MPLX LP reports fourth-quarter and full-year 2017 financial results

PR Newswire

FINDLAY, Ohio, Feb. 1, 2018

FINDLAY, Ohio, Feb. 1, 2018 /PRNewswire/ --

- Reported record fourth-quarter net income of $238 million and adjusted EBITDA of $569 million; reported record full-year net income of $794 million and adjusted EBITDA of $2 billion

- Reported fourth-quarter net cash from operating activities of $569 million and distributable cash flow of $445 million

- Declared 20th consecutive quarterly distribution increase to $0.6075 per common unit; delivered 12.1 percent distribution growth in 2017 with a full-year coverage ratio of 1.28

- Announced closing of transactions completing planned strategic actions with MPC

- Affirmed 2018 distribution growth guidance of 10 percent

- Announced 2018 capital investment plan focused on growth investments for the development of natural gas, gas liquids and crude oil infrastructure

MPLX LP (NYSE: MPLX) today reported fourth-quarter 2017 net income attributable to MPLX of $238 million and full-year 2017 net income attributable to MPLX of $794 million.

MPLX achieved record financial results in the fourth-quarter and full-year 2017, reporting $1.2 billion in income from operations for the year. This record-setting performance was primarily driven by gathered, processed and fractionated volume growth, resulting in high plant utilization, as well as contributions from acquired logistics and storage assets.

MPLX achieved 12.1 percent distribution growth for 2017, in line with prior guidance and ended the year with strong full-year distribution coverage of 1.28 times and debt-to-pro forma adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of 3.6 times. Higher earnings and cash flow, combined with a disciplined approach to capital investments, have increased the partnership's capacity to fund organic growth with debt and retained cash. As a result, there was no public equity issued in the fourth quarter.

MPLX and its sponsor, Marathon Petroleum Corp. (NYSE: MPC), announced that they are today closing the dropdown of refining logistics assets and fuels distribution services that are projected to generate approximately $1 billion in annual EBITDA as well as the exchange of MPC's general partner (GP) economic interests, including its incentive distribution rights (IDRs), for newly issued MPLX common (LP) units, eliminating the GP cash distribution requirements of the partnership.

"In 2017, MPLX delivered strong results with sequential earnings growth in all four quarters as we executed our strategy to grow the business through increased utilization of our existing assets; an impressive portfolio of organic projects; strategic third-party acquisitions; and strategic actions with our sponsor," said Gary R. Heminger, chairman and chief executive officer. "These actions have transformed MPLX, nearly doubling the partnership's earnings base and improving the partnership's cost of capital by permanently eliminating the IDR burden."

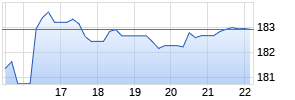

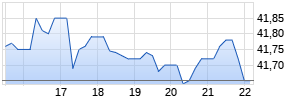

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Marathon Petroleum Corporation | ||

|

ME717Y

| Ask: 5,05 | Hebel: 4,36 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

|

MPLX also announced its 2018 capital investment plan, which includes approximately $2.2 billion of organic growth capital and $190 million of maintenance capital. For the Gathering and Processing (G&P) segment, this robust organic growth plan includes the addition of 8 processing plants representing nearly 1.5 billion cubic feet per day of incremental processing capacity as well as 100,000 barrels per day of additional fractionation capacity in the prolific Marcellus, Utica and Permian basins.

In the Marcellus and Utica basins, MPLX expects to strengthen its position as the largest processor and fractionator with the addition of six gas processing plants in 2018, increasing the partnership's processing capacity by 21 percent to over 7 billion cubic feet per day. Additionally, the partnership expects to add 40,000 barrels per day of ethane fractionation capacity, and 60,000 barrels per day of propane-plus fractionation capacity.

In the Southwest, the partnership also plans to expand its footprint by adding nearly 300 million cubic feet per day of processing capacity. The Argo gas processing plant will be placed in service in the first quarter, doubling the partnership's processing capacity in the Permian basin. Construction of the Omega gas processing plant in the STACK shale play of Oklahoma is on schedule and expected to be complete by mid-2018.

In the Logistics and Storage (L&S) segment, work continues on the expansion of the Ozark and Wood River-to-Patoka pipeline systems, which connect Cushing, Oklahoma, to Patoka, Illinois. Both are targeted for completion in mid-2018. Additional 2018 projects include the completion of a butane cavern in Robinson, Illinois; tank expansions in Patoka, Illinois, and Texas City, Texas; and an expansion of the partnership's marine fleet. Work also continues on the refining logistics project to expand Galveston Bay refinery's export capacity, expected to be completed in 2020. These projects are expected to create additional fee-based revenue for the partnership while providing logistics solutions to MPC and other market participants.

The partnership plans to fund its 2018 organic growth capital plan with retained cash and debt, while maintaining strong coverage and an investment grade credit profile. MPLX does not anticipate the need to issue public equity to fund organic growth capital.

"After the closing of today's dropdown and the elimination of IDRs, MPLX is among the largest diversified master limited partnerships in the energy sector with a very competitive cost of capital," Heminger said. "With a robust portfolio of organic projects in the Marcellus, Utica, Permian and STACK, which are among the most prolific and economic shale plays in the country, and a diversified suite of logistics assets, we believe MPLX is extraordinarily well-positioned to deliver attractive long-term returns."

Financial Highlights

| | Three Months Ended | | Year Ended | ||||||||||||

| (In millions, except per unit and ratio data) | 2017 | | 2016 | | 2017 | | 2016 | ||||||||

| Net income attributable to MPLX(a) | $ | 238 | | | $ | 133 | | | $ | 794 | | | $ | 233 | |

| Adjusted EBITDA attributable to MPLX(b) | | 569 | | | | 391 | | | | 2,004 | | | | 1,419 | |

| Net cash provided by operating activities | | 569 | | | | 516 | | | | 1,907 | | | | 1,491 | |

| Distributable cash flow ("DCF")(b) | | 445 | | | | 318 | | | | 1,628 | | | | 1,140 | |

| Distribution per common unit(c) | | 0.6075 | | | | 0.5200 | | | | 2.2975 | | | | 2.0500 | |

| Distribution coverage ratio(d) | | 1.24x | | | | 1.25x | | | | 1.28x | | | | 1.23x | |

| Growth capital expenditures(e) | | 400 | | | | 358 | | | | 1,518 | | | | 1,292 | |

| | | | | | | | | | | | | ||||

| | |

| (a) | The year ended Dec. 31, 2016, includes pretax, non-cash impairments of $89 million related to an equity method investment and $130 million related to the goodwill established in connection with the MarkWest acquisition. |

| (b) | Non-GAAP measure calculated before the distribution to preferred units and excluding impairment charges. See reconciliation below. |

| (c) | Distributions declared by the board of directors of our general partner. |

| (d) | Non-GAAP measure. See calculation below. |

| (e) | Excludes non-affiliated joint-venture (JV) members' share of capital expenditures. See capital expenditures table below. |

Operational Highlights

- Reported record gathered volumes in the Marcellus and Utica of 2.7 billion cubic feet per day in the fourth quarter of 2017, a 50 percent increase compared with the fourth quarter of 2016.

- Reported record processed volumes in the Marcellus and Utica of 5.2 billion cubic feet per day in the fourth quarter of 2017, a 17 percent increase compared with the fourth quarter of 2016.

- Reported record fractionated volumes in the Marcellus and Utica of 389,000 barrels per day in the fourth quarter of 2017, a 24 percent increase versus the fourth quarter of 2016.

- Commenced operations of the 40,000-barrel-per-day Majorsville de-ethanization plant in the fourth quarter.

- Commenced operations of the Sherwood IX 200 million-cubic-feet-per-day gas processing plant in January; two additional Sherwood plants are under construction.

Financial Position and Liquidity

As of Dec. 31, 2017, MPLX had $5 million in cash, $1.7 billion available through its bank revolving credit facility expiring in July 2022, and $114 million available through its credit facility with MPC. In 2017, MPLX received net proceeds from public equity issuances of approximately $473 million related to first- and second-quarter commitments under its at-the-market program. No additional common units were issued through this program in the third and fourth quarters.

The partnership's $1.9 billion of available liquidity and its access to the capital markets should provide it with sufficient flexibility to meet its day-to-day operational needs and continue investing in organic growth opportunities. The partnership's debt-to-pro forma adjusted EBITDA ratio was 3.6 times at Dec. 31, 2017. MPLX remains committed to maintaining an investment-grade credit profile.

Segment Results

| Segment operating income attributable to MPLX LP | | | | | | | | | | | | ||||

| | Three Months Ended | | Year Ended | ||||||||||||

| (In millions) | 2017 | | 2016 | | 2017 | | 2016 | ||||||||

| Logistics and Storage(a) | $ | 205 | | | $ | 118 | | | $ | 782 | | | $ | 453 | |

| Gathering and Processing(a) | | 364 | | | | 311 | | | | 1,335 | | | | 1,132 Werbung Mehr Nachrichten zur Marathon Petroleum Corporation Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |