Oclaro Closes Sale of its Amplifier and Micro-Optics Business to II-VI Incorporated

PR Newswire

SAN JOSE, Calif., Nov. 1, 2013

SAN JOSE, Calif., Nov. 1, 2013 /PRNewswire/ -- Oclaro, Inc. (NASDAQ: OCLR), a leading provider and innovator of optical communications solutions, today announced that it closed the previously announced sale of its Amplifier and Micro-Optics business (the Business) to II-VI Incorporated (NASDAQ: IIVI), on November 1, 2013, for $88.6 million.

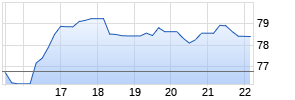

Under the terms of the agreement, II-VI paid Oclaro $79.6 million in cash at closing. II-VI previously had paid Oclaro $5 million for a 30-day option to buy the Business on September 12, 2013, which was credited against the $88.6 million purchase price. The remaining $4 million will be held by II-VI until December 31, 2014 to address any post-closing claims.

About Oclaro

Oclaro, Inc. (NASDAQ: OCLR) is one of the largest providers of optical components, modules and subsystems for the optical communications market. The company is a global leader dedicated to photonics innovation, with cutting-edge research and development (R&D) and chip fabrication facilities in the U.S., U.K., Italy, Korea and Japan. It has in-house and contract manufacturing sites in China, Malaysia and Thailand, with design, sales and service organizations in most of the major regions around the world. For more information, visit http://www.oclaro.com.

Safe Harbor Statement

This press release contains statements about management's future expectations, plans or prospects of Oclaro and its business, and together with the assumptions underlying these statements, constitute forward-looking statements for the purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements concerning expectation regarding the sale of and payment of the purchase price for its Amplifier and Micro-optics business. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including the fulfillment of certain conditions and performance of certain agreements by II-VI and Oclaro related to the sale of the Business, and other factors described in Oclaro's most recent annual report on Form 10-K and other documents it periodically files with the SEC. The forward-looking statements included in this announcement represent Oclaro's view as of the date of this announcement. Oclaro anticipates that subsequent events and developments may cause Oclaro's views and expectations to change. Oclaro specifically disclaims any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this announcement.

SOURCE Oclaro, Inc.

Mehr Nachrichten zur Coherent Corp. Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.