Main Street Announces Second Quarter 2017 Financial Results

PR Newswire

HOUSTON, Aug. 3, 2017

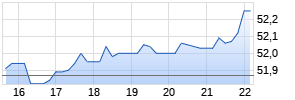

HOUSTON, Aug. 3, 2017 /PRNewswire/ -- Main Street Capital Corporation (NYSE: MAIN) ("Main Street") announced today its financial results for the second quarter of 2017.

Second Quarter 2017 Highlights

- Net investment income of $32.7 million (or $0.58 per share), representing an 18% increase from the second quarter of 2016

- Distributable net investment income(1) of $35.5 million (or $0.63 per share), representing a 19% increase from the second quarter of 2016

- Total investment income of $50.3 million, representing a 17% increase from the second quarter of 2016

- Industry leading ratio of total non-interest operating expenses as a percentage of quarterly average total assets ("Operating Expense to Assets Ratio") on an annualized basis of 1.7%, or 1.6% after excluding the effect of certain non-recurring professional fees and other expenses

- Generated net realized gains from portfolio company activities totaling $11.0 million

- Net asset value of $22.62 per share at June 30, 2017, representing an increase of $0.52 per share, or 2.4%, compared to $22.10 per share at December 31, 2016, or an increase of $0.80 per share, or 3.6%, after excluding the effect of the semi-annual supplemental cash dividend paid in June 2017

- Net increase in net assets resulting from operations of $42.8 million (or $0.76 per share)

- Paid semi-annual supplemental cash dividend of $0.275 per share in June 2017

- Declared regular monthly dividends totaling $0.555 per share for the third quarter of 2017, or $0.185 per share for each of July, August and September 2017, representing a 2.8% increase from the regular monthly dividends paid for the third quarter of 2016

- Completed $56.1 million in total lower middle market ("LMM") portfolio investments, including investments totaling $40.6 million in three new LMM portfolio companies, which after aggregate repayments of debt principal and return of invested equity capital from several LMM portfolio investments resulted in a net increase of $41.9 million in total LMM portfolio investments

- Net increase of $55.3 million in middle market portfolio investments

- Net decrease of $4.9 million in private loan portfolio investments

In commenting on Main Street's results, Vincent D. Foster, Main Street's Chairman and Chief Executive Officer, stated, "We are pleased with our operating results for the second quarter of 2017, a quarter during which we increased our total investment income and our distributable net investment income per share, both on a sequential basis over the first quarter of 2017 and over the same period in the prior year, and generated $11 million of net realized gains from our investment portfolio. As a result of our positive performance, we again generated distributable net investment income per share in excess of our regular monthly dividends, exceeding the regular monthly dividends paid during the quarter by over 13%. In addition, we also generated a net increase in net assets from operations of $0.76 per share, which represented an annualized return on equity for the quarter in excess of 13%."

Second Quarter 2017 Operating Results

The following table provides a summary of our operating results for the second quarter of 2017:

| | Three Months Ended June 30, | |||||||||

| | 2017 | | 2016 | | Change ($) | | Change (%) | |||

| | (dollars in thousands, except per share amounts) | |||||||||

| Interest income | $ | 39,065 | | $ | 33,419 | | $ | 5,646 | | 17% |

| Dividend income | 8,128 | | 7,735 | | 393 | | 5% | |||

| Fee income | 3,078 | | 1,711 | | 1,367 | | 80% | |||

| Income from marketable securities and idle funds | - | | 37 | | (37) | | (100%) | |||

| Total investment income | $ | 50,271 | | $ | 42,902 | | $ | 7,369 | | 17% |

| | | | | | | | | |||

| Net investment income | $ | 32,693 | | $ | 27,648 | | $ | 5,045 | | 18% |

| Net investment income per share | $ | 0.58 | | $ | 0.54 | | $ | 0.04 | | 7% |

| | | | | | | | | |||

| Distributable net investment income (1) | $ | 35,491 | | $ | 29,899 | | $ | 5,592 | | 19% |

| Distributable net investment income per share (1) | $ | 0.63 | | $ | 0.58 | | $ | 0.05 | | 9% |

| | | | | | | | | |||

| Net increase in net assets resulting from operations | $ | 42,829 | | $ | 30,911 | | $ | 11,918 | | 39% |

| Net increase in net assets resulting from operations per share | $ | 0.76 | | $ | 0.60 | | $ | 0.16 | | 27% |

| | | | | | | | | |||

The $7.4 million increase in total investment income in the second quarter of 2017 from the comparable period of the prior year was principally attributable to (i) a $5.6 million increase in interest income primarily related to higher average levels of portfolio debt investments and increased activities involving existing investment portfolio debt investments, (ii) a $1.4 million increase in fee income, and (iii) a $0.4 million increase in dividend income from investment portfolio equity investments. The $7.4 million increase in total investment income in the second quarter of 2017 includes an increase of $2.5 million related to higher accelerated prepayment, repricing and other activity for certain middle market and private loan investment portfolio debt investments when compared to the same period in 2016.

Cash operating expenses (total operating expenses excluding non-cash, share-based compensation expense) increased to $14.8 million in the second quarter of 2017 from $13.0 million for the corresponding period of 2016. This comparable period increase in cash operating expenses was principally attributable to (i) a $0.9 million increase in general and administrative expenses, including approximately $0.3 million related to non‑recurring professional fees and other expenses incurred on certain potential new portfolio investment opportunities which were terminated during the due diligence and legal documentation processes, (ii) a $0.6 million increase in compensation expense related to increases in the number of personnel, base compensation levels and incentive compensation accruals and (iii) a $0.5 million increase in interest expense, primarily due to the higher average interest rate and balance outstanding on our long-term revolving credit facility ("Credit Facility") in the second quarter of 2017, with these increases partially offset by a $0.3 million increase in the expenses allocated to our external investment manager, a wholly owned portfolio company and registered investment advisor that provides investment management services to third parties (the "External Investment Manager"), in each case when compared to the same period in the prior year. Excluding the effect of the non-recurring professional fees and other expenses, our Operating Expense to Assets Ratio was 1.6% on an annualized basis for the second quarter of 2017, compared to 1.4% on an annualized basis for the second quarter of 2016 and 1.5% for the year ended December 31, 2016. Including the effect of the non-recurring expenses, the ratio for the second quarter of 2017 was 1.7% on an annualized basis.

The $5.6 million increase in distributable net investment income, which is net investment income before non-cash, share-based compensation expense, was primarily due to the higher level of total investment income, partially offset by higher operating expenses as discussed above.(1) Distributable net investment income on a per share basis for the second quarter of 2017 reflects (i) an increase of approximately $0.04 per share from the comparable period in 2016 attributable to the net increase in the comparable levels of accelerated prepayment, repricing and other activity for certain investment portfolio debt investments and (ii) a greater number of average shares outstanding compared to the corresponding period in 2016 primarily due to shares issued through our at-the-market, or ATM, program, shares issued pursuant to our equity incentive plans and shares issued pursuant to our dividend reinvestment plan.

The $11.9 million change in the net increase in net assets resulting from operations was primarily the result of (i) an $11.9 million improvement in net change in unrealized appreciation (depreciation) from portfolio investments, including the impact of accounting reversals relating to realized gains/income (losses), from net unrealized depreciation of $10.6 million for the second quarter of 2016 to net unrealized appreciation of $1.3 million for the second quarter of 2017 and (ii) a $5.0 million increase in net investment income as discussed above, with these increases partially offset by (i) a $4.5 million decrease in the net realized gain from investments to a total net realized gain for the second quarter of 2017 of $11.0 million and (ii) a $0.4 million increase in the income tax provision. The net realized gain from investments of $11.0 million for the second quarter of 2017 was primarily the result of (i) realized gains of $6.8 million due to activity in our other portfolio, (ii) the realized gain of $2.4 million on the exit of a LMM investment, (iii) the realized gain of $1.4 million on the partial exit of a LMM investment and (iv) realized gains of $0.6 million due to activity in our middle market portfolio.

The following table provides a summary of the total net unrealized appreciation of $1.3 million for the second quarter of 2017:

| | Three Months Ended June 30, 2017 | ||||||||

| | LMM (a) | | Middle Market Werbung Mehr Nachrichten zur Main Street Capital Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||