Q2 2017 S&P 500 Buybacks Fall 9.8% from Q1, to $120.1 Billion

PR Newswire

NEW YORK, Sept. 18, 2017

NEW YORK, Sept. 18, 2017 /PRNewswire/ -- S&P Dow Jones Indices ("S&P DJI") today announced preliminary results indicating that S&P 500® stock buybacks, or share repurchases, totaled $120.1 billion for Q2 2017. This is a 9.8% decrease from the $133.1 billion reported for Q1 2017, a 5.8% decrease from the $127.5 billion reported for Q2 2016 and a 25.6% decrease from the $161.4 billion for Q1 2016, when companies were supporting share prices in a declining market.

For the 12-month period ending June 2017, S&P 500 issues spent $500.8 billion on buybacks, down 14.5% from the $585.4 billion set during the 12-month period ending June 2016.

Historical data on S&P 500 buybacks is available at: www.spdji.com/indices/equity/sp-500.

Key Takeaways:

- The number of S&P 500 issues substantially reducing their year-over-year share count, which is used to calculate EPS, declined to 13.8% for Q2 2017, compared to 14.8% for Q1 2017 and 26.6% for Q2 2016.

- Total shareholder return totaled $224.1 billion, down 4.2% from $234.0 billion for Q1 2017.

- S&P 500 dividends set a new record payment, at $104.0 billion, up from $100.9 billion for Q1 2017; for the 12-month period ending June 2017, the total shareholder return was $907.9 billion, down 6.9% from $974.8 billion for the 12-month period ending June 2016.

- 268 S&P 500 issues reduced their share count for Q2 2017, compared to 255 for Q1 2017 and 275 for Q2 2016.

- Year-over-year share count reductions of at least 4%, which are seen as affecting EPS, declined to 66 issues for Q2 2017, compared to 71 for Q1 2017 and 134 for Q2 2016.

"Share buyback expenditures for Q2 2017 declined, as share prices increased, resulting in fewer share repurchases and a weaker tailwind for EPS," said Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices.

"The going rate for the last two years was that more than 20% of S&P 500 issues provided at least a 4% tailwind to EPS via reduced share counts. For 2017, that rate has dropped significantly. The Street is interpreting the decline in discretionary buybacks, which reduce share counts and increase EPS, as a positive sign; while there is less support for EPS growth, companies are showing an ability to meet their EPS targets without the buyback tailwind, as their Q2 2017 record earnings show."

Buyback concentration declined for the quarter, as the top 20 issues accounted for 38.6% of all share repurchases, down from 42.1% for Q1 2017; it is the lowest recording for the top 20 since 37.6% for Q4 2015.

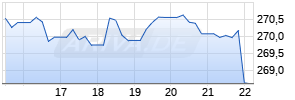

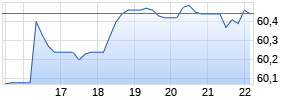

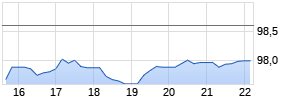

ARIVA.DE Börsen-Geflüster

Kurse

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

"The ability of companies to increase buybacks remains strong, as available cash set a new record, surpassing $1.5 trillion for the first time," said Silverblatt. "Net income improved, with Q2 2017 setting a record, and current Q3 2017 estimates projecting additional gains."

GICS® Sector Analysis:

Energy buybacks increased the most, up 47.5% to $3.1 billion, up from $2.1 billion for Q1 2017; expenditures still significantly trailed the pre-June 2014 oil price fall, when the sector spent $13.1 billion for Q1 2014.

Financials, which exhibited strength during Q1 2017 with a 10.2% increase, posted a 9.1% decrease for Q2 2017 with $26.8 billion, compared to $29.5 billion for Q1 2017, accounting for 22.3% of all buybacks. Of note, in June 2017 major banks received approval to increase their shareholder returns, leading to potentially higher buybacks and dividend expenditures.

Information Technology was steady, as expenditures rose 0.5% to $27.6 billion from the prior period's $27.5 billion. The sector represents 23.0% of all buybacks but has 46% of the index's cash reserves.

Issues:

Apple (AAPL) spent $7.1 billion for Q2 2017, down from $7.2 billion for Q1 2017 and down from $10.2 billion for Q2 2016.

Charter Communications (CHTR) was second, with $3.3 billion, up from $0.9 billion for Q1 2017 and $0.08 billion for Q2 2016.

J. P. Morgan (JPM) was third, with $3.0 billion, up from $2.8 billion for both Q1 2017 and Q2 2016.

Home Depot (HD) came in fourth, with $2.6 billion, up from $1.3 billion for Q1 2017.

Boeing (BA) rounded out the top five, at $2.5 billion, flat from Q1 2017.

Total Shareholder Return:

Silverblatt determined that total shareholder return, through regular cash dividends and buybacks, decreased 4.2% to $224.1 billion for Q2 2017, down from $234.0 billion for Q1 2017. For the 12-month period ending June 2017, shareholder return totaled $907.8 billion, down 6.9% from the record $974.8 billion set during the 12-month period ending June 2016.

Dividends posted a 3.1% increase for Q2 2017, to a record $104.0 billion, up from $100.9 billion for Q1 2017. Payments totaled $407.1 billion for the 12-month period ending June 2017, up 4.5% from $389.3 billion for the 12-month period ending June 2016. With Q3 2017 nearing its end, the quarter is expected to post another record for cash dividend payments.

According to Silverblatt, preliminary cash reserves increased from Q1 2017. S&P 500 Industrial (Old), which consists of the S&P 500 less Financials, Transportations and Utilities, available cash and equivalent surpassed $1.5 trillion for the first time, standing at $1.534 trillion. Available cash stood at $1.496 trillion for Q1 2017. The current cash level is 1.6 times greater than expected 2018 operating income.

"The key question remaining is whether companies will aid EPS through discretionary buybacks or through old-fashioned earnings growth," said Silverblatt.

"Income tax reform and potential cash repatriation are other key factors to watch, as new legislation could lead to a potential increase of shareholder returns."

For more information about S&P Dow Jones Indices, please visit www.spdji.com.

| S&P Dow Jones Indices | | | |||||||

| S&P 500, $ U.S. BILLIONS | (preliminary in bold) | | | | | | | ||

| PERIOD | MARKET | OPERATING | AS REPORTED | | | | | DIVIDEND & | DIVIDENDS |

| | VALUE | EARNINGS | EARNINGS | DIVIDENDS | BUYBACKS | DIVIDEND | BUYBACK | BUYBACK | & BUYBACKS |

| | $ BILLIONS | $ BILLIONS | $ BILLIONS | $ BILLIONS | $ BILLIONS | YIELD | YIELD | YIELD | $ BILLION |

| 12 Months Jun 2017 | $20,762 | $996.81 | $894.36 | $407.11 | $500.75 | 1.96% | 2.41% | 4.37% | $907.87 |

| 12 Months Jun 2016 | $18,193 | $857.84 | $759.50 | $389.43 | $585.35 | 2.14% | 3.22% | 5.36% | $974.78 |

| 2016 | $19,268 | $919.85 | $818.55 | $397.21 | $536.38 | 2.06% | 2.78% | 4.85% | $933.60 |

| 2015 | $17,900 | $885.38 | $762.74 | $382.32 | $572.16 | 2.14% | 3.20% | 5.33% | $954.47 |

| 2014 | $18,245 | $1,004.22 | $909.09 | $350.43 Werbung Mehr Nachrichten zur Cisco Systems Inc. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||