Royce Value Trust, Inc. Record Date Postponed for Its Common Stock Rights Offering; Expects to Announce New Record Date in Near Future

PR Newswire

NEW YORK, March 1, 2018

NEW YORK, March 1, 2018 /PRNewswire/ -- Royce Value Trust, Inc. (NYSE: RVT) (the "Fund") announced today that it was postponing its previously announced record date of March 5, 2018 for determination of stockholders entitled to participate in the Fund's pending common stock rights offering (the "Offer") in order to allow sufficient time for its Registration Statement to be declared effective prior to the record date as required by New York Stock Exchange ("NYSE") listing standards. The Fund intends to announce the updated record date and subscription schedule for the Offer, subject to compliance with applicable regulatory and NYSE requirements, through the issuance of a subsequent press release once the effective date for its Registration Statement is known.

The material terms of the Offer remain unchanged and are summarized below.

- Each stockholder will receive one non-transferable right (each, a "Right") for each whole share of common stock held of record as of the record date, rounded up to the nearest number of Rights evenly divisible by ten. The Rights will allow record date stockholders to subscribe for one share of common stock for each ten Rights held (the "Primary Subscription"). The Rights are non-transferable and may not be purchased or sold.

- The subscription price for all shares of common stock issued pursuant to the Offer will be the lower of: (i) $0.25 below the last reported sale price per share on the NYSE on the first business day after the expiration date of the Offer (the "Pricing Date") or (ii) the net asset value per share on the Pricing Date.

- Record date stockholders who fully exercise their Rights in the Primary Subscription may subscribe, subject to certain limitations and a pro-rata allotment, for those shares not purchased by other record date stockholder pursuant to the Primary Subscription.

- If such over-subscription requests exceed the number of shares available, the Fund may, in its sole discretion and subject to certain anti-dilution limitations, increase the number of shares subject to subscription by up to 20% of the number of shares available under the Primary Subscription.

The Offer is subject to the effectiveness of the Fund's Registration Statement on Form N-2 that was filed on January 25, 2018 with the Securities and Exchange Commission (the "Commission"). Such Registration Statement is not complete, remains subject to review and comment by the staff of the Commission, and may be changed. The Offer will be made only by means of a final prospectus.

The information in this press release is not complete and is subject to change. This press release is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. This press release is not an offering, which can only be made by a prospectus. Investors should carefully consider the Fund's investment objective, risks, charges, and expenses before investing. The prospectus will contain this information and additional information about the Fund and the Offer, and should be read carefully before investing. Please contact the Fund at (800) 221-4268 with any questions about the Offer.

Shares of closed-end investment companies frequently trade at a discount from their NAV per share. The market price of the Fund's shares of common stock is determined by a number of factors, several of which are beyond the control of the Fund. Therefore, the Fund cannot predict whether its shares will trade at, below, or above its NAV per share.

The Fund is a diversified, closed-end management investment company. Its investment goal is long-term capital growth. The Fund normally invests at least 65% of its assets in the equity securities of small- and micro-cap companies, generally those with stock market capitalizations ranging from $100 million to $3 billion, that Royce & Associates, LP ("Royce"), the Fund's investment adviser, believes are trading below its estimate of their current worth. The Fund also may invest up to 25% of its assets in securities of issuers headquartered outside the United States. The Fund may invest a portion of its assets in companies with stock market capitalizations in excess of $3 billion. In managing the Fund's assets, Royce uses a core approach that combines multiple investment themes and offers wide exposure to small- and micro-cap stocks by investing in companies with high returns on invested capital or those with strong fundamentals and/or prospects trading at what Royce believes are attractive valuations.

About Royce & Associates, LP: Royce & Associates, LP is a small-cap equity specialist offering distinct investment strategies with unique risk/return profiles designed to meet a variety of investors' needs. For more than 40 years, our strategies have focused on active, risk-conscious investing driven by deep, fundamental company research. Chuck Royce, the firm's founder and a pioneer of small-cap investing, enjoys one of the longest tenures in the industry. Royce & Associates, LP is a subsidiary of Legg Mason Inc. (NYSE: LM).

ARIVA.DE Börsen-Geflüster

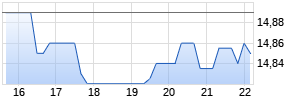

Kurse

|

|

![]() View original content:http://www.prnewswire.com/news-releases/royce-value-trust-inc-record-date-postponed-for-its-common-stock-rights-offering-expects-to-announce-new-record-date-in-near-future-300607095.html

View original content:http://www.prnewswire.com/news-releases/royce-value-trust-inc-record-date-postponed-for-its-common-stock-rights-offering-expects-to-announce-new-record-date-in-near-future-300607095.html

SOURCE Royce Value Trust, Inc.

Mehr Nachrichten zur Legg Mason Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.