Mountain Province Diamonds Prices New US$330,000,000 Senior Secured Second Lien Notes

PR Newswire

TORONTO and NEW YORK, Dec. 1, 2017

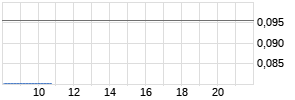

TSX and NASDAQ: MPVD

TORONTO and NEW YORK, Dec. 1, 2017 /PRNewswire/ - Mountain Province Diamonds Inc. ("Mountain Province", the "Company") (TSX and NASDAQ: MPVD) today announces the pricing of its offering of US$330,000,000 senior secured second lien notes due December 15, 2022 (the "Notes"), which are being offered on a private placement basis to qualified institutional buyers pursuant to Rule 144A under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act") ("Rule 144A") and outside the United States pursuant to Regulation S under the Securities Act ("Regulation S"). The coupon of the Notes will be 8.000% per year from the date of issuance, payable semi-annually in arrears. The notes will be issued at 97.992% of the aggregate principal amount. The Notes include a call provision allowing 10% of the aggregate amount of the securities issued to be called per year at 103% of par during the first two years. The offering is expected to close on December 11, 2017, subject to customary closing conditions.

Concurrent with the closing of the Notes offering on December 11, 2017, the Company intends to enter into a US$50 million first lien revolving credit agreement (the "Revolving Credit Agreement") with a banking group in order to maintain a liquidity cushion for general corporate purposes.

Mountain Province intends to use the net proceeds from the offering of the Notes, together with cash on its balance sheet, to fully repay and terminate its US$370 million project loan facility (of which US$357 million was outstanding as of September 30, 2017), to fully repay amounts owing to De Beers Canada, the operator of the Gahcho Kué diamond mine, for historic sunk costs related to the development of the mine (of which approximately C$48.5 million of costs and accumulated interest was outstanding as of September 30, 2017), and to pay related fees and expenses of the offering of the Notes and the entry into the new Revolving Credit Agreement.

This news release is not an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The Notes have not been and will not be registered under the U.S. Securities Act, or any state securities law, and may not be offered or sold in the United States absent registration or an applicable exemption from registration under the U.S. Securities Act and applicable state securities laws. The Notes will be offered only to qualified institutional buyers under Rule 144A and outside the United States under Regulation S. The Notes have not been and will not be offered for distribution by way of prospectus to the public under applicable Canadian securities laws and any offer or sale of the Notes will only be made on a private placement basis that is exempt from, or not subject to, the prospectus requirements of applicable Canadian securities laws.

Mountain Province Diamonds is a 49% participant with De Beers Canada in the Gahcho Kué diamond mine located in Canada's Northwest Territories. Gahcho Kué is the world's largest new diamond mine, consisting of a cluster of four diamondiferous kimberlites, three of which are being developed and mined under the initial 12 year mine plan.

Caution Regarding Forward Looking Information

This news release contains certain "forward-looking statements" and "forward-looking information" under applicable Canadian and United States securities laws concerning Mountain Province. Except for statements of historical fact relating to Mountain Province, certain information contained herein constitutes forward-looking statements. Forward-looking statements and forward-looking information include, but are not limited to, statements with respect to the closing of the Notes offering, the use of proceeds therefrom and the entry into the new revolving credit agreement. Forward-looking statements are frequently characterized by words such as "anticipates," "may," "can," "plans," "believes," "estimates," "expects," "projects," "targets," "intends," "likely," "will," "should," "to be", "potential" and other similar words, or statements that certain events or conditions "may", "should" or "will" occur. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made, and are based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Many of these assumptions are based on factors and events that are not within the control of Mountain Province and there is no assurance they will prove to be correct. Factors that could cause actual results to vary materially from results anticipated by such forward-looking statements include factors affecting the Gahcho Kué diamond mine and the mining industry. For a more complete description of these and other possible risks and uncertainties, please refer to our Annual Information Form for the year ended December 31, 2016, as well as to our subsequent filings with Canadian securities regulatory authorities at www.sedar.com and with the U.S. Securities and Exchange Commission at www.sec.gov. The forward-looking statements in this news release speak only as of the date of this new release and, except as required by applicable law, Mountain Province makes no commitment to update or publicly release any revisions to forward-looking statements in order to reflect new information or subsequent events, circumstances or changes in expectations.

SOURCE Mountain Province Diamonds Inc.

Mehr Nachrichten zur Mountain Province Diamonds Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.