MSC Reports Fiscal 2017 Second Quarter Results

PR Newswire

MELVILLE, N.Y. and DAVIDSON, N.C., April 6, 2017

MELVILLE, N.Y. and DAVIDSON, N.C., April 6, 2017 /PRNewswire/ --

FISCAL Q2 2017 HIGHLIGHTS

- Net sales of $703.8 million, an increase of 2.9% year-over-year

- Gross margin of 44.7%, a 40 basis point decline year-over-year

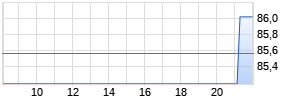

- Operating income of $86.6 million, an increase of 7.6% year-over-year

- Operating margin of 12.3%, a 50 basis point increase year-over-year

- Diluted EPS of $0.93, or 5 cents above the midpoint of guidance, including a 3 cent income tax benefit*

MSC INDUSTRIAL SUPPLY CO. (NYSE: MSM), "MSC" or the "Company," a premier distributor of Metalworking and Maintenance, Repair and Operations ("MRO") products and services to industrial customers throughout North America, today reported financial results for its fiscal 2017 second quarter ended March 4, 2017.

| | | | | | | |

| Financial Highlights1 | | FY17 Q2 | | FY16 Q2 | | Change |

| Net Sales | | $703.8 | | $684.1 | | 2.9% |

| Operating Income | | 86.6 | | 80.5 | | 7.6% |

| % of Net Sales | | 12.3% | | 11.8% | | |

| Net Income | | 53.6 | | 49.5 | | 8.1% |

| Diluted EPS | | $0.93 | 2 | $0.80 | 3 | 16.3% |

| 1In millions unless noted. 2Based on 57.2 million diluted shares outstanding for FY17 Q2. 3 Based on 61.3 million diluted shares outstanding for FY16 Q2. | ||||||

Erik Gershwind, president and chief executive officer, said, "The environment continued to improve during our fiscal second quarter and the momentum sustained into March, the start of our fiscal third quarter. Most of our customers continue to express an improving outlook, particularly those in our core metalworking market. Our fiscal second quarter results reflected these developments."

Rustom Jilla, executive vice president and chief financial officer, added, "Our second quarter growth of 2.9 percent was very welcomed after five quarters of declines in average daily sales. We turned this sales growth into an eight percent increase in operating income, with operating expenses as a percentage of sales declining by about 100 basis points, and operating margin improving roughly 50 basis points, evidence of the leverage potential in our business. Diluted earnings per share was up 16 percent over the prior year, with last August's share buyback and the share-based compensation tax change complementing our business performance."

Gershwind concluded, "We have used the last several years to capitalize on the opportunities presented by the prolonged downturn, and to focus on strengthening our business. Looking to the future, as the environment turns and momentum is building, I see a strong growth and leverage story playing out, particularly if inflation tailwinds continue to build as expected."

Outlook

Based on current market conditions, the Company expects net sales for the third quarter of fiscal 2017 to be between $734 million and $748 million. At the midpoint, average daily sales are expected to increase roughly 3.5 percent compared to last year's third quarter. The Company expects diluted earnings per share for the third quarter of fiscal 2017 to be between $1.05 and $1.09.

Conference Call Information

MSC will host a conference call today at 8:30 a.m. EDT to review the Company's fiscal 2017 second quarter results. The call, accompanying slides, and other operational statistics may be accessed at: http://investor.mscdirect.com. The conference call may also be accessed at 1-877-443-5575 (U.S.), 1-855-669-9657 (Canada) or 1-412-902-6618 (international).

An online archive of the broadcast will be available until April 13, 2017.

The Company's reporting date for fiscal 2017 third quarter results is scheduled for July 12, 2017.

About MSC Industrial Supply Co. MSC Industrial Supply Co. (NYSE: MSM) is a leading North American distributor of metalworking and maintenance, repair, and operations (MRO) products and services. We help our customers drive greater productivity, profitability and growth with more than 1 million products, inventory management and other supply chain solutions, and deep expertise from over 75 years of working with customers across industries.

Our experienced team of more than 6,000 associates is dedicated to working side by side with our customers to help drive results for their businesses - from keeping operations running efficiently today to continuously rethinking, retooling, and optimizing for a more productive tomorrow.

For more information on MSC, please visit mscdirect.com.

Note Regarding Forward-Looking Statements:

Statements in this Press Release may constitute "forward-looking statements" under the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, that address activities, events or developments that we expect, believe or anticipate will or may occur in the future, including statements about expected future results, expected benefits from our investment and strategic plans, and expected future margins, are forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those anticipated by these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The inclusion of any statement in this release does not constitute an admission by MSC or any other person that the events or circumstances described in such statement are material. Factors that could cause actual results to differ materially from those in forward-looking statements include: general economic conditions in the markets in which we operate, worldwide economic, social, political, and regulatory conditions, including conditions that may result from legislative, regulatory and policy changes, changing customer and product mixes, competition, industry consolidation, volatility in commodity and energy prices, credit risk of our customers, risk of cancellation or rescheduling of orders, work stoppages or other business interruptions (including those due to extreme weather conditions) at transportation centers or shipping ports, financial restrictions on outstanding borrowings, dependence on our information systems and the risk of business disruptions arising from changes to our information systems, disruptions due to computer system or network failures, computer viruses, physical or electronics break-ins and cyber-attacks, the inability to successfully manage the upgrade of our core financial systems, the loss of key suppliers or supply chain disruptions, problems with successfully integrating acquired operations, opening or expanding our customer fulfillment centers exposes us to risks of delays, the risk of war, terrorism and similar hostilities, dependence on key personnel, goodwill and intangible assets recorded as a result of our acquisitions could be impaired, and the outcome of potential government or regulatory proceedings or future litigation relating to pending or future claims, inquiries or audits. Additional information concerning these and other risks is described under "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the reports on Forms 10-K and 10-Q that we file with the U.S. Securities and Exchange Commission. We assume no obligation to update any of these forward-looking statements.

*The Company recorded a reduction to income tax expense of $1.8 million, or $0.03 per share, associated with the adoption of FASB Accounting Standards Update No. 2016-09 ("ASU 2016-09") in the second quarter of fiscal 2017. Under ASU 2016-09, excess tax benefits or deficiencies generated upon the settlement or exercise of stock awards are no longer recognized as additional paid-in capital, but are instead recognized as a reduction or increase to income tax expense.

| MSC INDUSTRIAL SUPPLY CO. AND SUBSIDIARIES | |||||

| Condensed Consolidated Balance Sheets | |||||

| (In thousands) | |||||

| | | | | | |

| | | | | | |

| | March 4, | | September 3, | ||

| | 2017 | | 2016 | ||

| | (unaudited) | | | | |

| ASSETS | | | | | |

| Current Assets: | | | | | |

| Cash and cash equivalents | $ | 35,602 | | $ | 52,890 |

| Accounts receivable, net of allowance for doubtful accounts | | 429,862 | | | 392,463 |

| Inventories | | 464,592 | | | 444,221 |

| Prepaid expenses and other current assets | | 45,771 | | | 45,290 |

| Deferred income taxes | | — | | | 46,627 |

| Total current assets | | 975,827 | | | 981,491 |

| Property, plant and equipment, net | | 318,981 | | | 320,544 |

| Goodwill | | 623,296 | | | 624,081 |

| Identifiable intangibles, net | | 101,103 | | | 105,307 |

| Other assets | | 32,310 | | | 33,528 |

| Total assets | $ | 2,051,517 | | $ | 2,064,951 |

| | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | |

| Current Liabilities: | | | | | |

| Revolving credit note | $ | 184,000 Werbung Mehr Nachrichten zur MSC Industrial Direct Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||