Red Oak Partners Issues Open Letter to Digirad Corporation Shareholders About the Current Proxy Contest

PR Newswire

NEW YORK, April 19, 2013

NEW YORK, April 19, 2013 /PRNewswire/ -- Red Oak Partners and the Red Oak Fund L.P. (collectively "Red Oak") release the following letter to Shareholders of Digirad Corporation (Nasdaq: DRAD) from Red Oak's Founder and Managing Member, David Sandberg:

Dear Fellow Digirad Shareholders,

Red Oak has been one of Digirad's large shareholders for the better part of the past 4 ½ years. We are in the midst of an important proxy contest against Digirad's current Directors, whom we believe have not been fully honest with you about their qualifications, and have instead dodged discussion about core issues while making un-substantiated representations about their skills and experience.

Additionally, Digirad has stated in its latest fight letter that "Red Oak just wants to seize control without paying a premium". This is blatantly misleading. Red Oak is NOT seeking control of Digirad's business. Our only objective it to ensure that Digirad has a Board of independent directors that have a vested interest in protecting shareholder value (and are not affiliated with one another like Messrs. Eberwein, Gillman and Climaco). Red Oak publicly commits to running an open independent process to review all strategic alternatives. Moreover, shareholders have the right to know how it was possible for Messrs. Gillman, Eberwein and Climaco, who we believe are very close associates, to get control of Digirad's board without having to spend any money of their own to buy Digirad shares. Who should shareholders trust: the current Board, who not only lacks relevant experience and received board control without investing a penny of their own funds, or Red Oak, a long term shareholder that has invested over $2.5 million of our own capital in buying Digirad shares?

A Brief History:

In late 2011 Red Oak, owning more shares than Digirad's collective Board (both then and now), challenged Digirad's Board to effect overdue change given material share price erosion while Directors enriched themselves and owned little stock. After Digirad received Red Oak's nomination letter, Digirad offered Red Oak three Board seats, provided incumbents retained control. Red Oak rejected this offer. At the same time, Charles Gillman – an individual claiming to work at a Tulsa family office – cold-called and solicited Red Oak, asking to lead a contest against Digirad's Board using Red Oak's shares because he owned none himself. Red Oak rejected Mr. Gillman's solicitation.

Shortly after this solicitation, Digirad's Board appointed four new Directors - Charles Gillman, Jeff Eberwein, John Climaco, and Jim Hawkins. It is important to note that none of the new Directors had any history of challenging the then-incumbent Board nor sought any improvements in Digirad's corporate governance as a condition to serving.

At the time of their appointment, not one of these four Directors:

a) Owned a single share of stock in Digirad – they were each new to the Company, and we don't believe any of them had owned any Digirad stock at any point in the past, either, through which they might have followed and learned about the Company

b) Had any industry experience regarding Digirad's main business: digital imaging

c) Led any strategic review process at a public micro-cap company

d) Had any track record or history turning around any company, whether public or private

e) Had any track record of effecting meaningful governance improvements or adopting insider ownership policies to align insiders with Shareholders

f) Had any expertise or meaningful experience regarding the utilization of tax loss assets via IRS Section 382 (Digirad has $125 million in tax loss assets)

Below we ask – publicly and in an open forum - relevant questions about and to these Directors:

Charles Gillman, as the Chair of the Governance Committee:

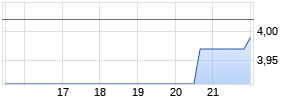

- Within the past year, you and your business school colleague Jeff Eberwein contested election in at least four small companies together (note in your one successful contest at On Track Innovations, Ticker: OTIV, that since your election on Dec 31st, 2012, the stock has declined approximately 37% to date). You and he also appear (according to SEC filings) to split purchases evenly in at least some of the companies you appear to be involved in together, rather than buying stock separately in the open market, as non-affiliated shareholders would do. Noting that a group can be defined as individuals "acting in concert," are you and Jeff Eberwein a group?

- Do you believe that Directors should have relevant industry experience or appropriate skill-sets, or is it more important that you personally know them? We note that you recommended both Jeff Eberwein and John Climaco to Digirad's Board despite neither having any prior public Board, micro-cap, governance, digital imaging, turnaround, or other seemingly relevant experience (noting that you have micro-cap and some Board experience, but lack relevant experience in the other areas we mentioned). However, you appear to work with Mr. Eberwein and you introduced Mr. Climaco to join the Board of Infusystems at the same time as you, and the two of you recently resigned within a day of each other.

- Why did you approve a grant to fellow Director, Jim Hawkins, for two-fold more options compensation vs. that which other Directors received? Why, contrary to industry practice, has the reason for this substantial grant not been disclosed?

Charles Gillman and Jeff Eberwein:

- In Digirad's proxy it states that you both recommended Mr. Climaco to serve as a Director. Per publicly available information, in the past decade Mr. Climaco's primary experience was as a producer at Quokka - which went bankrupt - and as CEO of Axial - which sold its assets last year for less than 20% of funds raised.

- Given this history, why do you, through Digirad's filings, continue to laud his "substantial experience" and "fund-raising" capabilities (and why would a company seeking to buy stock need fund-raising, let alone from someone who appears to have lost significant money for his past investors?). Did you perform any form of adequate due diligence and did you know about his background and his performance record prior to your recommendation?

Jeff Eberwein:

- For the record, what caused your departure from Soros, and why did you wait more than a year after leaving Soros before starting your own firm?

- In your fight letter you reference 20 years of experience creating value for shareholders, and suggest that you can introduce Digirad to new investors. We can find no record of you having created shareholder value at any public company over your 20 year career, and seem to be only experienced in buying stock in large capitalization companies. Can you please direct us to where you accomplished this? Further, why should a Chairman's primary value-add in a micro-cap turnaround situation such as Digirad be in seeking to promote the stock via investor introductions, as opposed to hiring an affordable micro-cap IR firm, and instead providing experience, leadership, and oversight to the Board and the management team?

Digirad Board:

- Why would a company with 2012 costs in excess of $50 million only find $3-4 million in cost reductions, and only in one division? We specifically chose our slate to be balanced, and four of our nominees have successful turnaround experience at name brand and prestigious firms including Alvarez and Marsal, CounterPoint Capital, Waterfield Group, and I, David Sandberg, via Red Oak which has led successful turnarounds. We believe, based on our slate's expertise, that your estimates of cost reductions are woefully inaccurate and reflect your lack of experience and learning on the job. The camera business alone loses more than DIS and was 30% of revenues and therefore presumably more than 30% of costs. 30% of 2012 R&D and SG&A, excluding depreciation and amortization, would result in $5 million in cost savings in that business alone and we estimate the savings would be higher given the camera business's higher cost structure. This is close to double what you have indicated, and we find no inclusion for DIS or corporate cost reductions. Please explain your math because candidly, it doesn't make any sense.

- Why did Digirad purchase less than $700k of stock since you were appointed to the Board in 2012 under what was supposedly an active buyback plan and with the stock trading at lower prices? Also, why didn't you issue a dividend or tender offer in 2012 when taxes were lower (at a time when hundreds of other public companies announced such plans), especially given you have now increased the buyback and indicated that significant excess cash exists? Why didn't you reach the same conclusion last year?

- According to other Digirad shareholders who have contacted us, you are using a Raymond James retail broker out of California to operate the buyback plan, and that broker does not always answer his phone and has rejected offers to sell shares at market prices. Further, Messrs. Gillman and Eberwein have recently reduced their share purchases by 80% (to 1,000 shares per day, and they continue to own well under what they told Red Oak they would own when Red Oak agreed to give them a year to prove themselves via the June 2012 agreement). Is there any sincerity to the buyback plan, and why did you not give it to an experienced institutional desk to oversee the trading?

- You cite that management salaries are within a "requisite peer group." Is this the peer group from your proxy which contains materially larger and more valuable companies?

- You claim that a change in your auditors would "be disruptive and potentially threaten the success of our new strategic plan." We note none of you have ever achieved a successful turnaround and we believe this speaks to your lack of experience. When Red Oak replaced the entire Board of Asure Software in late 2009 and achieved a NO vote against the re-appointment of its auditors, Asure suffered zero distraction due to the NO vote because the auditor process was and should be managed via transition. In that instance, the same auditors were included in a process with other bidders, and won with a materially reduced bid for the same level of service. That auditor was Ernst & Young, the same auditor as at Digirad. We can't stress enough that we believe you are inexperienced and making many mistakes, and should have included these rebids in what has been a 10+ month process.

Red Oak took nearly a year to consider and recruit the appropriate slate of directors to turn around the Digirad business. Please read our proxy: we go into detail about our turn-around plan (far more detail than Messrs Eberwein or Gillman have in any of their proxies in contests where they've sought to replace a majority of the Board). Red Oak has worked with only one of our director nominees before; the additional proposed directors came after a thoughtful "needs and fits" process. Tony Snow too worked at Soros, but unlike Eberwein, he has real experience within operating companies at a prestigious private equity firm. Chris Iorillo was a Paul Hastings Securities attorney before working inside companies at Platinum Equity and then co-founding private equity firm CounterPoint Capital Partners which specifically focuses on turnaround and internal operating improvements and investments. Raymond Brooks was a Managing Director at the prestigious turnaround firm Alvarez and Marsal and has been a full-time and interim CEO many times, including CEO of a $500 million (in assets) company which specifically financed digital imaging systems sold into hospitals. J. Randall Waterfield is an owner of Cappello Waterfield & Co., which has led investment banking healthcare transactions in excess of $1 billion. Previously, he sold two large private companies for $750 million, and has significant and successful public Board experience in creating long-term value and overseeing turnarounds at public companies. Lastly, my experience is public record as a Chair and Director of many companies, adopting best governance practices, leading the charge for most of the improvements seen at Digirad today, and having already "done this before" (referring to leading a micro-cap turnaround), which is something no incumbent Digirad director has done.

AS SHAREHOLDERS OUR INTEREST IS ALIGNED WITH ALL SHAREHOLDERS.

We believe it is time for change at Digirad. The current Board has failed to present a credible turnaround plan because it is inexperienced and unqualified to do so, and has overseen continued deterioration in Digirad's core business. Moreover, it has acted only when pressured by Red Oak. We have assembled a highly qualified team of nominees who have the right knowledge and skill-set to turn around Digirad and create value for all shareholders.

Time is very short. No matter how many or how few shares you own, it is very important that you vote the enclosed BLUE proxy card today and vote in Favor of electing us to represent you in the boardroom. PLEASE DO NOT RETURN THE WHITE PROXY CARD or any other proxy card furnished to you on behalf of Digirad. Not even to vote against them. Doing so may cancel your vote on the BLUE card.

If you have already returned a WHITE proxy card, you have every right to change your vote by voting a later-dated BLUE proxy card. Just please do so today.

Please VOTE THE BLUE CARD FOR RED OAK's SLATE of nominees and Against the Auditor and Say on Pay Proposals.

For information or help with voting the BLUE card, please contact:

Alliance Advisors LLC

200 Broadacres Drive 3rd Floor

Bloomfield, NJ 07003

Shareholders Call Toll Free: (888)-991-1289

Banks and Brokers Call Collect: 973-873-7721

You may also contact me at:

David Sandberg

304 Park Avenue South, 11th Floor

New York, NY 10010

Direct phone: (212) 614-8952

Sincerely,

David Sandberg

I URGE YOU TO VOTE TO CHANGE DIGIRAD FOR THE BETTER AND TO PROTECT YOUR INVESTMENT. VOTE FOR ALL OF OUR DIRECTOR NOMINEES ON THE BLUE PROXY CARD TODAY.

SOURCE Red Oak Partners

Mehr Nachrichten zur Star Equity Holdings Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.