Qualcomm Commences Cash Tender Offer for All Outstanding Shares of NXP

PR Newswire

SAN DIEGO, Nov. 18, 2016

SAN DIEGO, Nov. 18, 2016 /PRNewswire/ -- Qualcomm Incorporated (NASDAQ: QCOM) today announced that Qualcomm River Holdings B.V., an indirect wholly owned subsidiary of Qualcomm, has commenced the previously announced tender offer for all of the outstanding common shares of NXP Semiconductors N.V. (NASDAQ: NXPI) at a price of $110.00 per share, less any applicable withholding taxes and without interest, to the holders thereof and payable in cash. The tender offer is being made pursuant to the Purchase Agreement, dated as of October 27, 2016, by and between Qualcomm River Holdings B.V. and NXP.

A tender offer statement on Schedule TO that includes the Offer to Purchase and related Letter of Transmittal that set forth the complete terms and conditions of the tender offer will be filed today with the U.S. Securities and Exchange Commission by Qualcomm River Holdings B.V. Additionally, NXP will file with the SEC a solicitation/recommendation statement on Schedule 14D-9 today that includes the recommendation of NXP's board of directors that NXP shareholders tender their shares in the tender offer.

The tender offer will expire at 5:00 p.m., New York City time, on February 6, 2017, unless extended or earlier terminated, in each case pursuant to the terms of the Purchase Agreement.

The tender offer is not subject to any financing condition. The completion of the tender offer is conditioned upon, among other things, satisfaction of a minimum tender condition and the receipt of regulatory approvals in various jurisdictions.

Copies of the tender offer documents are available free of charge by contacting Innisfree M&A Incorporated, the information agent for the tender offer, toll free at (888) 750-5834 (for shareholders) or collect at (212) 750-5833 (for banks and brokers), and, when they become available, at the website maintained by the SEC at www.sec.gov. American Stock Transfer & Trust Company, LLC is acting as depositary for the tender offer.

About Qualcomm

Qualcomm Incorporated (NASDAQ: QCOM) is a world leader in 3G, 4G and next-generation wireless technologies. Qualcomm Incorporated includes Qualcomm's licensing business, QTL, and the vast majority of its patent portfolio. Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, operates, along with its subsidiaries, substantially all of Qualcomm's engineering, research and development functions, and substantially all of its products and services businesses, including its semiconductor business, QCT. For more than 30 years, Qualcomm ideas and inventions have driven the evolution of digital communications, linking people everywhere more closely to information, entertainment and each other. For more information, visit Qualcomm's website, OnQ blog, Twitter and Facebook pages.

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in NXP Semiconductors | ||

|

ME8G3V

| Ask: 0,60 | Hebel: 4,91 |

| mit moderatem Hebel |

Zum Produkt

| |

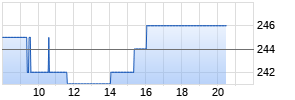

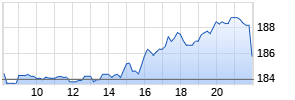

Kurse

|

|

About NXP

NXP Semiconductors N.V. (NASDAQ:NXPI) enables secure connections and infrastructure for a smarter world, advancing solutions that make lives easier, better and safer. As the world leader in secure connectivity solutions for embedded applications, NXP is driving innovation in the secure connected vehicle, end-to-end security & privacy and smart connected solutions markets. Built on more than 60 years of combined experience and expertise, the company has 44,000 employees in more than 35 countries and posted revenue of $6.1 billion in 2015. Find out more at www.nxp.com.

Additional Information and Where to Find It

This document is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any common shares of NXP Semiconductors N.V. ("NXP") or any other securities. On the commencement date of the tender offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents, will be filed with the United States Securities and Exchange Commission (the "SEC") by Qualcomm River Holdings B.V. ("Buyer"), a subsidiary of Qualcomm Incorporated ("Qualcomm"), and a solicitation/recommendation statement on Schedule 14D-9 will be filed with the SEC by NXP. The offer to purchase common shares of NXP will only be made pursuant to the offer to purchase, the letter of transmittal and related documents filed as a part of the Schedule TO. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. SHAREHOLDERS OF NXP ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT SUCH HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES. Investors and security holders may obtain a free copy of these statements (when available) and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov. In addition, free copies of these documents (when they become available) may be obtained by contacting Innisfree M&A Incorporated, the information agent for the tender offer, toll free at (888) 750-5834 (for shareholders) or collect at (212) 750-5833 (for banks and brokers).

Cautionary Note Regarding Forward-Looking Statements

Any statements contained in this document that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Words such as "anticipate", "believe", "estimate", "expect", "forecast", "intend", "may", "plan", "project", "predict", "should" and "'will" and similar expressions as they relate to Qualcomm, Buyer or NXP are intended to identify such forward-looking statements. These forward-looking statements involve risks and uncertainties concerning the parties' ability to complete the tender offer and close the proposed transaction, the expected closing date of the transaction, the financing of the transaction, the anticipated benefits and synergies of the transaction, anticipated future combined businesses, operations, products and services, and liquidity, debt repayment and capital return expectations. Actual events or results may differ materially from those described in this document due to a number of important factors. These factors include, among others, the outcome of regulatory reviews of the proposed transaction; the ability of the parties to complete the transaction; the ability of Qualcomm to successfully integrate NXP's businesses, operations (including manufacturing and supply operations), sales and distribution channels, business and financial systems and infrastructures, research and development, technologies, products, services and employees; the ability of the parties to retain their customers and suppliers; the ability of the parties to minimize the diversion of their managements' attention from ongoing business matters; Qualcomm's ability to manage the increased scale, complexity and globalization of its business, operations and employee base post-closing; and other risks detailed in Qualcomm's and NXP's filings with the SEC, including those discussed in Qualcomm's most recent Annual Report on Form 10-K and in any subsequent periodic reports on Form 10-Q and Form 8-K and NXP's most recent Annual Report on Form 20-F and in any subsequent reports on Form 6-K, each of which is on file with the SEC and available at the SEC's website at www.sec.gov. SEC filings for Qualcomm are also available in the Investor Relations section of Qualcomm's website at www.qualcomm.com, and SEC filings for NXP are available in the Investor Relations section of NXP's website at www.nxp.com. Qualcomm is not obligated to update these forward-looking statements to reflect events or circumstances after the date of this document. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates.

Contacts

Investors:

John Sinnott, Investor Relations

1-858-658-4813

ir@qualcomm.com

Media:

Clare Conley, Media Relations

1-858-845-5959

corpcomm@qualcomm.com

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/qualcomm-commences-cash-tender-offer-for-all-outstanding-shares-of-nxp-300365691.html

SOURCE Qualcomm Incorporated

Mehr Nachrichten zur Qualcomm Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.