Newpark Resources Reports Second Quarter 2017 Results

PR Newswire

THE WOODLANDS, Texas, July 27, 2017

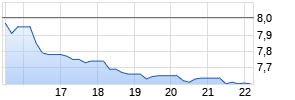

THE WOODLANDS, Texas, July 27, 2017 /PRNewswire/ -- Newpark Resources, Inc. (NYSE: NR) today announced results for its second quarter ended June 30, 2017. Total revenues for the second quarter of 2017 were $183.0 million compared to $158.7 million in the first quarter of 2017 and $115.3 million in the second quarter of 2016. Net income for the second quarter of 2017 was $1.6 million, or $0.02 per diluted share, compared to a net loss of $1.0 million, or $0.01 per share, in the first quarter of 2017, and a net loss of $13.9 million, or $0.17 per share, in the second quarter of 2016. Second quarter 2016 results included net charges of $0.11 per share associated with asset impairments, the termination of our previous revolving credit facility and charges associated with workforce reductions.

Paul Howes, Newpark's President and Chief Executive Officer, stated, "Building upon the positive momentum from the first quarter, I'm pleased to report another period of strong sequential gains in both segments. The Mats segment had an exceptionally strong second quarter, posting the highest revenue and operating income level in two years, benefiting from our diversification strategy. The sequential revenue gains were driven by broad-based improvements across targeted market sectors, including the impact of a few large utilities transmission and distribution projects in the Gulf Coast region. The quarter further benefited from weather events, where our scale and rapid service response uniquely positioned us to support our customers following a string of storms that impacted areas within Texas and Louisiana. With the meaningful lift in demand, rental and service revenues increased to $25 million in the quarter. The surge in rental demand also provided a meaningful lift in segment operating margin, which came in at 35% for the second quarter.

"In Fluids, revenue gains were once again led by our U.S. operations, where revenues improved sequentially by 34% and outperformed the market rig count gains for the third consecutive quarter. The strong U.S. performance more than offset the anticipated seasonal impact of Spring break-up in Canada, resulting in a 12% increase in total North America fluids revenues. Internationally, fluids revenues also increased by 8%, benefiting from a rebound in activity in North Africa and Eastern Europe," added Howes. "With the stronger revenue contribution from the U.S. and EMEA regions, the Fluids segment profitability remained relatively stable despite the sharp seasonal decline in Canada, posting a 4% operating margin."

2017 Convertible Notes Update

In preparation for the October 2017 maturity of convertible notes, the restricted cash balance (reported within prepaid expenses and other current assets) increased by $30 million during the second quarter of 2017, reflecting funds that have been placed in an escrow account in advance of the scheduled maturity. As a result of this as well as meeting other administrative requirements, the Company has satisfied the conditions to avoid the accelerated maturity date of its Asset-Based Loan ("ABL") Facility. Accordingly, the maturity date of the ABL Facility remains March 6, 2020.

Segment Results

The Fluids Systems segment generated revenues of $150.6 million in the second quarter of 2017 compared to $136.1 million in the first quarter of 2017 and $96.2 million in the second quarter of 2016. Segment operating income was $5.9 million in the second quarter of 2017, compared to $6.4 million of income in the first quarter of 2017 and an $11.9 million loss in the second quarter of 2016. Segment results for the second quarter of 2016 included a total of $8.3 million of charges, including impairments of intangible and other long-lived assets in the Asia Pacific region, as well as costs associated with workforce reductions and the impairment of inventory in North America.

The Mats and Integrated Services segment generated revenues of $32.4 million in the second quarter of 2017 compared to $22.6 million in the first quarter of 2017 and $19.2 million in the second quarter of 2016. Segment operating income was $11.4 million in the second quarter of 2017, compared to $6.4 million in the first quarter of 2017, and $4.0 million in the second quarter of 2016.

CONFERENCE CALL

Newpark has scheduled a conference call to discuss second quarter 2017 results, which will be broadcast live over the Internet, on Friday, July 28, 2017 at 10:00 a.m. Eastern Time / 9:00 a.m. Central Time. To participate in the call, dial (412) 902-0030 and ask for the Newpark conference call at least 10 minutes prior to the start time, or access it live over the Internet at www.newpark.com. For those who cannot listen to the live call, a replay will be available through August 11, 2017 and may be accessed by dialing (201) 612-7415 and using pass code 13663806#. Also, an archive of the webcast will be available shortly after the call at www.newpark.com for 90 days.

Newpark Resources, Inc. is a worldwide provider of value-added drilling fluids systems and composite matting systems used in oilfield and other commercial markets. For more information, visit our website at www.newpark.com.

This news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act that are based on management's current expectations, estimates and projections. All statements that address expectations or projections about the future, including Newpark's strategy for growth, product development, market position, expected expenditures and future financial results are forward-looking statements. Some of the forward-looking statements may be identified by words like "expects," "anticipates," "plans," "intends," "projects," "indicates," and similar expressions. These statements are not guarantees of future performance and involve a number of risks, uncertainties and assumptions. Many factors, including those discussed more fully elsewhere in this release and in documents filed with the Securities and Exchange Commission by Newpark, particularly its Annual Report on Form 10-K for the year ended December 31, 2016, as well as others, could cause results to differ materially from those expressed in, or implied by, these statements. These risk factors include, but are not limited to, risks related to the worldwide oil and natural gas industry, our customer concentration and reliance on the U.S. exploration and production market, risks related to our international operations, the cost and continued availability of borrowed funds including noncompliance with debt covenants, operating hazards present in the oil and natural gas industry, our ability to execute our business strategy and make successful business acquisitions and capital investments, the availability of raw materials and skilled personnel, our market competition, compliance with legal and regulatory matters, including environmental regulations, the availability of insurance and the risks and limitations of our insurance coverage, potential impairments of long-lived intangible assets, technological developments in our industry, risks related to severe weather, particularly in the U.S. Gulf Coast, cybersecurity breaches or business system disruptions and risks related to the fluctuations in the market value of our common stock. Newpark's filings with the Securities and Exchange Commission can be obtained at no charge at www.sec.gov, as well as through our website at www.newpark.com.

| Contacts: | Gregg Piontek |

| | Vice President and Chief Financial Officer |

| | Newpark Resources, Inc. |

| | gpiontek@newpark.com |

| | 281-362-6800 |

| Newpark Resources, Inc. | |||||||||||||||||||

| Condensed Consolidated Statements of Operations | |||||||||||||||||||

| (Unaudited) | |||||||||||||||||||

| | | | | ||||||||||||||||

| | Three Months Ended | | Six Months Ended | ||||||||||||||||

| (In thousands, except per share data) | June 30, | | March 31, | | June 30, | | June 30, | | June 30, | ||||||||||

| Revenues | $ | 183,020 | | | $ | 158,691 | | | $ | 115,315 | | | $ | 341,711 | | | $ | 229,859 | |

| Cost of revenues | 148,431 | | | 129,590 | | | 102,803 | | | 278,021 | | | 214,376 | | |||||

| Selling, general and administrative expenses | 26,630 | | | 25,397 | | | 21,435 | | | 52,027 | | | 44,927 | | |||||

| Other operating income, net | (9) | | | (42) | | | (713) | | | (51) | | | (2,409) | | |||||

| Impairments and other charges | — | | | — | | | 6,925 | | | — | | | 6,925 | | |||||

| Operating income (loss) | 7,968 | | | 3,746 | | | (15,135) | | | 11,714 | | | (33,960) | | |||||

| | | | | | | | | | | ||||||||||

| Foreign currency exchange (gain) loss | 534 | | | 392 | | | (746) | | | 926 | | | (1,201) | | |||||

| Interest expense, net | 3,441 | | | 3,218 | | | 3,022 | | | 6,659 | | | 5,103 | | |||||

| Gain on extinguishment of debt | — | | | — | | | — | | | — | | | (1,894) | | |||||

| Income (loss) from operations before income taxes | 3,993 | | | 136 | | | (17,411) | | | 4,129 | | | (35,968) | | |||||

| | | | | | | | | | | ||||||||||

| Provision (benefit) for income taxes | 2,361 | | | 1,119 Werbung Mehr Nachrichten zur Newpark Resources Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||||||||||