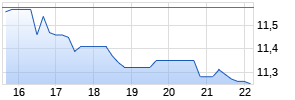

ProAssurance Announces Preliminary Results for Third Quarter 2016

PR Newswire

BIRMINGHAM, Ala., Oct. 24, 2016

BIRMINGHAM, Ala., Oct. 24, 2016 /PRNewswire/ -- ProAssurance Corporation (NYSE: PRA) today announced preliminary per share results for the third quarter of 2016. We expect to report net income of between $0.61 and $0.65 per diluted share and operating earnings of between $0.43 and $0.47 per diluted share when we release final third quarter results on November 2, 2016. We believe gross premiums written in the quarter will be approximately $230 million and net earned premium for the quarter will be approximately $185 million. We expect our consolidated combined ratio to be in a range between 92% and 94% for the quarter.

Our current year insurance operations continue to produce results in line with prior quarters. We anticipate favorable loss development will be in the range of $28.5 million to $30.0 million.

Our investment in unconsolidated subsidiaries will report a loss expected to be in the range of $3.2 to $3.4 million, primarily due to the accelerated recognition of our estimate of partnership operating losses related to our tax credit investments.

Our Workers' Compensation subsidiary paid $1.3 million in assessments based on prior period loss severity primarily in two southeastern states, which represents an increase of $700,000 over the same period last year.

Additionally, we expect our Lloyd's segment to report a pre-tax operating loss of between $1.7 and $1.9 million in the quarter. These results are reported on a one-quarter lag and are unrelated to recent storms.

ProAssurance Chairman and Chief Executive Officer W. Stancil Starnes noted, "Given the long tailed nature of the business we write and the inherent uncertainties of ultimate reserve development, we do not forecast earnings on a quarterly basis. However, we recognize that our expected operating results will not reach the projections of some in the investment community. Those projections necessarily include estimates that are difficult to predict with any precision on a quarterly basis, which is why we take such a long-term view of our business. We see nothing in these events to suggest that there are fundamental issues with our business. ProAssurance remains solidly profitable and our long-term strategy continues to allow us to both retain existing business and write new business in a rapidly evolving healthcare delivery environment. We remain confident in the future of our business."

Announcement of Final Third Quarter Results and Conference Call Information

ProAssurance will release final third quarter 2016 results, as previously announced, after the close of normal New York Stock Exchange trading on Wednesday, November 2, 2016. Management will be discussing the results and the Company's strategic direction during a conference call at 10:00 AM ET on Thursday, November 3, 2016 to discuss the results, and other items of interest to investors participating in the call. Investors are invited to participate by phone by dialing 888-349-0134 (toll free) or 412-317-5145. The conference call will also be webcast through the Investor Relations section of ProAssurance.com.

A telephone replay of the call will be available through December 3, 2016 at (877) 344-7529 (toll free) or (412) 317-0088, using access code 10094092. A replay will be available on the internet through November 19, 2016 at ProAssurance.com. ProAssurance will make a podcast of the call available on its website and on iTunes.

Caution Regarding Forward-Looking Statements

Statements in this news release that are not historical fact or that convey our view of future business, events or trends are specifically identified as forward-looking statements. Forward-looking statements are based upon our estimates and anticipation of future events and highlight certain risks and uncertainties that could cause actual results to vary materially from our expected results. We expressly claim the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, for any forward-looking statements in this news release. Forward-looking statements represent our outlook only as of the date of this news release. Except as required by law or regulation, we do not undertake and specifically decline any obligation to publicly release the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Forward-looking statements are generally identified by words such as, but not limited to, "anticipate," "believe," "estimate," "expect," "hope," "hopeful," "intend," "likely," "may," "optimistic," "possible," "potential," "preliminary," "project," "should," "will," and other analogous expressions. When we address topics such as liquidity and capital requirements, the value of our investments, return on equity, financial ratios, net income, premiums, losses and loss reserves, premium rates and retention of current business, competition and market conditions, the expansion of product lines, the development or acquisition of business, the availability of acceptable reinsurance, actions by regulators and rating agencies, court actions, legislative actions, payment or performance of obligations under indebtedness, payment of dividends, and other similar matters, we are making forward-looking statements.

These forward-looking statements are subject to significant risks, assumptions and uncertainties, including, among other things, the following factors that could affect the actual outcome of future events:

- changes in general economic conditions, including the impact of inflation or deflation and unemployment;

- our ability to maintain our dividend payments;

- regulatory, legislative and judicial actions or decisions that could affect our business plans or operations;

- the enactment or repeal of tort reforms;

- formation or dissolution of state-sponsored insurance entities providing coverages now offered by ProAssurance which could remove or add sizable numbers of insureds from or to the private insurance market;

- changes in the interest rate environment;

- changes in U.S. laws or government regulations regarding financial markets or market activity that may affect the U.S. economy and our business;

- changes in the ability of the U.S. government to meet its obligations that may affect the U.S. economy and our business;

- performance of financial markets affecting the fair value of our investments or making it difficult to determine the value of our investments;

- changes in requirements or accounting policies and practices that may be adopted by our regulatory agencies, the FASB, the SEC, the PCAOB, or the NYSE that may affect our business;

- changes in laws or government regulations affecting the financial services industry, the property and casualty insurance industry or particular insurance lines underwritten by our subsidiaries;

- the effect on our insureds, particularly the insurance needs of our insureds, and our loss costs, of changes in the healthcare delivery system, including changes attributable to the Patient Protection and Affordable Care Act;

- consolidation of our insureds into or under larger entities which may be insured by competitors, or may not have a risk profile that meets our underwriting criteria or which may not use external providers for insuring or otherwise managing substantial portions of their liability risk;

- uncertainties inherent in the estimate of our loss and loss adjustment expense reserve and reinsurance recoverable;

- changes in the availability, cost, quality, or collectability of insurance/reinsurance;

- the results of litigation, including pre- or post-trial motions, trials and/or appeals we undertake;

- effects on our claims costs from mass tort litigation that are different from that anticipated by us;

- allegations of bad faith which may arise from our handling of any particular claim, including failure to settle;

- loss or consolidation of independent agents, agencies, brokers, or brokerage firms;

- changes in our organization, compensation and benefit plans;

- changes in the business or competitive environment may limit the effectiveness of our business strategy and impact our revenues;

- our ability to retain and recruit senior management;

- the availability, integrity and security of our technology infrastructure or that of our third-party providers of technology infrastructure, including any susceptibility to cyber-attacks which might result in a loss of information or operating capability;

- the impact of a catastrophic event, as it relates to both our operations and our insured risks;

- the impact of acts of terrorism and acts of war;

- the effects of terrorism-related insurance legislation and laws;

- assessments from guaranty funds;

- our ability to achieve continued growth through expansion into new markets or through acquisitions or business combinations;

- changes to the ratings assigned by rating agencies to our insurance subsidiaries, individually or as a group;

- provisions in our charter documents, Delaware law and state insurance laws may impede attempts to replace or remove management or may impede a takeover;

- state insurance restrictions may prohibit assets held by our insurance subsidiaries, including cash and investment securities, from being used for general corporate purposes;

- taxing authorities can take exception to our tax positions and cause us to incur significant amounts of legal and accounting costs and, if our defense is not successful, additional tax costs, including interest and penalties; and

- expected benefits from completed and proposed acquisitions may not be achieved or may be delayed longer than expected due to business disruption; loss of customers, employees or key agents; increased operating costs or inability to achieve cost savings; and assumption of greater than expected liabilities, among other reasons.

Additional risks that could arise from our membership in the Lloyd's of London market and our participation in Syndicate 1729 include, but are not limited to, the following:

- members of Lloyd's are subject to levies by the Council of Lloyd's based on a percentage of the member's underwriting capacity, currently a maximum of 3%, but can be increased by Lloyd's;

- Syndicate operating results can be affected by decisions made by the Council of Lloyd's over which the management of Syndicate 1729 has little ability to control, such as a decision to not approve the business plan of Syndicate 1729, or a decision to increase the capital required to continue operations, and by our obligation to pay levies to Lloyd's;

- Lloyd's insurance and reinsurance relationships and distribution channels could be disrupted or Lloyd's trading licenses could be revoked making it more difficult for Syndicate 1729 to distribute and market its products;

- rating agencies could downgrade their ratings of Lloyd's as a whole; and

- Syndicate 1729 operations are dependent on a small, specialized management team and the loss of their services could adversely affect the Syndicate's business. The inability to identify, hire and retain other highly qualified personnel in the future, could adversely affect the quality and profitability of Syndicate 1729's business.

Our results may differ materially from those we expect and discuss in any forward-looking statements. The principal risk factors that may cause these differences are described in "Item 1A, Risk Factors" in our Form 10-K and other documents we file with the Securities and Exchange Commission, such as our current reports on Form 8-K, and our regular reports on Form 10-Q. We caution readers not to place undue reliance on any such forward-looking statements, which are based upon conditions existing only as of the date made, and advise readers that these factors could affect our financial performance and could cause actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. Except as required by law or regulations, we do not undertake and specifically decline any obligation to publicly release the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Logo - http://photos.prnewswire.com/prnh/20081024/PROASSURANCELOGO

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/proassurance-announces-preliminary-results-for-third-quarter-2016-300349989.html

SOURCE ProAssurance Corporation

Mehr Nachrichten zur Proassurance Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.