Robbins Geller Rudman & Dowd LLP Files Class Action Suit Against Volkswagen AG

PR Newswire

SAN DIEGO, Sept. 25, 2015

SAN DIEGO, Sept. 25, 2015 /PRNewswire/ -- Robbins Geller Rudman & Dowd LLP ("Robbins Geller")(http://www.rgrdlaw.com/cases/volkswagen/) today announced that a class action has been commenced on behalf of an institutional investor in the United States District Court for the Eastern District of Virginia on behalf of purchasers of Volkswagen AG ("Volkswagen") (OTCMKTS:VLKAY; OTCMKTS:VLKPY; OTCMKTS:VLKAF) publicly traded ordinary and preferred American Depositary Receipts ("ADRs") during the period between November 19, 2010 and September 21, 2015 (the "Class Period").

If you wish to serve as lead plaintiff, you must move the Court no later than 60 days from today. If you wish to discuss this action or have any questions concerning this notice or your rights or interests, please contact plaintiff's counsel, Darren Robbins of Robbins Geller at 800/449-4900 or 619/231-1058, or via e-mail at djr@rgrdlaw.com. If you are a member of this class, you can view a copy of the complaint as filed or join this class action online at http://www.rgrdlaw.com/cases/volkswagen/. Any member of the putative class may move the Court to serve as lead plaintiff through counsel of their choice, or may choose to do nothing and remain an absent class member.

The complaint charges Volkswagen and certain of its officers and directors with violations of the Securities Exchange Act of 1934. Volkswagen is one of the world's leading automobile manufacturers and the largest carmaker in Europe.

The complaint alleges that prior to and during the Class Period, defendants engaged in a scheme to defraud and made numerous materially false and misleading statements and omissions to investors regarding the Company's operations and its business and financial condition and outlook. Specifically, defendants misled investors by failing to disclose that the Company had utilized a "defeat device" in certain of its diesel cars that allowed such cars to temporarily reduce emissions during testing, while achieving higher performance and fuel economy, as well as discharging dramatically higher emissions, when testing was not being conducted. The use of this device allowed Volkswagen to market its diesel vehicles to environmentally conscious consumers, increasing its sale of diesel cars in the United States and abroad and, as a result, its profitability. As a result of defendants' scheme and false and misleading statements and omissions, Volkswagen's ordinary and preferred ADRs traded at artificially inflated prices during the Class Period, reaching highs of $54.82 and $56.55 per ADR, respectively, on December 30, 2013.

The truth regarding defendants' false and misleading statements and omissions and scheme to defraud was revealed to investors and the markets through several shocking disclosures and news reports. On September 18, 2015, the Environmental Protection Agency ("EPA") issued a Notice of Violation ("NOV"). The NOV stated that defendants had installed sophisticated software in Volkswagen and Audi diesel vehicles sold in the United States that could detect when the vehicle was undergoing official emissions testing and turn the full emissions controls on only during the test. At all other times, however, the emissions controls were deactivated, meaning that pollution was freely released into the environment at levels exceeding those allowed by federal and state clean air regulators. This software produced and used by Volkswagen is a "defeat device" as defined by the Clean Air Act.

That same day, The New York Times published a front-page article entitled "U.S. Orders Major VW Recall Over Emissions Test Trickery." The article reported that the Company had "illegally installed software in its diesel-power cars to evade standards for reducing smog" and that Volkswagen had "admitted to the use of a so-called defeat device. The recall involves 4 cylinder Volkswagen and Audi vehicles from model years 2009-2015." The article also reported that the Department of Justice ("DOJ") had opened an investigation and that fines of as much as $18 billion could be imposed as a result of defendants' misconduct.

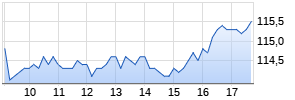

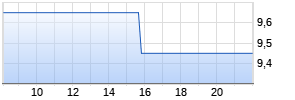

In the days following these disclosures, which began to reveal the relevant truth that had previously been concealed from the market, Volkswagen's share price collapsed. Specifically, between September 17, 2015 and September 22, 2015, the price of Volkswagen's ordinary ADRs plummeted over 33%, from a close of $38.03 per share on September 17, 2015 to $25.44 per share on September 22, 2015. Volkswagen's preferred ADRs declined from a close of $38.05 per share on September 17, 2015 to a close of $23.98 per share on September 22, 2015.

ARIVA.DE Börsen-Geflüster

Kurse

|

|

|

These price declines have resulted in hundreds of millions of dollars in losses to Volkswagen ADR investors, who relied on the accuracy of defendants' statements and suffered damages when the truth began to be revealed.

Plaintiff seeks to recover damages on behalf of all purchasers of Volkswagen ADRs during the Class Period (the "Class"). The plaintiff is represented by Robbins Geller, which has extensive experience in prosecuting investor class actions including actions involving financial fraud.

Robbins Geller, with 200 lawyers in ten offices, represents U.S. and international institutional investors in contingency-based securities and corporate litigation. The firm has obtained many of the largest securities class action recoveries in history and was ranked first in both the amount and number of shareholder class action recoveries in ISS's SCAS Top 50 report for 2014. Please visit http://www.rgrdlaw.com/cases/volkswagen/ for more information.

https://www.linkedin.com/company/rgrdlaw

https://twitter.com/rgrdlaw

https://www.facebook.com/rgrdlaw

https://plus.google.com/+Rgrdlaw/posts

Logo - http://photos.prnewswire.com/prnh/20150415/198876LOGO

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/robbins-geller-rudman--dowd-llp-files-class-action-suit-against-volkswagen-ag-300149223.html

SOURCE Robbins Geller Rudman & Dowd LLP

Mehr Nachrichten zur Volkswagen AG St Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.