Mercantile Bank Corporation Declares Regular Cash Dividend

PR Newswire

GRAND RAPIDS, Mich., April 17, 2018

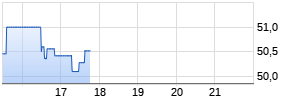

GRAND RAPIDS, Mich., April 17, 2018 /PRNewswire/ -- Mercantile Bank Corporation (NASDAQ: MBWM) ("Mercantile") announced today that on April 12, 2018, its Board of Directors declared a regular quarterly cash dividend of $0.22 per common share, payable on June 20, 2018, to holders of record as of June 8, 2018.

"We are very pleased that our sound financial condition has enabled us to once again reward shareholders with a competitive dividend yield and positioned us to meet growth initiatives," said Robert B. Kaminski, Jr., President and Chief Executive Officer of Mercantile. "As depicted by the sustained cash dividend program, we remain committed to providing shareholders with a meaningful cash return and confident that our strong operating results will continue in future periods. We expect future cash dividend payouts to represent between 35 percent and 40 percent of net income."

About Mercantile Bank Corporation

Based in Grand Rapids, Michigan, Mercantile Bank Corporation is the bank holding company for Mercantile Bank of Michigan. Mercantile provides banking services to businesses, individuals and governmental units, and differentiates itself on the basis of service quality and the expertise of its banking staff. Mercantile has assets of approximately $3.2 billion and operates 47 banking offices. Mercantile Bank Corporation's common stock is listed on the NASDAQ Global Select Market under the symbol "MBWM."

Forward-Looking Statements

This news release contains comments or information that constitute forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of risks and uncertainties. Actual results may differ materially from the results expressed in forward-looking statements. Factors that might cause such a difference include changes in interest rates and interest rate relationships; demand for products and services; the degree of competition by traditional and nontraditional competitors; changes in banking regulation or actions by bank regulators; changes in tax laws; changes in prices, levies, and assessments; the impact of technological advances; governmental and regulatory policy changes; the outcomes of contingencies; trends in customer behavior as well as their ability to repay loans; changes in local real estate values; changes in the national and local economies; and other factors, including risk factors, disclosed from time to time in filings made by Mercantile with the Securities and Exchange Commission. Mercantile undertakes no obligation to update or clarify forward-looking statements, whether as a result of new information, future events or otherwise.

![]() View original content:http://www.prnewswire.com/news-releases/mercantile-bank-corporation-declares-regular-cash-dividend-300630722.html

View original content:http://www.prnewswire.com/news-releases/mercantile-bank-corporation-declares-regular-cash-dividend-300630722.html

SOURCE Mercantile Bank Corporation

Mehr Nachrichten zur Mercantile Bank Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.