New Destiny Signs Option Agreement on Treasure Mountain Silver Property

Vancouver, British Columbia (FSCwire) - New Destiny Mining Corp. (“New Destiny” or the “Company”) (TSX-V Symbol: NED) is pleased to announce that it has signed an option agreement with Ximen Mining Corp. (TSX-V Symbol: XIM) (“Ximen”) under which New Destiny may acquire 100% of Ximen’s Treasure Mountain Silver Property (the “Property”) located 30 km’s east of Hope, British Columbia (the “Transaction”).

“We are excited to have the opportunity to bring on the Treasure Mountain Silver Property, which currently has in place its drill permits, and just had completed an extensive 3-phase sample program on it”, stated Robert Birmingham, President of New Destiny Mining Corp. “Working with Ximen during our due diligence process gave us full confidence on the potential of this project, and we are anticipating to get significant work completed on the property immediately.”

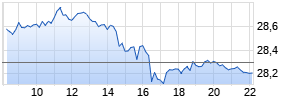

To view the graphic in its original size, please click here

Mineralized sample recovered near Superior Minfile

The Treasure Mountain Silver Property covers historically prospective ground in the Similkameen and New Westminster Mining Divisions. The Property is adjacent to Nicola Mining Inc.’s Treasure Mountain Property, site of the previous operating Treasure Mountain Silver-Lead-Zinc Mine which exploited polymetallic veins. The Property occurs within the Intermontane Tectonic Belt, which hosts numerous porphyry copper and copper-gold deposits. The Property covers approximately 9500 hectares and hosts seven gold, silver, lead, zinc and / or copper occurrences in various regions as reported in B.C. Ministry of Energy and Mines MINFILE database. These include gold-quartz vein, polymetallic vein and porphyry type occurrences. Some of these mineral occurrences have associated historic, underground workings.

Under terms of the agreement, New Destiny may earn in a 100% interest in the Property by making certain staged cash and share payments of common shares in New Destiny to Ximen over a four year period equal to a total of $400,000 in cash or stock payments, including a $25,000 payment upon signing the agreement (paid), and $50,000 cash and $50,000 in stock upon TSX approval. New Destiny Mining will also be required to spend $750,000 in exploration over the term 4 year period.

Under terms of the agreement for each year’s payment, New Destiny will make the decision as to pay Ximen either cash or equivalent value stock calculated by the 60-day volume weighted average price of common shares, with a minimum of $10,000 cash paid out per payment.

Ximen will retain a 2.5% new smelter return royalty (the “NSR Royalty”) which New Destiny may buy down the 1% of the NSR Royalty by paying $1,000,000, leaving the Optionor with 1.5%.

The Transaction is subject to, among other things, the completion of a National Instrument 43-101 technical report on the Property, and obtaining all necessary regulatory approvals, including the TSX Venture Exchange (“TSXV”). For more information on the Treasure Mountain property please visit www.newdestinymining.com. If complete, the Transaction will constitute a “Fundamental Acquisition” as such term is defined in TSXV Policy 5.3. The common shares of New Destiny will remain halted until the TSXV has reviewed the Transaction in accordance with TSXV Policy 5.3.

For further information on New Destiny contact Robert Birmingham, New Destiny’s President and Chief Executive Officer, at 604-783-0499.

ON BEHALF OF THE BOARD OF DIRECTORS

“Robert Birmingham”

Robert L. Birmingham, President and Chief Executive Officer

This News Release may contain forward-looking statements including but not limited to comments regarding the acquisition of certain mineral claims. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements and New Destiny undertakes no obligation to update such statements, except as required by law. There can be no assurance that the Proposed Transaction will be completed or, if completed, will be successful.

Forward-looking statements are based on the then-current expectations, beliefs, assumptions, estimates and forecasts about the business and the industry and markets in which the Company operates, including that: the current price of and demand for minerals being targeted by the Company will be sustained or will improve; the Company will be able to obtain required exploration licences and other permits; general business and economic conditions will not change in a material adverse manner; financing will be available if and when needed on reasonable terms; the Company will not experience any material accident; and the Company will be able to identify and acquire additional mineral interests on reasonable terms or at all. Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including: that resource exploration and development is a speculative business; that environmental laws and regulations may become more onerous; that the Company may not be able to raise additional funds when necessary; fluctuations in currency exchange rates; fluctuating prices of commodities; operating hazards and risks; competition; potential inability to find suitable acquisition opportunities and/or complete the same; and other risks and uncertainties listed in the Company’s public filings. These risks, as well as others, could cause actual results and events to vary significantly. Accordingly, readers should not place undue reliance on forward-looking statements and information, which are qualified in their entirety by this cautionary statement. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward looking information, will prove to be accurate. The Company does not undertake any obligations to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view this press release as a PDF file, click onto the following link:

public://news_release_pdf/NewDestiny12012016.pdf

Source: New Destiny Mining Corp. (TSX Venture:NED)

To follow New Destiny Mining Corp. on your favorite social media platform or financial websites, please click on the icons below.

Maximum News Dissemination by FSCwire. http://www.fscwire.com

Copyright © 2016 Filing Services Canada Inc.