MoneyGram and Ant Financial Enter Into Amended Merger Agreement

PR Newswire

DALLAS and NEW YORK, April 16, 2017

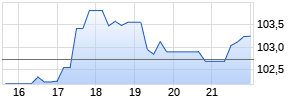

DALLAS and NEW YORK, April 16, 2017 /PRNewswire/ -- MoneyGram (NASDAQ: MGI) and Ant Financial Services Group today announced that the companies have entered into an amendment to the definitive agreement under which MoneyGram will merge with Ant Financial (the "Amended Merger Agreement"). Pursuant to the amendment, Ant Financial increased the offer price to acquire all of the outstanding shares of MoneyGram from $13.25 per share to $18.00 per share in cash. The MoneyGram board of directors has unanimously approved the Amended Merger Agreement.

The offer price of $18.00 per share provides approximately $320 million in additional cash consideration to MoneyGram stockholders from the prior agreement. The per share consideration represents a premium of approximately 64 percent to MoneyGram's volume weighted average share price over the prior three month period ended January 25, 2017, the day prior to the original transaction announced with Ant Financial. The transaction is valued at approximately $1,204 million for all of MoneyGram's common and preferred shares on a fully diluted basis. Ant Financial will assume or refinance MoneyGram's outstanding debt.

Pamela Patsley, Executive Chairman of MoneyGram, said, "Throughout this process, our board of directors has remained laser-focused on maximizing value for MoneyGram stockholders, while taking into account price, the ability to complete a transaction and other important considerations. We are pleased to offer even more value to our stockholders through the amendment of our merger agreement with Ant Financial. We continue to be excited about the transaction, which we are confident will provide substantial benefits to all of our stakeholders, including stockholders, customers, agents and employees."

Alex Holmes, Chief Executive Officer of MoneyGram, added, "As I have stated previously, we believe this transaction will significantly benefit consumers throughout the world who depend on innovative and reliable financial connections to friends and family. We share Ant Financial's commitment to successfully completing the transaction, which will allow us to grow our business, making money transfers easier for customers and providing a wider selection of services for the agents who serve them around the world."

Doug Feagin, President of Ant Financial International, said, "We look forward to joining forces with MoneyGram, which will add valuable cross-border remittance capabilities to the Ant Financial ecosystem, serving our more than 630 million users globally. Over the past few months, we have enjoyed working closely with the MoneyGram team and remain committed to our plans to invest further in the MoneyGram business. We plan to grow the U.S.-based team and create even greater opportunities for the MoneyGram community as we pursue our shared vision of global inclusive finance in an increasingly digital era."

Mr. Feagin continued, "We are fully committed to maintaining the MoneyGram brand that has earned the trust of millions of customers. As part of Ant Financial, MoneyGram will have access to resources to further enhance its technology, systems and anti-money laundering and compliance programs."

Following the completion of the transaction, MoneyGram will operate as an independent subsidiary of Ant Financial and retain its brand, management team, IT infrastructure and headquarters in Dallas, Texas. All of MoneyGram's current procedures and protections related to data security and personally identifiable information will remain intact.

ARIVA.DE Börsen-Geflüster

Kurse

|

|

MoneyGram and Ant Financial have already made significant progress towards obtaining the regulatory approvals necessary to complete the transaction, including obtaining antitrust clearance in the United States and filing for certain state licensing approvals. The transaction is subject to the approval of MoneyGram stockholders, obtaining remaining regulatory approvals, including the clearance of the transaction by the Committee on Foreign Investment in the United States, and other customary closing conditions. The transaction continues to be expected to close in the second half of 2017. The transaction is not subject to any financing conditions.

MoneyGram stockholders of record as of April 7, 2017 will be asked to vote on the Amended Merger Agreement at a special meeting of the stockholders of MoneyGram scheduled for May 16, 2017. Thomas H. Lee Partners and certain MoneyGram executives who collectively own approximately 46 percent of the outstanding voting shares of MoneyGram previously entered into agreements with MoneyGram to vote in favor of the transaction, which agreements remain in effect following entry into the Amended Merger Agreement. The MoneyGram board of directors recommends that MoneyGram stockholders vote "for" the Amended Merger Agreement at the special meeting.

On April 14, 2017, MoneyGram received a binding offer from Euronet Worldwide, Inc. ("Euronet") (NASDAQ: EEFT) to acquire all of the outstanding shares of MoneyGram Common Stock and Preferred Stock (on an as-converted basis) for $15.20 per share in cash. Upon receipt of Ant Financial's increased offer on April 15, 2017, MoneyGram's board of directors, after careful review and consideration in consultation with its outside legal and financial advisors, compared the relative merits of the increased offer reflected in the Amended Merger Agreement with Ant Financial to the binding offer from Euronet and unanimously determined that the Euronet proposal was not superior to the Amended Merger Agreement and that entering into the Amended Merger Agreement was in the best interests of MoneyGram stockholders.

Citi is serving as financial advisor to Ant Financial and Simpson Thacher & Bartlett LLP is serving as its legal advisor. BofA Merrill Lynch is serving as financial advisor to MoneyGram and Vinson & Elkins LLP is serving as its legal advisor.

For additional information regarding the transaction, including a presentation from Ant Financial, please visit www.antandmoneygram.com.

About MoneyGram

MoneyGram is a global provider of innovative money transfer services and is recognized worldwide as a financial connection to friends and family. Whether online, or through a mobile device, at a kiosk or in a local store, we connect consumers any way that is convenient for them. We also provide bill payment services, issue money orders and process official checks in select markets. More information about MoneyGram International, Inc. is available at moneygram.com.

About Ant Financial

Ant Financial Services Group is focused on serving small and micro enterprises, as well as consumers. With the vision "bring small and beautiful changes to the world," Ant Financial is dedicated to building an open ecosystem of Internet thinking and technologies while working with other financial institutions to support the future financial needs of society. Businesses operated by Ant Financial Services Group include Alipay, Ant Fortune, Zhima Credit and MYbank. Ant Financial Services Group is privately held and its majority owners are its employees and members of the Alibaba Partnership. For more information on Ant Financial, its Board of Directors and senior management please visit our website at www.antgroup.com or follow us on Twitter @AntFinancial.

Forward-Looking Statements

This press release contains forward-looking statements which are protected as forward-looking statements under the Private Securities Litigation Reform Act of 1995 that are not limited to historical facts, but reflect MoneyGram's current beliefs, expectations or intentions regarding future events. Words such as "may," "will," "could," "should," "expect," "plan," "project," "intend," "anticipate," "believe," "estimate," "predict," "potential," "pursuant," "target," "continue," and similar expressions are intended to identify such forward-looking statements. The statements in this press release that are not historical statements are forward-looking statements within the meaning of the federal securities laws, including, among other things, statements regarding the likelihood of the merger with Ant Financial being consummated and the timing of the special meeting. These statements are subject to numerous risks and uncertainties, including the risk that the conditions to the closing of the merger may not be consummated or that Euronet or a third party may make a revised proposal with respect to an alternative transaction to the merger, many of which are beyond MoneyGram's control, which could cause actual results to differ materially from the results expressed or implied by the statements.

Additional Information for Stockholders

In connection with the proposed merger with Ant Financial, MoneyGram has filed a definitive proxy statement and other materials with the Securities and Exchange Commission (the "SEC") and mailed such definitive proxy statement to its stockholders of record as of April 7, 2017. In addition, MoneyGram will also file other relevant documents with the SEC regarding the Amended Merger Agreement and the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT(S) AND OTHER DOCUMENTS THAT HAVE BEEN OR MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION WITH ANT FINANCIAL.

Investors and security holders may obtain a free copy of the proxy statement(s) (when available) and other documents filed with the SEC by the Company, at the Company's website, corporate.moneygram.com, or at the SEC's website, www.sec.gov. The proxy statement(s) and other relevant documents may also be obtained for free from the Company by writing to MoneyGram International, Inc., 2828 North Harwood Street, 15th Floor, Dallas, Texas 75201, Attention: Investor Relations.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of the Company in connection with the proposed transaction. Information about the directors and executive officers of the Company is set forth in the Proxy Statement on Schedule 14A for the 2016 annual meeting of stockholders for the Company, which was filed with the SEC on April 4, 2016. This document can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the definitive proxy statement that has been filed with the SEC and will be contained in other relevant materials to be filed with the SEC.

Ant Financial Contact

USA: Sard Verbinnen & Co

Paul Kranhold / Reze Wong / Andrew Duberstein

+1 415 618 8750 / +1 212 687 8080

pkranhold@sardverb.com / rwong@sardverb.com / aduberstein@sardverb.com

China: Miranda Shek

+86-18616682252

miranda@ant-financial.com

MoneyGram Contact

Michael Freitag / Joseph Sala / Viveca Tress

Joele Frank, Wilkinson Brimmer Katcher

Phone: 212 355 4449

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/moneygram-and-ant-financial-enter-into-amended-merger-agreement-300440100.html

SOURCE Ant Financial

Mehr Nachrichten zur Euronet Worldwide Inc Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.