PSEG Outlines 5-Year, $15 Billion Capital Investment Program

PR Newswire

NEW YORK, March 6, 2017

NEW YORK, March 6, 2017 /PRNewswire/ -- (NYSE: PEG) -- Public Service Enterprise Group (PSEG) today said that it plans to invest approximately $15 billion over the next five years upgrading its energy infrastructure. PSEG reaffirmed its 2017 earnings guidance of $2.80 to $3.00 per share.

Speaking at the company's Annual Investor Conference in New York, Ralph Izzo, PSEG chairman, president and CEO, told the financial community that the company's strategy and strength of its financial position successfully delivered double-digit growth in rate base and earnings in 2016 at PSE&G. In February, the company announced a 4.9 percent increase in the dividend, marking the 13th increase in PSEG's dividend in the last 14 years.

PSEG expects the utility to represent approximately two-thirds of its non-GAAP operating earnings in 2017 and its share is forecast to continue to grow. Over the next five years, the utility projects a baseline $12.3 billion infrastructure program which will deliver high-single digit rate base growth. Extensions and expansions of the baseline investment program should expand PSE&G's five year capital program to $13.8 billion and a 9 percent growth rate. PSE&G has further identified potential opportunities that could address public policy and customer needs for long-term reliability.

"Together, these investment programs could extend our existing forecast of a baseline of 7 percent and up to 9 percent compound annual growth in the utility's rate base well into the next decade," Izzo said. "By investing in energy efficiency while making improvements to our electric and gas infrastructure, we think utilities can help customers save on their monthly energy bills and still provide a stable rate of return for their investors."

Izzo explained that PSE&G has the potential to become a model utility of the future -- an energy company that meets societal demands for enhanced grid resiliency, investment in renewables and universal access to energy-efficient technology. These long-term opportunities to invest in the utility of the future are not reflected in current capital expenditure plans, but have the potential to bring significant gains to both customers and shareholders.

"Recent growth in the utility has offset the challenges to our business from low electricity prices this year," Izzo said. "As energy markets continue to evolve in response to the low-priced natural gas environment, PSEG Power is meeting the challenge by increasing the efficiency and performance of its plants while lowering costs."

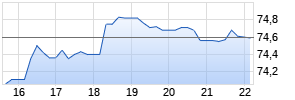

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Public Service Enterprise Group Inc | ||

|

MD7RV2

| Ask: 1,31 | Hebel: 4,51 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

Power's plants, with locational and fuel-cost advantages, generate free cash flow that can be used for re-investment. As Power's investments decline with the completion of three clean, highly efficient combined-cycle gas plants in the PJM and New England markets, more cash will be available to help fund expanded investment at PSE&G.

"We continue to work toward a future with universal access to more reliable, resilient, cleaner and affordable energy," Izzo said. "By delivering on our strategic investment program, we are building an energy company that provides strong growth for our shareholders and a sustainable energy future for our customers."

The conference will be webcast live beginning at 8 a.m. To listen, register at: http://edge.media-server.com/m/p/fhfjs7es.

Forward-Looking Statements

The statements contained in this communication about our and our subsidiaries' future performance, including, without limitation, future revenues, earnings, strategies, prospects, consequences and all other statements that are not purely historical, are "forward-looking statements" within the meaning of The Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from those anticipated. Such statements are based on management's beliefs as well as assumptions made by and information currently available to management. When used herein, the words "anticipate," "intend," "estimate," "believe," "expect," "plan," "should," "hypothetical," "potential," "forecast," "project," variations of such words and similar expressions are intended to identify forward-looking statements. Factors that may cause actual results to differ are often presented with the forward-looking statements themselves. Other factors that could cause actual results to differ materially from those contemplated in any forward-looking statements made by us herein are discussed in our Annual Report on Form 10-K and subsequent reports on Form 10-Q and Form 8-K filed with the Securities and Exchange Commission (SEC), and available on our website: http://investor.pseg.com/sec-filings. All of the forward-looking statements made in this communication are qualified by these cautionary statements and we cannot assure you that the results or developments anticipated by management will be realized or even if realized, will have the expected consequences to, or effects on, us or our business, prospects, financial condition, results of operations or cash flows. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date hereof. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even in light of new information or future events, unless otherwise required by applicable securities laws.

Due to the forward looking nature of non-GAAP Operating Earnings guidance, PSEG is unable to reconcile this non-GAAP financial measure to the most directly comparable GAAP financial measure. Management is unable to project certain reconciling items, in particular MTM and NDT gains (losses), for future periods due to market volatility.

From time to time, PSEG, PSE&G and PSEG Power release important information via postings on their corporate website at http://investor.pseg.com. Investors and other interested parties are encouraged to visit the corporate website to review new postings. The "Email Alerts" link at http://investor.pseg.com may be used to enroll to receive automatic email alerts and/or Really Simple Syndication (RSS) feeds regarding new postings.

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/pseg-outlines-5-year-15-billion-capital-investment-program-300418188.html

SOURCE Public Service Enterprise Group (PSEG)

Mehr Nachrichten zur Public Service Enterprise Group Inc Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.