan and deposit volumes compared to a year ago.

Nordea Group's Basel III Common equity tier 1 (CET1) capital ratio was in line with Nordea's capital policy. CET 1 ratio increased to 17.9 per cent at the end of the third quarter of 2016 from 16.8 per cent at the end of the second quarter of 2016. The increase to the CET1 capital ratio was due to a decrease in REA (risk exposure amount) of EUR 6.7 billion mainly driven by the new securitisation transaction, market risk and an increase in Common equity tier 1 capital of EUR 0.4 billion mainly driven by a dividend pay-out from NLP and profit generation.

Life insurance

Profit before taxes for life insurance operations in January-September 2016 amounted to EUR 157 million (132). The total comprehensive income for the period after tax reflecting the changes in market values of assets increased strongly to EUR 193 million from EUR 50 million in the corresponding period a year earlier. Return on equity (RoE) improved to 18.0 per cent (5.3).

Net investment income, excluding income on unit-linked contracts, amounted to EUR 224 million (316). Net income from unit-linked contracts was EUR 135 million (23). In January-September 2016 fair value reserve increased to EUR 598 million (532).

Total technical reserves of Mandatum Life Group were EUR 10.9 billion (10.9). The unit-linked reserves exceeded EUR 6 billion and amounted to EUR 6.1 billion (5.9) at the end of September 2016, which corresponds to 56 per cent (54) of total technical reserves. With profit reserves decreased to EUR 4.8 billion (5.0) in January-September 2016. Reserves related to the higher guarantees of 4.5 and 3.5 per cent decreased EUR 165 million to EUR 2.9 billion in the same period.

Mandatum Life has all in all supplemented its technical reserves with a total of EUR 223 million (244) due to low level of interest rates. The figure does not take into account the reserves relating to the segregated fund. The discount rates used for 2016, 2017 and 2018 are 0.5 per cent, 0.75 per cent, and 1.50 per cent, respectively. Discount rate applied to the segregated fund is 0.75 per cent.

On 30 September 2016 Mandatum Life Group's investment assets, excluding the assets of EUR 6.1 billion (5.9) covering unit-linked liabilities, amounted to EUR 6.6 billion (6.7) at market values.

The assets covering Mandatum Life's original with profit liabilities on 30 September 2016 amounted to EUR 5.4 billion (5.5) at market values. 43 per cent (47) of the assets are in fixed income instruments, 11 per cent (7) in money market, 31 per cent (29) in equities and 15 per cent (16) in alternative investments. The investment return marked-to-market for January - September 2016 was 5.1 per cent (3.7). The duration of fixed income assets at the end of September 2016 was 2.1 years (2.1) and average maturity 2.5 years (2.8). Fixed income (incl. money market) running yield was 3.1 per cent (3.2).

The assets covering the segregated fund amounted to EUR 1.2 billion (1.2), of which 74 per cent (71) was in fixed income, 7 per cent (9) in money market, 12 per cent (12) in equities and 7 per cent (8) in alternative investments. Segregated fund's investment return marked-to-market for January - September 2016 was 3.6 per cent (2.3). At the end of September 2016 the duration of fixed income assets was 2.6 years (2.3) and average maturity 3.8 years (3.8). Fixed income (incl. money market) running yield was 1.9 per cent (0.9).

Expense result for life insurance segment decreased to EUR 15 million (20) and risk result amounted to EUR 15 million (15).

Mandatum Life Group's premium income on own account decreased to EUR 669 million (838) in January - September 2016. However, in the third quarter of 2016 premiums grew by 9 per cent to EUR 177 million. Mandatum Life's market share in Finland amounted to 20.4 per cent (17.3).

Holding

Holding segment's profit before taxes for January - September 2016 amounted to EUR 527 million (589), of which EUR 546 million (577) relates to Sampo's share of Nordea's January - September 2016 profit. Segment's profit excluding Nordea was EUR -19 million (-12). Investment income ended up EUR -2 million (60) negative because of realized equity losses in the third quarter amounting to EUR 8 million. Finance costs continued to decrease because of low interest rates and the weakness of Swedish krone.

Sampo plc's debt financing on 30 September 2016 amounted to EUR 2,845 million (2,302) and interest bearing assets to EUR 992 million (1,343). Interest bearing assets include bank accounts, fixed income instruments and EUR 623 million (579) of hybrid capital and subordinated debt instruments issued by the subsidiaries and associated companies. At the end of the third quarter of 2016 the net debt amounted to EUR 1,853 million (959). The net debt calculation only takes into account interest bearing assets and liabilities. Gross debt to Sampo plc's equity was 41 per cent (32) and financial leverage 29 per cent (24).

In connection to the mandatory bid on Topdanmark, Sampo plc increased the amount of commercial papers issued from EUR 338 million at the end of the second quarter 2016 to EUR 702 million on 30 September 2016.

On 30 September 2016 financial liabilities in Sampo plc's balance sheet consisted of issued senior bonds and notes of EUR 2,142 million (1,997) and EUR 702 million (305) of CPs issued. The average interest, net of interest rate swaps, on Sampo plc's debt as of 30 September 2016 was 1.17 per cent (1.65).

OTHER DEVELOPMENTS

Mandatory offer for Topdanmark

Sampo plc announced on 7 September 2016 the obligation to make a mandatory offer to the shareholders of Topdanmark A/S. In the mandatory offer, Sampo offered to acquire all outstanding shares, excluding treasury shares, and other financial instruments, warrants and share options, if applicable, issued by Topdanmark and shares held by Topdanmark shareholders resident in certain restricted jurisdictions. The cash price offered in the mandatory offer was DKK 183 for each share issued by Topdanmark. The offer period commenced on 27 September 2016 and expired on 25 October 2016. As a result of the offer, Sampo plc acquired altogether 7,374,306 Topdanmark shares and held on 26 October 2016 41.1 per cent of all Topdanmark shares.

The mandatory offer was made pursuant to the Danish Takeover Order (no. 562 of 2 June 2014) Section 2(1). The obligation to make the Mandatory Offer arose as a result of Sampo in the period from 6 September 2016 until 7 September having acquired 200,000 Topdanmark shares in the market with the highest purchase price being DKK 183 and thereby crossing the applicable Danish threshold of one third of the total outstanding voting rights of Topdanmark. In connection herewith, Sampo also acquired 31,476,920 Topdanmark shares at a price of DKK 183 per share, representing approximately 33.13 per cent of the entire issued share capital and of all voting rights of Topdanmark (including treasury shares), from its wholly owned subsidiary If P&C Insurance Holding Ltd. Following Sampo's acquisition of If's shareholding in Topdanmark, If no longer holds any shares in Topdanmark.

If P&C booked a sales gain of approx. EUR 450 million in this transaction but as Sampo plc's share of Topdanmark's profit will continue to be shown in the P&C insurance segment, this effectively means that the sales gain is eliminated in the segment and not at all visible in Sampo Group reported numbers.

Mandatum Life's agency agreement with Danske Bank

In connection with the acquisition of Sampo's banking operations by Danske Bank A/S in early 2007, Sampo Bank plc (now Danske Bank Plc), and Sampo Life Insurance Company Ltd (now Mandatum Life Insurance Company Ltd) signed an agency agreement that guaranteed Sampo Life the exclusive right to sell life and pension insurance products through Sampo Bank's branch network in Finland.

Mandatum Life decided 20 October 2016 not to prolong the agency agreement as of 31 December 2016. In relation to the agency agreement Mandatum Life has the right to sell the insurance portfolio sold through Danske Bank's branch network in Finland, to Danske Bank. Mandatum Life decided on 27 October 2016 to use this option.

The valuation of the portfolio will be conducted by a third party in accordance with the terms and conditions of the bank transaction agreement referred to above. The valuation is estimated to take until the summer of 2017 and the transfer of the portfolio is estimated to take place during the fourth quarter of 2017. The transfer is subject to regulatory approvals.

The portfolio consists of 151,000 policies and the technical reserves related to the portfolio amounted to EUR 3,060 million at the end of 2015. The portfolio accrued premiums of EUR 453 million in 2015 and contains almost exclusively unit linked and loan insurance products. The amount of with profit technical reserves is EUR 212 million.

Shares in the joint book-entry account

When Sampo plc's shares were incorporated to the book-entry system in 1997 shareholders were obliged to provide the share certificates and request registration of the shares into their book-entry accounts during the registration period set in the General Meeting's resolution to incorporate the shares into the book-entry system. A joint book-entry account in the name of the Company was opened for those shareholders who did not request the registration of their shares.

According to the Finnish Companies Act the Annual General Meeting may after September 2016 resolve that the shares in the joint book-entry account and the rights that those shares carry have been forfeited. After the General Meeting's resolution the provisions on treasury shares apply to forfeited shares and the Board may, for example, resolve on cancellation of treasury shares.

As this will be the first time the Annual General Meeting has an option to resolve the issue, the Audit Committee has initiated a project to look into the procedure and consequences of such a resolution by the Annual General Meeting with a particular view on the equal treatment of all shareholders.

Internal dividends

Mandatum Life paid a dividend of EUR 125 million to Sampo plc in March 2016. On 17 March 2016 Nordea Bank AB's Annual General Meeting decided to pay a dividend of EUR 0.64 per share. With its current holding Sampo plc's share amounted to EUR 551 million. The dividend was paid on 30 March 2016.

If P&C normally pays its dividend towards the end of the calendar year. If P&C made a sales gain in connection to the mandatory offer on Topdanmark shares and paid an extra SEK 2.8 billion (EUR 293 million) dividend to Sampo plc on 22 September 2016. In December 2016 If P&C plans to pay a normal dividend of SEK 5.8 billion to Sampo plc.

Solvency

On 30 September 2016 If P&C Group's Solvency II capital requirement under standard model amounted to EUR 1,940 million (2,073) and own funds to EUR 3,818 million (3,202). Solvency ratio amounted to 197 per cent (154). S&P rating total capital charge for If P&C Group amounted to EUR 2,961 million (3,058) at the end of September 2016 while the capital base amounted to EUR 3,714 million (3,455).

Mandatum Life's solvency ratio after transitional measures remained strong at 153 per cent (158). Own funds of EUR 1,743 million (1,913) exceed Solvency Capital Requirement (SCR) of EUR 1,141 million (1,212) by EUR 602 million. Without transitional measures, own funds would have amounted to EUR 1,283 and the solvency capital requirement EUR 1,334 million leading to a solvency ratio of 96 per cent.

Group's conglomerate solvency ratio (own funds in relation to minimum requirements for own funds) using Solvency II rules for the insurance subsidiaries was 149 per cent (145) as at 30 September 2016.

OUTLOOK

Outlook for the rest of 2016

Sampo Group's business areas are expected to report good operating results for 2016.

However, the mark-to-market results are, particularly in life insurance, highly dependent on capital market developments. The continuing low interest rate level also creates a challenging environment for reinvestment in fixed income instruments.

The P&C insurance operations are expected to reach a combined ratio of 86 - 88 per cent excluding the release from the Swedish MTPL reserves.

Nordea's contribution to the Group's profit is expected to be significant.

The major risks and uncertainties to the Group in the near-term

In its day-to-day business activities Sampo Group is exposed to various risks and uncertainties mainly through its separately managed major business units. Parent company Sampo plc's contribution to risks is a minor one.

Major risks affecting the Group companies' profitability and its variation are market, credit, insurance and operational risks that are quantified independently by the major business units. At the Group level sources of risks are same, but they are not additive because of diversification effects.

Uncertainties in the form of major unforeseen events may have an immediate impact on the Group's profitability. Identification of unforeseen events is easier than estimation of their probabilities, timing and potential outcomes. Currently there are a number of widely identified macro-economic, political and other sources of uncertainty which can in various ways affect financial services industry negatively.

Other sources of uncertainty are unforeseen structural changes in the business environment and already identified trends and potential wide-impact events. These external drivers may also have a long-term impact on how the business shall be conducted.

SAMPO PLC

Board of Directors

For more information, please contact:

Peter Johansson, Group CFO, tel. +358 10 516 0010

Jarmo Salonen, Head of Investor Relations and Group Communications, tel. +358 10 516 0030

Essi Nikitin, IR Manager, tel. +358 10 516 0066

Maria Silander, Communications Manager, tel. +358 10 516 0031

Conference call

An English-language conference call for investors and analysts will be arranged at 4 pm Finnish time (2 pm UK time). Please call tel. +44 (0)20 3 043 2003, +46 (0)8 5033 6574, +1 719 457 2086 or +358 (0)9 7479 0361. Confirmation Code: 9535979

The conference call can also be followed live at www.sampo.com/result. A recorded version will later be available at the same address.

In addition the Supplementary Financial Information Package is available at www.sampo.com/result.

Sampo will publish the Full-year Financial Report for June 2016 on 8 February 2017.

Distribution:

Nasdaq Helsinki

London Stock Exchange

The principal media

Financial Supervisory Authority

www.sampo.com

The issuer of this announcement warrants that they are solely responsible for the content, accuracy and originality of the information contained therein.

Source: Sampo Oyj via Globenewswire

Mehr Nachrichten zur Sampo Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.