MGM RESORTS INTERNATIONAL REPORTS SECOND QUARTER 2023 FINANCIAL AND OPERATING RESULTS

PR Newswire

LAS VEGAS, Aug. 2, 2023

- MGM Resorts International achieved all-time record for consolidated net revenue

- MGM China outperformed Macau market recovery with Adjusted Property EBITDAR and net revenues surpassing 2Q19

- Las Vegas Strip Resorts achieved solid results with ADR and occupancy growth year-over-year, bookings pace remains up for remainder of 2023

- Repurchased approximately 15 million shares for $626 million during the quarter

- Announced long-term license agreement with Marriott International to drive higher profitability from access to Marriott's extensive global database

LAS VEGAS, Aug. 2, 2023 /PRNewswire/ -- MGM Resorts International (NYSE: MGM) ("MGM Resorts" or the "Company") today reported financial results for the quarter ended June 30, 2023.

"Beyond MGM's outstanding second quarter performance, we also cemented a long-term agreement with Marriott which will provide us with an expansive customer booking channel to further bolster our profitability. Also, BetMGM reported that it achieved its first positive EBITDA quarter and remains on track to achieve its next milestone of second half profitability," said Bill Hornbuckle, Chief Executive Officer and President of MGM Resorts. "Looking forward to the rest of 2023 and beyond, we are encouraged by the pacing of both Formula 1 and the Super Bowl and the announced relocation of the A's, which will further solidify Las Vegas as the sports and entertainment capital of the world."

"We expect to continue to pursue long-term growth opportunities by expanding our global online presence and digital capabilities and through our development efforts in Japan and New York," said Jonathan Halkyard, Chief Financial Officer and Treasurer of MGM Resorts.

Second Quarter 2023 Financial Highlights:

Consolidated Results

- Consolidated net revenues of $3.9 billion, an increase of 21% compared to the prior year quarter, due primarily to the removal of COVID-19 related entry restrictions in Macau;

- Operating income was $371 million compared to $2.4 billion in the prior year quarter due to a $2.3 billion gain in the prior year quarter related to the sale of MGM Growth Properties LLC ("MGP") to VICI Properties Inc. ("VICI"), and an increase in rent expense related to the VICI and The Cosmopolitan leases, which commenced in April 2022 and May 2022, respectively, partially offset by the increase in net revenues discussed above and a decrease in amortization expense related to the MGM Grand Paradise gaming subconcession;

- Net income attributable to MGM Resorts was $201 million in the current quarter compared to $1.8 billion in the prior year quarter. Net income attributable to MGM Resorts was impacted by the items affecting operating income above;

- Diluted income per share of $0.55 in the current quarter compared to $4.20 in the prior year quarter;

- Adjusted diluted earnings per share ("Adjusted EPS")(1) of $0.59 in the current quarter compared to $0.04 in the prior year quarter;

- Consolidated Adjusted EBITDAR(2) of $1.1 billion;

- Net cash flow provided by (used in) operating, investing, and financing activities for the six months ended June 30, 2023 was $1.3 billion, ($59 million), and ($3.3 billion), respectively; and

- Free Cash Flow(3) for the six months ended June 30, 2023 of $887 million.

Las Vegas Strip Resorts

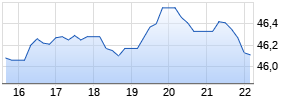

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in MGM Resorts International Ltd. | ||

|

VM1PH4

| Ask: 0,67 | Hebel: 4,70 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

- Net revenues of $2.1 billion in the current quarter, which was flat compared to the prior year quarter;

- Same-store net revenues (adjusted for acquisitions and dispositions) of $1.8 billion, which was flat compared to the prior year quarter;

- Adjusted Property EBITDAR(2) of $777 million in the current quarter compared to $825 million in the prior year quarter, a decrease of 6%;

- Same-Store Adjusted Property EBITDAR(2) of $662 million in the current quarter compared to $723 million in the prior year quarter, a decrease of 8%; and

- Adjusted Property EBITDAR margin(2) of 36.2% in the current quarter compared to 38.6% in the prior year quarter, a decrease of 244 basis points primarily due to an increase in payroll related expense.

Regional Operations

- Net revenues of $926 million in the current quarter compared to $960 million in the prior year quarter, a decrease of 3%, due primarily to the disposition of Gold Strike Tunica in February 2023;

- Same-store net revenues (adjusted for dispositions) of $926 million in the current quarter compared to $904 million in the prior year quarter, an increase of 2%;

- Adjusted Property EBITDAR of $294 million in the current quarter compared to $340 million in the prior year quarter, a decrease of 14%;

- Same-Store Adjusted Property EBITDAR of $294 million in the current quarter compared to $315 million in the prior year quarter, a decrease of 7%; and

- Adjusted Property EBITDAR margin of 31.7% in the current quarter compared to 35.4% in the prior year quarter, a decrease of 369 basis points, due primarily to a decrease in casino revenues and an increase in payroll related expenses.

MGM China

- Net revenues of $741 million in the current quarter compared to $143 million in the prior year quarter, an increase of 418%, and an increase of 5% compared to the second quarter of 2019. The current quarter was positively affected by the removal of COVID-19 related travel and entry restrictions and an increase in visitation;

- Adjusted Property EBITDAR of $209 million in the current quarter compared to Adjusted Property EBITDAR loss of $52 million in the prior year quarter, and an increase of 21% compared to the second quarter of 2019; and

- Adjusted Property EBITDAR margin of 28.3% in the current quarter compared to 24.5% in the second quarter of 2019.

Adjusted EPS

The following table reconciles diluted earnings per share ("EPS") to Adjusted EPS (approximate EPS impact shown, per share; positive adjustments represent charges to income):

| Three Months Ended June 30, | 2023 | | 2022 |

| Diluted earnings per share | $ 0.55 | | $ 4.20 |

| Property transactions, net | 0.01 | | (0.05) |

| Gain on REIT transactions, net | — | | (5.41) |

| Non-operating items: | | | |

| Loss (gain) related to debt and equity investments | (0.02) | | 0.05 |

| Foreign currency transaction loss | 0.02 | | 0.02 |

| Change in the fair value of foreign currency contracts | 0.04 | | 0.05 |

| Income tax impact on net income adjustments(1) | (0.01) | | 1.18 |

| Adjusted EPS | $ 0.59 | | $ 0.04 |

| | |

| 1. | The income tax impact includes current and deferred income tax expense based upon the nature of the adjustment and the jurisdiction in which it occurs. |

The prior year quarter also included a non-cash income tax charge of $90 million resulting from an increase in the valuation allowance on Macau deferred tax assets and a non-cash income tax benefit of $37 million to record the impact of the VICI transaction on state deferred tax liabilities.

Las Vegas Strip Resorts

The following table shows key gaming statistics for Las Vegas Strip Resorts:

| Three Months Ended June 30, | 2023 | | 2022 | % Change |

| | (Dollars in millions) | | ||

| Casino revenue | $ 492 | | $ 499 | (1) % |

| Table games drop | $ 1,498 | | $ 1,429 | 5 % |

| Table games win | $ 345 | | $ 330 | 5 % |

| Table games win % | 23.1 % | | 23.1 % | |

| Slot handle | $ 5,947 | | $ 5,344 | 11 % |

| Slot win | $ 551 | | $ 498 | 11 % |

| Slot win % | 9.3 % | | 9.3 % | |

The following table shows key hotel statistics for Las Vegas Strip Resorts:

| Three Months Ended June 30, | 2023 | | 2022 | % Change |

| Room revenue (in millions) | $ 707 | | $ 696 | 2 % |

| Occupancy | 96 % | | 92 % | |

| Average daily rate (ADR) | $ 234 | | $ 225 | 4 % |

| Revenue per available room (RevPAR)4 | $ 224 | | $ 208 Werbung Mehr Nachrichten zur MGM Resorts International Ltd. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |