Regulated information - Ageas reports Q1 2017 result

- Marked increase in Insurance net result

- Residual impact of regulatory review in the UK

| Q1 2017 | |

| Net Result |

|

| Inflows |

|

| Operating Performance |

|

| Balance Sheet |

|

| Belgium |

|

| UK |

|

| Continental Europe |

|

| Asia |

|

All Q1 2017 figures are compared to the Q1 2016 figures unless otherwise stated.

Ageas CEO Bart De Smet said: "In the first quarter, all segments achieved solid results with the exception of the UK. The UK's result was affected by the residual impact of the regulatory discount rate revision by the UK government. Although various mitigating actions have already been taken, the impact will continue to be felt throughout the year. The overall Insurance net result reflected a good operating performance and benefitted also from solid capital gains on Ageas's real estate transactions.

The group's balance sheet remained solid with an Insurance Solvency IIageas ratio that slightly decreased but remained above target.

Also during the first quarter an important next step in the Fortis settlement was taken with a public hearing held by the Court of Amsterdam. The Court confirmed that it will take a decision regarding Ageas's request to declare the settlement binding on Friday 16 June 2017."

The issuer of this announcement warrants that they are solely responsible for the content, accuracy and originality of the information contained therein.

Source: Ageas via Globenewswire

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in Ageas | ||

|

ME0VMT

| Ask: 0,12 | Hebel: 6,18 |

| mit moderatem Hebel |

Zum Produkt

| |

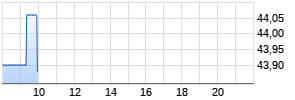

Kurse

|

Mehr Nachrichten zur Ageas Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.