MGM Resorts International Reports Second Quarter Financial And Operating Results

PR Newswire

LAS VEGAS, July 27, 2017

LAS VEGAS, July 27, 2017 /PRNewswire/ -- MGM Resorts International (NYSE: MGM) ("MGM Resorts" or the "Company") today reported financial results for the quarter ended June 30, 2017.

"MGM Resorts continues to drive profitability and operational efficiency, as the Company produced diluted earnings per share of $0.36 in the second quarter and our domestic resorts exhibited Adjusted Property EBITDA and margin growth on a same-store basis. CityCenter reported another quarter of exceptional results driven by Aria. Our results benefited from the addition of MGM National Harbor and Borgata, which continue to lead their respective markets. In Macau, we are excited to bring world-class entertainment and diversified attractions to the marketplace with the opening of MGM Cotai in the fourth quarter," said Jim Murren, Chairman & CEO of MGM Resorts. "We remain squarely on our path to generate the best possible cash flow performance and return value to our shareholders. This quarter's results clearly demonstrate that."

Financial Highlights:

- Diluted earnings per share for the second quarter of 2017 of $0.36, including a benefit of $0.04 related to a Borgata property tax settlement and a benefit of $0.05 from a modification of the 2016 NV Energy exit fee, compared to $0.83 in the prior year quarter, which included $0.57 related to a gain on CityCenter's sale of Crystals;

- Net revenues increase of 22% over the prior year quarter at the Company's domestic resorts to $2.1 billion, due to the inclusion of MGM National Harbor and Borgata, and a decrease of 1% on a same-store basis primarily due to lower year over year table games hold;

- REVPAR(1) growth of 1.2% over the prior year quarter at the Company's Las Vegas Strip resorts;

- Operating income of $520 million at the Company's domestic resorts, a 33% increase over the prior year quarter, including the impact of $41 million related to the NV Energy exit fee modification and $36 million related to the Borgata property tax settlement;

- Net income attributable to MGM Resorts of $211 million, compared to $474 million in the prior year quarter;

- Adjusted Property EBITDA(2) growth of 28% over the prior year quarter to $658 million at the Company's domestic resorts, and an increase of 1% on a same-store basis;

- Same-store operating margin of 25.1% in the current quarter at the Company's domestic resorts, an increase of 205 basis points compared to the prior year quarter;

- Same-store Adjusted Property EBITDA margin of 30.8% at the Company's domestic resorts, an increase of 44 basis points compared to the prior year quarter;

- MGM China operating income of $43 million compared to $51 million in the prior year quarter, and Adjusted EBITDA of $116 million, a 2% decrease compared to the prior year quarter; and

- CityCenter operating income of $57 million and Adjusted EBITDA of $105 million, a 36% increase in Adjusted EBITDA compared to the prior year quarter.

Certain Items Affecting Second Quarter Results

The following table lists certain other items that affect the comparability of the current and prior year quarterly results (approximate EPS impact shown, net of tax, per share; negative amounts represent charges to income):

| Three months ended June 30, | | 2017 ARIVA.DE Börsen-GeflüsterWerbung Weiter abwärts?

Morgan Stanley

Den Basisprospekt sowie die Endgültigen Bedingungen und die Basisinformationsblätter erhalten Sie hier: ME6BMH,. Beachten Sie auch die weiteren Hinweise zu dieser Werbung. Der Emittent ist berechtigt, Wertpapiere mit open end-Laufzeit zu kündigen.

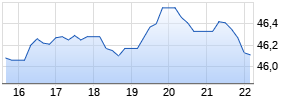

Kurse

| | | 2016 | | ||||||||||||

| Borgata property tax settlement | | $ | 0.04 | | | $ | — | | ||||||||||

| NV Energy exit expense | | | 0.05 | | | | — | | ||||||||||

| Preopening and start-up expenses | | | (0.02) | | | | (0.03) | | ||||||||||

| Property transactions, net | | | (0.01) | | | | — | | ||||||||||

| Income from unconsolidated affiliates: | | | | | | | | | ||||||||||

| Gain on the sale of Crystals | | | — | | | | 0.57 | | ||||||||||

Domestic Resorts

Casino revenue for the second quarter of 2017 increased 41% compared to the prior year quarter, due primarily to the acquisition of Borgata Hotel Casino and Spa ("Borgata") in August 2016 and the MGM National Harbor opening in December 2016, partially offset by a decrease in table games revenue. Casino revenues decreased 5% on a same-store basis compared to the prior year quarter. Same-store table games revenue decreased 20% primarily due to lower year over year table games hold. Same-store slot revenues increased 3%.

The following table shows key gaming statistics for the Company's Las Vegas Strip resorts:

| Three months ended June 30, | | 2017 | | | 2016 | | ||

| | | (Dollars in millions) | | |||||

| Table Games Drop | | $ | 872 | | | $ | 905 | |

| Table Games Win % | | | 20.9 | % | | | 25.6 | % |

| Slot Handle | | $ | 3,053 | | | $ | 2,953 | |

| Slot Hold % | | | 8.7 | % | | | 8.8 | % |

Domestic resorts rooms revenue increased 9% compared to the prior year quarter. On a same-store basis, rooms revenue increased 1% compared to the prior year quarter. Las Vegas Strip REVPAR increased 1.2%.

Mr. Murren added, "The evolution of our continuous improvement strategies have yielded strong profit opportunities with an emphasis on margin growth and maximizing cash flow."

The following table shows key hotel statistics for the Company's Las Vegas Strip resorts:

| Three months ended June 30, | | 2017 | | | 2016 | | ||

| Occupancy % | | | 94 | % | | | 95 | % |

| Average Daily Rate (ADR) | | $ | 161 | | | $ | 157 | |

| Revenue per Available Room (REVPAR) | | $ | 151 | | | $ | 149 | |

Operating income at the Company's domestic resorts was $520 million for the second quarter of 2017 compared to $390 million in the prior year quarter and benefited from $36 million related to Borgata's share of a property tax settlement from Atlantic City, as well as $41 million related to a modification of the 2016 NV Energy exit fee. Domestic resorts Adjusted Property EBITDA increased 28% to $658 million in the second quarter of 2017 and was positively impacted by $101 million of Adjusted Property EBITDA from Borgata, which includes the property tax settlement discussed above, and $37 million of Adjusted Property EBITDA from MGM National Harbor. Same-store Adjusted Property EBITDA increased 1% compared to the prior year quarter.

Mr. Murren concluded, "As we look to the third quarter, we face a challenging comparison at our Las Vegas Strip resorts due to favorable table games hold of 25% and RevPAR growth of 10.7% in the third quarter of 2016. We also continue to see higher than anticipated disruption at Monte Carlo as the property undergoes its transformation to Park MGM. Despite these considerations, given our strong event calendar, we anticipate third quarter revenues to increase slightly, with our Strip REVPAR expected to grow 2%-3%. We anticipate our Adjusted Property EBITDA margins to modestly increase."

MGM China

Key second quarter results for MGM China include:

- Net revenues of $449 million, a 1% decrease compared to the prior year quarter;

- Main floor table games revenue decreased 2% compared to the prior year quarter due to an 8% decrease in volume partially offset by an increase in hold percentage to 19.3% in the current year quarter, from 18.2% in the prior year quarter, and against 22.2% hold percentage in the first quarter of 2017;

- VIP table games revenue increased 1% compared to the prior year quarter due to a 3% increase in turnover partially offset by a decrease in hold percentage to 2.9% in the current year quarter, from 3.1% in the prior year quarter, and against 3.4% hold percentage in the first quarter of 2017;

- Operating income was $43 million compared to $51 million in the prior year quarter;

- Adjusted EBITDA decreased 2% to $116 million, compared to $119 million in the prior year quarter, including $8 million of license fee expense in both the current and prior year quarters; and

- Operating margin was 9.6% in the current year quarter, and Adjusted EBITDA margin was 25.9% compared to 26.4% in the prior year quarter.

MGM China paid the previously announced $78 million final 2016 dividend in June 2017, of which $44 million was received by MGM Resorts.

Unconsolidated Affiliates

The following table summarizes information related to the Company's share of income from unconsolidated affiliates:

| Three months ended June 30, | | 2017 | | | 2016 | | ||

| | | (In thousands) | | |||||

| CityCenter | | $ | 37,646 | | | $ | 416,144 | |

| Borgata | | | — | | | | 27,376 | |

| Other | | | 2,937 | | | | 4,789 | |

| | | $ | 40,583 Werbung Mehr Nachrichten zur MGM Resorts International Ltd. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||