Number of Homes for Sale Drop at Fastest Pace in Four Years

PR Newswire

SEATTLE, June 22, 2017

SEATTLE, June 22, 2017 /PRNewswire/ -- The number of for-sale homes hitting the market is dropping at its fastest pace in almost four years, according to the May Zillow® Real Estate Market Reportsi. The typical home stayed on the market for just 77 days, the fewest days on Zillowii ever reported.

Across the country, home shoppers will have 9 percent fewer homes to choose from than a year ago, which is the greatest drop in inventory since August 2013 when inventory was down more than 10 percent.

Columbus, Ohio, San Jose, Calif. and Minneapolis reported the greatest annual declines in the number of homes for sale, with about 30 percent fewer homes for sale in each market. In San Diego, there are 26 percent fewer homes on the market than a year ago, and 22 percent fewer in Seattle. Both San Diego and Seattle have high buyer demand and home value growth of over 6 percent.

When the housing market crashed, many Americans went from owning single-family homes to renting them -- between 2005 and 2016, the number of owner-occupied single-family homes fell by 680,000, while the number of renter-occupied single-family homes increased by 6.2 millioniii.

This increase in the number of single-family home rentals is one of the reasons why inventory remains low. The amount of new construction coming available hasn't been enough to offset the subtraction of more single-family homes being converted to rentals. Rental homes are put for sale less frequently, which creates more options for renters, but fewer for buyers.

"Inventory has been falling for years with supply no longer meeting demand, and there are multiple reasons for the worsening situation," said Zillow Chief Economist Dr. Svenja Gudell. "On the demand side, simple demographic change is contributing to incredibly high demand as millennials reach their prime home-buying years and begin to enter the market in droves. This is coupled with relatively low levels of new home construction on the supply side insufficient to keep pace with demand, and what is built is largely priced beyond the reach of many of the first-time and entry-level home buyers in the market. Thousands of single-family homes that were once bought and sold every few years prior to the recession have now been converted into rental properties by investors, trading hands much less frequently and further contributing to inventory shortages. And finally, in some still hard-hit markets, negative equity is likely keeping many homeowners of lower-end homes from listing their home for sale because they can't afford to profitably do so. There is no silver bullet that will clear the market of all of these issues, and buyers frustrated by the status quo will likely have to remain patient and be ready to pounce once that perfect home does become available."

The median home value across the country is $199,200, up 7.4 percent since this time last year. Seattle, Dallas and Tampa, Fla. reported the highest year-over-year home value appreciation among the 35 largest U.S. metros. In Seattle, home values rose almost 13 percent to a median value of $440,100. Home values in Dallas and Tampa are up about 11 percent since this time last year.

Median rent across the nation rose 0.7 percent since last May, to a median payment of $1,416 per month. Seattle, Sacramento, Calif. and Los Angeles reported the greatest year-over-year rent appreciation among the 35 largest U.S. metros. Rents in Seattle are up almost 6 percent to a Zillow Rent Indexiv (ZRI) of $2,127. Median rent in Sacramento is up 4.5 percent, while Los Angeles median rent are up 4 percent.

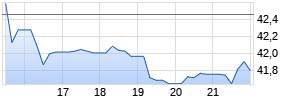

Mortgage ratesv on Zillow ended the month of May at 3.73 percent, the lowest level of the month. Mortgage rates hit a high of 3.90 percent less than two weeks into Mayvi. Zillow's real-time mortgage rates are based on thousands of custom mortgage quotes submitted daily to anonymous borrowers on the Zillow Mortgages site and reflect the most recent changes in the market.

| Metropolitan Area | Zillow Home Value | Year- | Zillow Rent | Year- | Year-over- | % Change in |

| United States | $ 199,200 | 7.4% | $ 1,416 | 0.7% | -9.4% | 46.6% |

| New York, NY | $ 419,000 | 8.7% | $ 2,374 | -1.9% | -16.6% | 0.4% |

| Los Angeles-Long | $ 606,500 | 5.8% | $ 2,667 | 4.1% | -12.4% | 19.5% |

| Chicago, IL | $ 210,200 | 6.3% | $ 1,631 | -1.0% | -11.4% | 83.6% |

| Dallas-Fort Worth, | $ 209,200 | 11.2% | $ 1,580 | 2.9% | 8.3% | 66.1% |

| Philadelphia, PA | $ 218,300 | 5.0% | $ 1,563 | -0.9% | -14.5% | 39.5% |

| Houston, TX | $ 175,800 | 2.7% | $ 1,541 | -2.7% | 9.1% | 59.1% |

| Washington, DC | $ 383,200 | 3.4% | $ 2,120 | -0.1% | -18.7% | 38.1% |

| Miami-Fort | $ 251,700 | 8.2% | $ 1,848 | -1.8% | 1.3% | 76.8% |

| Atlanta, GA | $ 178,700 | 7.8% | $ 1,343 | 2.8% | -8.1% | 159.1% |

| Boston, MA | $ 425,500 | 7.6% | $ 2,361 | 3.2% | -21.2% | 27.3% |

| San Francisco, CA | $ 851,900 | 5.3% | $ 3,362 | -0.4% Werbung Mehr Nachrichten zur Zillow Group A Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |