Morningstar Reports U.S. Mutual Fund and ETF Asset Flows for February 2017

PR Newswire

CHICAGO, March 17, 2017

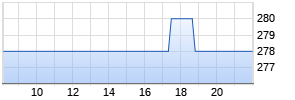

CHICAGO, March 17, 2017 /PRNewswire/ -- Morningstar, Inc. (NASDAQ: MORN), a leading provider of independent investment research, today reported estimated U.S. mutual fund and exchange-traded fund (ETF) asset flows for February 2017. In February, investors put $29.1 billion into U.S. equity passive funds, down from $30.6 billion in January 2017. On the active side, investors pulled $8.9 billion out of U.S. equity funds during the month. Total inflows to U.S. equity funds, both active and passive, doubled since January. Morningstar estimates net flow for mutual funds by computing the change in assets not explained by the performance of the fund and net flow for ETFs by computing the change in shares outstanding.

Highlights from Morningstar's report about U.S. asset flows in February:

- Investors continue to contribute to fixed income, adding $35.5 billion in estimated net flows. The MSCI EAFE Index rose 1.4 percent in February, signaling modest growth in developed international markets. International-equity funds enjoyed $14.7 billion in new flows, with passive making up the majority at $13.6 billion.

- All category groups except allocation enjoyed positive flows in February, showing optimism about the U.S. market. U.S. equity has been in positive-flow territory for four consecutive months, a feat not witnessed since late 2014.

- Morningstar Category trends for February continue to show large- and mid-cap blend in the top five in terms of inflows. Intermediate-term bond was in the top spot, with inflows of $6.2 billion to active and $6.0 billion flowing into passive.

- Among top U.S. fund families, T. Rowe Price, American Funds, and PIMCO had modest inflows on the active side in February, with $1.7 billion, $1.5 billion, and $1.2 billion, respectively. Vanguard and iShares continued to dominate on the passive side, garnering $29.8 billion and $16.7 billion, respectively.

- Among active funds, PIMCO Income, which has a Morningstar Analyst Rating™ of Silver, attracted the largest inflows of $2.0 billion. Bronze-rated PIMCO Total Return continued to place in the bottom five despite good returns, with outflows of $1.0 billion in February.

- Active fund Vanguard Institutional Short-Term Bond had the worst outflows of all active funds in February, at $1.6 billion. In the passive arena, iShares saw three of its funds land in the bottom five: iShares Russell 2000, iShares iBoxx $ High Yield Corporate Bond, and iShares MSCI Japan, with $1.6 billion, $397.0 million, and $347.0 million in outflows, respectively.

To view the complete report, please click here. For more information about Morningstar Asset Flows, please visit http://global.morningstar.com/assetflows.

The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

About Morningstar, Inc.

Morningstar, Inc. is a leading provider of independent investment research in North America, Europe, Australia, and Asia. The company offers an extensive line of products and services for individual investors, financial advisors, asset managers, retirement plan providers and sponsors, and institutional investors in the private capital markets. Morningstar provides data and research insights on a wide range of investment offerings, including managed investment products, publicly listed companies, private capital markets, and real-time global market data. Morningstar also offers investment management services through its investment advisory subsidiaries, with more than $200 billion in assets under advisement and management as of Dec. 31, 2016. The company has operations in 27 countries.

Morningstar's Manager Research Group consists of various wholly owned subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC. Analyst Ratings are subjective in nature and should not be used as the sole basis for investment decisions. Analyst Ratings are based on Morningstar's Manager Research Group's current expectations about future events and therefore involve unknown risks and uncertainties that may cause such expectations not to occur or to differ significantly from what was expected. Analyst Ratings are not guarantees nor should they be viewed as an assessment of a fund's or the fund's underlying securities' creditworthiness. This press release is for informational purposes only; references to securities in this press release should not be considered an offer or solicitation to buy or sell the securities.

©2017 Morningstar, Inc. All Rights Reserved.

MORN-R

Media Contact:

Sarah Pellegrino, +1 312 244-7358 or sarah.pellegrino@morningstar.com

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/morningstar-reports-us-mutual-fund-and-etf-asset-flows-for-february-2017-300425503.html

SOURCE Morningstar, Inc.

Mehr Nachrichten zur Morningstar Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.