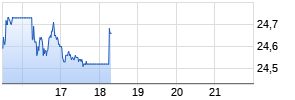

MGIC Investment Corporation Reports Fourth Quarter 2017 Results

PR Newswire

MILWAUKEE, Jan. 18, 2018

MILWAUKEE, Jan. 18, 2018 /PRNewswire/ -- MGIC Investment Corporation (NYSE: MTG) today reported operating and financial results for the fourth quarter ended December 31, 2017. Net income for the quarter was $27.3 million, or $0.07 per diluted share, compared with net income of $107.5 million, or $0.28 per diluted share for the fourth quarter of 2016. Net income for the full year 2017 was $355.8 million or $0.95 per diluted share compared with net income of $342.5 million or $0.86 per diluted share for the full year 2016.

The tax reform enacted in the fourth quarter of 2017 resulted in a reduction of approximately $133 million in our net income for the fourth quarter and full year 2017 due to the remeasurement of our net deferred tax assets to reflect lower enacted corporate tax rates. The impact of this remeasurement was a reduction of $0.36 per diluted share in the fourth quarter and a reduction of $0.34 per diluted share for the full year 2017.

Adjusted net operating income for the fourth quarter 2017 was $160.7 million, or $0.43 per diluted share, compared with $107.7 million, or $0.28 per diluted share for the fourth quarter of 2016. Adjusted net operating income for the full year ended December 31, 2017 was $517.7 million, or $1.36 per diluted share, compared with $396.3 million, or $0.99 per diluted share for full year 2016. We present the non-GAAP financial measure "Adjusted net operating income" to increase the comparability between periods of our financial results. See "Use of Non-GAAP Financial Measures" below.

Fourth Quarter Summary

- New Insurance Written of $12.8 billion was unchanged from the fourth quarter of 2016.

- Insurance in force of $194.9 billion at December 31, 2017 increased by 2.0% during the quarter and 7.1% year-to-date.

- Primary delinquent inventory(1) of 46,556 at December 31, 2017 increased from 41,235 at September 30, 2017, driven by new notice activity from areas affected by major 2017 hurricanes. Our primary delinquent inventory declined 7.4% year-to-date from 50,282 at December 31, 2016.

- As of December 31, 2017, the primary delinquent inventory includes 12,446 from the hurricane impacted areas compared to 7,162 as of December 31, 2016.

- The percentage of loans that were delinquent, excluding bulk loans, was 3.70% at December 31, 2017 compared to 4.05% at December 31, 2016, and 5.11% at December 31, 2015. Including bulk loans, the percentage of loans that were delinquent at December 31, 2017 was 4.55%, compared to 5.04% at December 31, 2016, and 6.31% at December 31, 2015.

- Persistency, or the percentage of insurance remaining in force from one year prior, was 80.1% at December 31, 2017 compared with 78.8% at September 30, 2017 and 76.9% at December 31, 2016.

- The loss ratio for the fourth quarter of 2017 was (13.1%) compared to 12.5% for the third quarter of 2017 and 20.3% for the fourth quarter of 2016. The loss ratios for these periods were each impacted by positive development on our primary loss reserves.

- The underwriting expense ratio(2) for the fourth quarter of 2017 was 15.9% compared to 15.7% for the third quarter of 2017 and 15.8% for the fourth quarter of 2016.

- Book value per common share increased by 0.7% during the quarter and 13.8% year-to-date to $8.51(3).

(1) # of loans, (2) insurance operations, (3) based on shares outstanding

Patrick Sinks, CEO of MTG and Mortgage Guaranty Insurance Corporation ("MGIC") said, "I am pleased to report that in 2017 we achieved another year of strong financial results and continued to position our company for further success. Specifically, our insurance in force increased as we added $49 billion of high quality new insurance and persistency increased, the credit characteristics and performance of the new business written beginning in 2009 remain excellent, the legacy book continued to decline and contributed fewer delinquencies, and we maintained our traditionally low expense ratio." Sinks continued, "In 2017 we retired our 2017 Senior Notes and converted the 2020 Convertible Senior Notes which improved our debt ratios, received ratings upgrades from Moody's and Standard and Poor's, and increased dividends to our holding company to $140 million from $64 million last year."

Sinks added, "Reflecting the current trends in the origination market we expect to write slightly more new insurance in 2018 compared to 2017 and expect that our insurance in force will continue to grow. Further we anticipate that the number of new mortgage delinquency notices, claims paid and delinquency inventory will continue to decline. We will continue to focus on capital management activities and maintaining our industry leading expense ratio. We are well positioned to provide credit enhancement and low down payment solutions to lenders, GSEs and borrowers, now, and in the future."

Revenues

Total revenues for the fourth quarter of 2017 were $271.5 million, compared to $266.5 million in the fourth quarter last year. Net premiums written for the quarter were $259.5 million, compared to $243.5 million for the same period last year. Net premiums earned were $237.4 million compared to $235.1 million for the same period last year as a result of an increase in insurance in force offset by a lower effective premium yield. Investment income for the fourth quarter was $31.3 million, compared to $28.1 million for the same period last year.

Losses and expenses

Losses incurred

Losses incurred in the fourth quarter of 2017 were $(31.0) million, compared to $47.7 million in the fourth quarter of 2016. During the fourth quarter of 2017 there was a $103 million reduction in losses incurred due to positive development on our primary loss reserves for previously received delinquencies, due primarily to a lower estimated claim rate, compared to a reduction of $43 million in the fourth quarter of 2016. Losses incurred in the quarter associated with delinquent notices received in the quarter reflect a lower claim rate when compared to the same quarter last year, especially on loans in hurricane impacted areas as we do not expect a material increase in claims from these notices.

Underwriting and other expenses

Net underwriting and other expenses were $43.8 million in the fourth quarter of 2017, compared to $40.6 million reported for the same period last year. Interest expense was $13.3 million in the fourth quarter of 2017, compared to $16.2 million reported for the same period last year. The decrease was a result of the retirement of the 5% Senior Notes and conversion of the 2% Convertible Senior Notes.

Provision for income taxes

The effective income tax rate for the year ended 2017 increased to 54.7% from 33.5% for the year ended 2016 due to the remeasurement of our net deferred tax assets to reflect lower enacted corporate tax rates and the additional provision related to our expected IRS settlement. We expect our tax rate in 2018 to be marginally less than the 21% federal statutory rate.

Capital

- As of December 31, 2017 total shareholders' equity was $3.15 billion and outstanding principal on borrowings was $837 million.

- MGIC paid a dividend of $50 million to our holding company during the fourth quarter of 2017.

- Consolidated Risk-to-Capital was 10.5:1(4) as of December 31, 2017 compared to 12.0:1 as of December 31, 2016.

- MGIC's PMIERs Available Assets totaled $4.8 billion, or $0.8 billion above its Minimum Required Assets as of December 31, 2017.

(4) preliminary as of December 31, 2017

Other Balance Sheet and Liquidity Metrics

- Total assets were $5.62 billion as of December 31, 2017, compared to $5.73 billion as of December 31, 2016, and $5.87 billion as of December 31, 2015.

- The fair value of our investment portfolio, cash and cash equivalents was $5.1 billion as of December 31, 2017 compared to $4.8 billion as of December 31, 2016, and $4.8 billion as of December 31, 2015.

- Investments, cash and cash equivalents at the holding company were $216 million as of December 31, 2017 compared with $182 million as of September 30, 2017 and $283 million as of December 31, 2016.

Conference Call and Webcast Details

MGIC Investment Corporation will hold a conference call today, January 18, 2018, at 10 a.m. ET to allow securities analysts and shareholders the opportunity to hear management discuss the company's quarterly results. The conference call number is 1-844-231-8825. The call is being webcast and can be accessed at the company's website at http://mtg.mgic.com/. A replay of the webcast will be available on the company's website through February 18, 2018 under "Newsroom."

About MGIC

MGIC (www.mgic.com), the principal subsidiary of MGIC Investment Corporation, serves lenders throughout the United States, Puerto Rico, and other locations helping families achieve homeownership sooner by making affordable low-down-payment mortgages a reality. At December 31, 2017, MGIC had $194.9 billion of primary insurance in force covering approximately one million mortgages.

This press release, which includes certain additional statistical and other information, including non-GAAP financial information, and a supplement that contains various portfolio statistics are both available on the Company's website at https://mtg.mgic.com/ under "Newsroom."

From time to time MGIC Investment Corporation releases important information via postings on its corporate website without making any other disclosure and intends to continue to do so in the future. Investors and other interested parties are encouraged to enroll to receive automatic email alerts and Really Simple Syndication (RSS) feeds regarding new postings. Enrollment information can be found at https://mtg.mgic.com under "Newsroom."

Safe Harbor Statement

Forward Looking Statements and Risk Factors:

Our actual results could be affected by the risk factors below. These risk factors should be reviewed in connection with this press release and our periodic reports to the Securities and Exchange Commission ("SEC"). These risk factors may also cause actual results to differ materially from the results contemplated by forward looking statements that we may make. Forward looking statements consist of statements which relate to matters other than historical fact, including matters that inherently refer to future events. Among others, statements that include words such as "believe," "anticipate," "will" or "expect," or words of similar import, are forward looking statements. We are not undertaking any obligation to update any forward looking statements or other statements we may make even though these statements may be affected by events or circumstances occurring after the forward looking statements or other statements were made. No investor should rely on the fact that such statements are current at any time other than the time at which this press release was issued.

In addition, the current period financial results included in this press release may be affected by additional information that arises prior to the filing of our Form 10-K for the year ended December 31, 2017.

While we communicate with security analysts from time to time, it is against our policy to disclose to them any material non-public information or other confidential information. Accordingly, investors should not assume that we agree with any statement or report issued by any analyst irrespective of the content of the statement or report, and such reports are not our responsibility.

Use of Non-GAAP Financial Measures

We believe that use of the Non-GAAP measures of adjusted pre-tax operating income (loss), adjusted net operating income (loss) and adjusted net operating income (loss) per diluted share facilitate the evaluation of the company's core financial performance thereby providing relevant information to investors. These measures are not recognized in accordance with accounting principles generally accepted in the United States of America (GAAP) and should not be viewed as alternatives to GAAP measures of performance. The measures described below have been established to increase transparency for the purpose of evaluating our fundamental operating trends.

Adjusted pre-tax operating income (loss) is defined as GAAP income (loss) before tax, excluding the effects of net realized investment gains (losses), gain (loss) on debt extinguishment, net impairment losses recognized in income (loss) and infrequent or unusual non-operating items where applicable.

Adjusted net operating income (loss) is defined as GAAP net income (loss) excluding the after-tax effects of net realized investment gains (losses), gain (loss) on debt extinguishment, net impairment losses recognized in income (loss), and infrequent or unusual non-operating items where applicable. The amounts of adjustments to components of pre-tax operating income (loss) are tax effected using a federal statutory tax rate of 35%.

Adjusted net operating income (loss) per diluted share is calculated in a manner consistent with the accounting standard regarding earnings per share by dividing (i) adjusted net operating income (loss) after making adjustments for interest expense on convertible debt, whenever the impact is dilutive, by (ii) diluted weighted average common shares outstanding, which reflects share dilution from unvested restricted stock units and from convertible debt when dilutive under the "if-converted" method.

Although adjusted pre-tax operating income (loss) and adjusted net operating income (loss) exclude certain items that have occurred in the past and are expected to occur in the future, the excluded items represent items that are: (1) not viewed as part of the operating performance of our primary activities; or (2) impacted by both discretionary and other economic or regulatory factors and are not necessarily indicative of operating trends, or both. These adjustments, along with the reasons for their treatment, are described below. Trends in the profitability of our fundamental operating activities can be more clearly identified without the fluctuations of these adjustments. Other companies may calculate these measures differently. Therefore, their measures may not be comparable to those used by us.

| (1) | Net realized investment gains (losses). The recognition of net realized investment gains or losses can vary significantly across periods as the timing of individual securities sales is highly discretionary and is influenced by such factors as market opportunities, our tax and capital profile, and overall market cycles. |

| | |

| (2) | Gains and losses on debt extinguishment. Gains and losses on debt extinguishment result from discretionary activities that are undertaken to enhance our capital position, improve our debt profile, and/or reduce potential dilution from our outstanding convertible debt. |

| | |

| (3) | Net impairment losses recognized in earnings. The recognition of net impairment losses on investments can vary significantly in both size and timing, depending on market credit cycles, individual issuer performance, and general economic conditions. |

| | |

| (4) | Infrequent or unusual non-operating items. Our income tax expense for 2017 reflects a reduction in our net deferred tax asset due to the rate decrease included in the tax reform enacted in the fourth quarter of 2017 (the "Tax Act"). Our income tax expense also includes amounts related to our IRS dispute and is related to past transactions which are non-recurring in nature and are not part of our primary operating activities. |

| MGIC INVESTMENT CORPORATION AND SUBSIDIARIES | ||||||||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) | ||||||||||||||||

| | | | | | | | | | ||||||||

| | | Three Months Ended December 31, | | Year Ended December 31, | ||||||||||||

| (In thousands, except per share data) | | 2017 | | 2016 | | 2017 | | 2016 | ||||||||

| | | | | | | | | | ||||||||

| Net premiums written | | $ | 259,523 | | | $ | 243,471 | | | $ | 997,955 | | | $ | 975,091 | |

| Revenues | | | | | | | | | ||||||||

| Net premiums earned | | $ | 237,425 | | | $ | 235,053 | | | $ | 934,747 | | | $ | 925,226 | |

| Net investment income | | 31,276 | | | 28,094 | | | 120,871 | | | 110,666 | | ||||

| Net realized investment gains (losses) | | 460 | | | (52) | | | 249 | | | 8,932 | | ||||

| Other revenue | | 2,341 | | | 3,425 | | | 10,187 | | | 17,659 | | ||||

| Total revenues | | 271,502 | | | 266,520 | | | 1,066,054 | | | 1,062,483 | | ||||

| Losses and expenses | | | | | | | | | ||||||||

| Losses incurred, net | | (30,996) | | | 47,658 | | | 53,709 Werbung Mehr Nachrichten zur Mgic Investment Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||||