PBF Energy Reports Fourth Quarter 2016 Results, Declares Dividend of $0.30 Per Share

PR Newswire

PARSIPPANY, N.J., Feb. 16, 2017

PARSIPPANY, N.J., Feb. 16, 2017 /PRNewswire/ -- PBF Energy Inc. (NYSE:PBF) today reported fourth quarter 2016 income from operations of $139.8 million as compared to a loss from operations of $178.4 million for fourth quarter of 2015. Excluding special items, fourth quarter 2016 loss from operations was $60.7 million as compared to income from operations of $167.7 million for the fourth quarter of 2015. Special items in the fourth quarter 2016 results include a net, non-cash, after-tax gain of $122.2 million, or $1.17 per share, lower-of-cost-or-market ("LCM") inventory adjustment and an after-tax benefit of $9.8 million, or $0.09 per share, related to a change in the tax receivable liability agreement. Additionally, included in our results was a net after-tax charge totaling approximately $7.2 million, or $0.07 per share, related to an inventory layer decrement.

The company reported fourth quarter 2016 net income of $71.8 million, and net income attributable to PBF Energy Inc. of $54.6 million or $0.54 per share. This compares to net loss of $121.5 million, and net loss attributable to PBF Energy Inc. of $119.5 million or $1.24 per share for the fourth quarter 2015. Adjusted fully-converted net loss for the fourth quarter 2016, excluding special items, was $74.9 million, or $0.71 per share on a fully-exchanged, fully-diluted basis, as described below, compared to adjusted fully-converted net income of $71.0 million, or $0.70 per share, for the fourth quarter 2015.

Net income attributable to PBF Energy Inc. for the year-ended December 31, 2016 was $170.8 million, or $1.74 per share as compared to net income of $146.4 million, or $1.65 per share, for the year-ended December 31, 2015. Income from operations for the years ended December 31, 2016 and 2015 were $498.9 million and $360.1 million, respectively. Excluding special items, loss from operations was $22.5 million for the year-ended December 31, 2016 as compared to income from operations of $787.3 million for the year-ended December 31, 2015. Adjusted fully-converted net loss for the year 2016, excluding special items, was $145.7 million, or $1.41 per share on a fully-exchanged, fully-diluted basis, as compared to adjusted fully-converted net income of $402.1 million, or $4.27 per share, for the fourth quarter 2015. PBF Energy's financial results reflect the consolidation of PBF Logistics LP (NYSE: PBFX), a master limited partnership of which PBF indirectly owns the general partner and approximately 44.2% of the limited partner interests as of December 31, 2016.

"Our fourth quarter and full-year 2016 results reflect the numerous market and regulatory headwinds faced by the independent refiners and we, as a company, did not operate our assets to the fullest of their potential," said Tom Nimbley, PBF Energy's Chairman and CEO, "Looking ahead, with the proceeds from our recent equity raise, we are pleased to be starting the year with a strong and flexible balance sheet. We are committed to the continued integration of both Torrance and Chalmette, and further optimizing our entire system in 2017."

PBF Logistics will proceed with two organic growth projects comprised of the construction of a 625,000 barrel tank at PBF Energy's Chalmette refinery and development of a natural gas pipeline to supply PBF Energy's Paulsboro refinery. PBF Logistics expects to spend approximately $82.1 million dollars to complete both projects at an attractive return. Both projects will be funded by PBF Logistics and supported by long-term agreements with minimum volume commitments from PBF Energy.

PBF Energy Inc. Declares Dividend

The company announced today that it will pay a quarterly dividend of $0.30 per share of Class A common stock on March 13, 2017, to holders of record as of February 27, 2017.

Outlook

For the first quarter 2017, we expect East Coast total throughput to average 310,000 to 330,000 barrels per day; Mid-Continent total throughput is expected to average 135,000 to 145,000 barrels per day; Gulf Coast total throughput is expected to average 150,000 to 160,000 barrels per day and West Coast total throughput is expected to average 145,000 to 155,000 barrels per day. These figures include the impact of the previously announced planned turnarounds at the Delaware City and Chalmette refineries.

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in PBF Energy | ||

|

ME7ZYH

| Ask: 1,33 | Hebel: 6,60 |

| mit moderatem Hebel |

Zum Produkt

| |

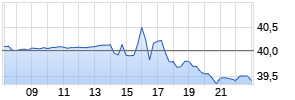

Kurse

|

|

Non-GAAP Measures

This earnings release, and the discussion during the management conference call, may include references to non-GAAP (Generally Accepted Accounting Principles) measures including Adjusted Fully-Converted Net Income, Adjusted Fully-Converted Net Income per fully-exchanged, fully-diluted share, gross refining margin, gross refining margin per barrel of throughput, EBITDA (Earnings before Interest, Income Taxes, Depreciation and Amortization), Adjusted EBITDA and projected EBITDA related to the refinery acquisitions. PBF believes that non-GAAP financial measures provide useful information about its operating performance and financial results. However, these measures have important limitations as analytical tools and should not be viewed in isolation or considered as alternatives for, or superior to, comparable GAAP financial measures. PBF's non-GAAP financial measures may also differ from similarly named measures used by other companies. See the accompanying tables and footnotes in this release for additional information on the non-GAAP measures used in this release and reconciliations to the most directly comparable GAAP measures.

Adjusted Fully-Converted Results

Adjusted fully-converted results assume the exchange of all PBF Energy Company LLC Series A Units and dilutive securities into shares of PBF Energy Inc. Class A common stock on a one-for-one basis, resulting in the elimination of the noncontrolling interest and a corresponding adjustment to the company's tax provision.

Conference Call Information

PBF Energy's senior management will host a conference call and webcast regarding quarterly results and other business matters on Thursday, February 16, 2017, at 8:30 a.m. ET. The call is being webcast and can be accessed at PBF Energy's website, http://www.pbfenergy.com. The call can also be heard by dialing (888) 632-3382 or (785) 424-1677, conference ID: PBFQ416. The audio replay will be available two hours after the end of the call through March 6, 2017, by dialing (800) 283-5758 or (402) 220-0863.

Forward-Looking Statements

Statements in this press release relating to future plans, results, performance, expectations, achievements and the like are considered "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve known and unknown risks, uncertainties and other factors, many of which may be beyond the company's control, that may cause actual results to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors and uncertainties that may cause actual results to differ include but are not limited to the risks disclosed in the company's filings with the SEC, as well as the risk disclosed in PBF Logistics LP's SEC filings and any impact PBF Logistics LP may have on the company's credit rating, cost of funds, employees, customer and vendors; risk relating to the securities markets generally; and the impact of adverse market conditions affecting the company, unanticipated developments, regulatory approvals, changes in laws and other events that negatively impact the company. All forward-looking statements speak only as of the date hereof. The company undertakes no obligation to revise or update any forward-looking statements except as may be required by applicable law.

About PBF Energy Inc.

PBF Energy Inc. (NYSE:PBF) is one of the largest independent refiners in North America, operating, through its subsidiaries, oil refineries and related facilities in California, Delaware, Louisiana, New Jersey and Ohio. Our mission is to operate our facilities in a safe, reliable and environmentally responsible manner, provide employees with a safe and rewarding workplace, become a positive influence in the communities where we do business, and provide superior returns to our investors.

PBF Energy Inc. also currently indirectly owns the general partner and approximately 44.2% of the limited partnership interest of PBF Logistics LP (NYSE: PBFX).

| PBF ENERGY INC. AND SUBSIDIARIES | ||||||||||||||||||||

| EARNINGS RELEASE TABLES | ||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||||||||||||||

| (Unaudited, in thousands, except share and per share data) | ||||||||||||||||||||

| | | | | | | | | | | | | | ||||||||

| | | | | | | Three Months Ended | | Year Ended | ||||||||||||

| | | | | | | December 31, | | December 31, | ||||||||||||

| | | | | | | 2016 | | 2015 | | 2016 | | 2015 | ||||||||

| Revenues | | $ | 4,748,568 | | | $ | 3,360,489 | | | $ | 15,920,424 | | | $ | 13,123,929 | | ||||

| | | | | | | | | | | | | | ||||||||

| Costs and expenses: | | | | | | | | | | |||||||||||

| | Cost of sales, excluding depreciation | | 4,074,222 | | | 3,162,210 | | | 13,598,341 | | | 11,481,614 | | |||||||

| | Operating expenses, excluding depreciation | | 433,902 | | | 268,577 | | | 1,423,198 | | | 904,525 | | |||||||

| | General and administrative expenses | | 41,477 | | | 54,919 | | | 166,452 | | | 181,266 | | |||||||

| | (Gain) loss on sale of assets | | (7) | | | 129 | | | 11,374 | | | (1,004) | | |||||||

| | Depreciation and amortization expense | | 59,147 | | | 53,016 | | | 222,176 | | | 197,417 | | |||||||

| | | | | | | 4,608,741 | | | 3,538,851 | | | 15,421,541 | | | 12,763,818 | | ||||

| | | | | | | | | | | | | | ||||||||

| Income (loss) from operations | | 139,827 | | | (178,362) | | | 498,883 | | | 360,111 | | ||||||||

| | | | | | | | | | | | | | ||||||||

| Other income (expense) | | | | | | | | | | |||||||||||

| | Change in tax receivable agreement liability | | 16,051 | | | 20,365 | | | 12,908 | | | 18,150 | | |||||||

| | Change in fair value of catalyst lease | | 5,978 | | | 1,202 | | | 1,422 | | | 10,184 | | |||||||

| | Interest expense, net | | (38,051) | | | (29,093) | | | (150,045) | | | (106,187) | | |||||||

| Income (loss) before income taxes | | 123,805 | | | (185,888) | | | 363,168 | | | 282,258 | | ||||||||

| Income tax expense (benefit) | | 52,043 | | | (64,347) | | | 137,650 | | | 86,725 | | ||||||||

| Net income (loss) Werbung Mehr Nachrichten zur PBF Energy Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||||||||||||||||