S&P 500 Buybacks Fall 17.5% Year-over-Year to $133.1 Billion for Q1 2017

PR Newswire

NEW YORK, June 21, 2017

NEW YORK, June 21, 2017 /PRNewswire/ -- S&P Dow Jones Indices ("S&P DJI") today announced preliminary results indicating that S&P 500® stock buybacks, or share repurchases, totaled $133.1 billion for Q1 2017. This is a 1.6% decrease from the $135.3 billion reported for Q4 2016 and a 17.5% decrease from the $161.4 billion reported for Q1 2016, when companies actively supported declining share prices.

For the 12-month period ending March 2017, S&P 500 issues spent $508.1 billion on buybacks, down 13.8% from $589.4 billion for the prior 12-month period; the 12-month period ending March 2016 remains the all-time record.

Historical data on S&P 500 buybacks is available at: www.spdji.com/indices/equity/sp-500.

Key Takeaways:

- Fewer buybacks resulted in fewer share count reductions and less earnings per share (EPS) support.

- S&P 500 issues substantially reducing their year-over-year share count, which is used to calculate EPS, declined to 14.8%, compared to 19.4% for Q1 2017 and 28.2% for Q1 2016.

- Total shareholder return totaled $234.0 billion, down 2.1% from $239.1 billion for Q4 2016.

- S&P 500 dividends slightly declined to $100.9 billion, from $103.8 billion for Q4 2016; for the 12-month period ending March 2017, the total shareholder return was $909.6 billion, down 6.7% from $975.0 billion for the 12-month period ending March 2016.

- 255 S&P 500 issues reduced their share count for Q1 2017, down from 281 for Q4 2016 and 324 for Q1 2016.

- Year-over-year share count reductions of at least 4%, which are seen as affecting EPS, declined to 71 issues for Q1 2017, compared to 93 for Q4 2016 and 139 for Q1 2016.

"The expenditures on share buybacks declined as share prices increased, resulting in fewer share repurchases and an impact to EPS growth," said Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices.

"Over the past two years, more than 20% of S&P 500 issues have given at least a 4% tailwind for EPS via reduced share counts; for Q1 2017, that rate dropped to 14.8%, with indications that Q2 2017 may offer even less support. Companies may have to increase EPS the old-fashioned way – by earning it."

Buybacks remained concentrated, as the top 20 issues accounted for 42.1% of all share repurchases, down from 46.7% for Q4 2016.

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in Bank of America | ||

|

UH9W5C

| Ask: 0,58 | Hebel: 4,52 |

| mit moderatem Hebel |

Zum Produkt

| |

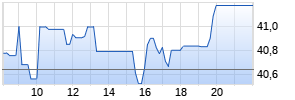

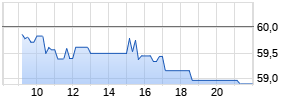

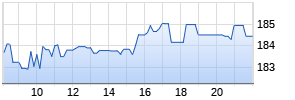

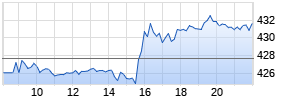

Kurse

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

"The ability of companies to increase buybacks remains high, as available cash set a new record," said Silverblatt. "Net income has improved, with Q2 2017 estimates projecting additional gains, potentially setting a new record. On an issue level, the question now is where share counts end up and the overall amount of EPS support."

Sector Analysis:

Financials increased its expenditures by 10.2%, to $29.5 billion, the most of any sector. Financials accounted for 22.2% of all buybacks. Of note, the upcoming bank stress test results may indicate potential future actions.

Health Care expenditures declined 6.5% to $27.0 billion, from $28.9 billion, as it accounted for 20.3% of all buybacks (down from 21.4% for Q4 2016).

Information Technology continued strong, even as its expenditures declined 4.4% to $27.5 billion from the prior period's $28.7 billion; the sector represents 20.6% of all buybacks.

Energy buybacks more than doubled to $2.1 billion for Q1 2017, from $1.0 billion for Q4 2016, but still pales against the $13.1 billion spent for Q1 2014 when oil prices were higher.

Issues:

Apple (AAPL) spent $7.2 billion for Q1 2017, down from $10.9 billion for Q4 2016 but up from $6.7 billion for Q1 2016.

Pfizer (PFE) was second, with $5.0 billion, as it matched its Q1 2016 expenditure after no buybacks between Q2-Q4 2016.

CVS Health (CVS) was third, with $3.6 billion, up from $0.4 billion for Q4 2016 and $2.1 billion for Q1 2016.

American International Group (AIG) came in fourth, with $3.6 billion, up from $3.0 billion for Q4 2016.

Johnson & Johnson (JNJ) rounded out the top 5, at $3.3 billion, up from $2.0 billion for Q4 2016.

Exxon Mobil (XOM) ranked 68, up from 111 last quarter (and 291 for Q3 2016), as it increased its expenditures to $501 million from last quarter's $250 million and $1 million for both Q2 2016 and Q3 2016.

Total Shareholder Return:

Silverblatt determined that total shareholder return through regular cash dividends and buybacks decreased 2.1% to $234.0 billion for Q1 2017, down from $239.1 billion for Q4 2016. For the 12-month period ending March 2017, shareholder return totaled $909.6 billion, down 6.7% from the record $975.0 billion for the 12-month period ending March 2016.

Dividends posted a 2.8% decline for Q1 2017, to $100.9 billion, from the Q4 2016 record of $103.8 billion. Payments totaled $401.4 billion for the 12-month period ending March 2017, up 4.1% from $385.6 billion for the 12-month period ending March 2016. With Q2 2017 nearing its end, the quarter could post a record.

According to Silverblatt, preliminary cash reserves ticked up from Q4 2016. S&P 500 Industrial (Old), which consists of the S&P 500 less Financials, Transportations and Utilities, available cash and equivalent now stands at $1.496 trillion, surpassing the previous record of $1.487 trillion from Q3 2016. The current cash level is 1.7 times greater than expected 2017 operating income.

"Companies' ability to increase their expenditure, be it buybacks, dividends capital expenditures or M&A, remains very high, given their cash reserves and cash flow," said Silverblatt. "Additionally, while dividend growth has slowed, Q2 2017 and full-year 2017 may post quarterly and annual records, respectively."

"Base buyback expenditures must increase if companies wish to negate stock options, as higher stock prices can be costly and bring in additional out-of-the-money options."

"Discretionary buybacks, which are typically used to reduce share count and increase EPS, continued to decline, indicating that companies may feel they can compensate via higher earnings; if not, they have the choice to quickly increase their buybacks."

For more information about S&P Dow Jones Indices, please visit www.spdji.com.

| S&P Dow Jones Indices | | | | | | | | | |

| S&P 500, $ U.S. BILLIONS | (preliminary in bold) | | | | | | | ||

| PERIOD | MARKET OPERATING AS REPORTED | | | | | DIVIDEND & | DIVIDENDS | ||

| | VALUE | EARNINGS | EARNINGS | DIVIDENDS | BUYBACKS | DIVIDEND | BUYBACK | BUYBACK | & BUYBACKS |

| | $ BILLIONS | $ BILLIONS | $ BILLIONS | $ BILLIONS | $ BILLIONS | YIELD | YIELD | YIELD | $ BILLION |

| 12 Months Mar 2017 | $20,275.97 | $958.10 | $864.83 | $401.41 | $508.15 | 1.98% | 2.51% | 4.49% | $909.56 |

| 12 Months Mar 2016 | $17,958.30 | $865.92 | $759.06 | $385.57 | $589.41 | 2.15% | 3.28% | 5.43% | $974.99 |

| 2016 | $19,267.93 | $919.85 | $818.55 | $397.21 | $536.38 | 2.06% | 2.78% | 4.85% | $933.60 |

| 2015 | $17,899.56 | $885.38 | $762.74 | $382.32 | $572.16 | 2.14% | 3.20% | 5.33% | $954.47 |

| 2014 | $18,245.16 | $1,004.22 | $909.09 Werbung Mehr Nachrichten zur Boeing Co. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||