Republic First Bancorp, Inc. Announces Completion Of $100 Million Common Stock Offering And The Election Of Vernon W. Hill, II As Chairman

PR Newswire

PHILADELPHIA, Dec. 5, 2016

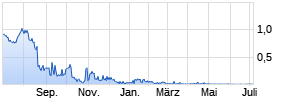

PHILADELPHIA, Dec. 5, 2016 /PRNewswire/ -- Republic First Bancorp, Inc. (NASDAQ: FRBK), the holding company for Republic Bank, today announced that it completed the sale of $100 million of its common stock at a price of $5.35 per share and elected Vernon W. Hill, II as a Director and Chairman of Republic First Bancorp, Inc.

Mr. Hill is often credited with reinventing Retail Banking as:

- The Founder and Chairman of Commerce Bancorp, a $50 billion Retail Bank with 450 locations headquartered in Metro Philadelphia, sold in 2007

- Founder and Chairman of Metro Bank (UK) (LSE: METR) the first new Retail high street bank opened in Britian since 1840, now with 48 stores and assets of £10 billion ($12 billion) and a market capitalization of $3.2 billion

- A major investor and consultant to Republic First Bancorp, Inc.

- Chairman of Petplan USA, one of America's premier pet health insurers

Harry D. Madonna, founder of Republic First Bancorp, will continue as Chief Executive Officer and Chairman of Republic Bank, a subsidiary of Republic First Bancorp, Inc. Mr. Madonna commented, "Using Vernon's model and strengthened by this $100 million equity raise, Republic has been transformed into a regional, high growth bank, creating "Fans Not Customers" for both retail and business customers."

Mr. Hill commented, "The Power of Red is Back as Republic Bank returns to New Jersey and Pennsylvania our unique, totally customer-oriented business model. I am pleased to work with Chairman Madonna and President Andy Logue to, again, redefine American banking.

The additional capital will be utilized to expand the growth opportunities of Republic Bank through the addition of new stores, primarily in southern New Jersey and the surrounding Philadelphia area. The Bank has opened eight new locations over the last three years using its signature glass building. There are plans for additional stores during 2017 in Cherry Hill, Medford, Sicklerville and Blackwood, NJ and Fairless Hills and Bensalem, PA.

"Our expansion plan represents the Bank's commitment to world-class service and convenience. The Power of Red is Definitely Back," said Mr. Madonna.

The Company's capital ratios at September 30, 2016 and on a pro-forma basis after giving effect to the offering are as follows:

| | Actual 9/30/16 | | Pro-forma After Offering |

| | | | |

| Leverage Ratio | 8.14% | | 14.14% |

| | | | |

| Common Equity Tier 1 | 9.40% | | 17.66% |

| | | | |

| Tier 1 Risk Based Capital | 11.22% | | 19.48% |

| | | | |

| Total Risk Based Capital | 12.00% | | 20.27% |

As of September 30, 2016, Republic First Bancorp, Inc. continued its sustained growth:

| | Actual 9/30/16 | | 12 Month |

| | | | |

| Assets | $ 1.7 B | | 26% |

| | | | |

| Loans | $ 0.9 B | | 12% |

| | | | |

| Deposits | $ 1.6 B | | 28% |

After giving pro-forma effect to the offering, the book value of the Company's stock would have increased from $3.16 to $3.87 per common share at September 30, 2016. Assuming the future reversal of the deferred tax asset valuation allowance, the book value would increase by an additional $0.23 to $4.10 per share.

Keefe, Bruyette & Woods and Sandler O'Neill Partners acted in a financial advisory role and assisted the Company with the offer and sale of the common stock in this offering. The shares were issued through a registered direct offering under the shelf registration statement previously filed with the Securities and Exchange Commission. Closing on the sale is scheduled for Tuesday, December 6, 2016.

About Republic Bank

Republic Bank, a subsidiary of Republic First Bancorp, Inc., is a full-service, state-chartered commercial bank, whose deposits are insured up to the applicable limits by the Federal Deposit Insurance Corporation (FDIC). The Bank provides diversified financial products through its nineteen offices located in southern New Jersey and southeastern Pennsylvania. For more information about Republic Bank, visit www.myrepublicbank.com.

Forward Looking Statements

The Company may from time to time make written or oral "forward-looking statements", including statements contained in this release and in the Company's filings with the Securities and Exchange Commission. The forward-looking statements contained herein are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected in the forward-looking statements. For example, risks and uncertainties can arise with changes in: general economic conditions, including turmoil in the financial markets and related efforts of government agencies to stabilize the financial system; the adequacy of our allowance for loan losses and our methodology for determining such allowance; adverse changes in our loan portfolio and credit risk-related losses and expenses; concentrations within our loan portfolio, including our exposure to commercial real estate loans, and to our primary service area; changes in interest rates; business conditions in the financial services industry, including competitive pressure among financial services companies, new service and product offerings by competitors, price pressures and similar items; deposit flows; loan demand; the regulatory environment, including evolving banking industry standards, changes in legislation or regulation; impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act; our securities portfolio and the valuation of our securities; accounting principles, policies and guidelines as well as estimates and assumptions used in the preparation of our financial statements; rapidly changing technology; litigation liabilities, including costs, expenses, settlements and judgments; our ability to successfully implement our business strategy, including the timely opening of new stores to expand the Company's geographic coverage area; and other economic, competitive, governmental, regulatory and technological factors affecting our operations, pricing, products and services. You should carefully review the risk factors described in the Form 10-K for the year ended December 31, 2015 and other documents the Company files from time to time with the Securities and Exchange Commission. The words "would be," "could be," "should be," "probability," "risk," "target," "objective," "may," "will," "estimate," "project," "believe," "intend," "anticipate," "plan," "seek," "expect" and similar expressions or variations on such expressions are intended to identify forward-looking statements. All such statements are made in good faith by the Company pursuant to the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. The Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company, except as may be required by applicable law or regulations.

Logo - http://photos.prnewswire.com/prnh/20100707/PH31611LOGO

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/republic-first-bancorp-inc-announces-completion-of-100-million-common-stock-offering-and-the-election-of-vernon-w-hill-ii-as-chairman-300372924.html

SOURCE Republic First Bancorp, Inc.

Mehr Nachrichten zur Republic First Bancorp Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.