Main Street Announces New Portfolio Investment

PR Newswire

HOUSTON, Dec. 7, 2016

HOUSTON, Dec. 7, 2016 /PRNewswire/ -- Main Street Capital Corporation (NYSE: MAIN) ("Main Street") is pleased to announce that it recently led a new portfolio investment to facilitate the recapitalization of Hawk Ridge Systems, LLC and related companies (collectively, "Hawk Ridge" or the "Company"), one of North America's largest value added resellers ("VAR") of SolidWorks' computer-aided design ("CAD"), computer-aided manufacturing ("CAM") and computer-aided engineering ("CAE") software solutions and 3D Systems Corporation's 3D printing solutions. Main Street, along with a co-investor, partnered with the Company's co-founder and chief executive officer to facilitate the transaction, which resulted in the buy-out of the chief executive officer's co-founding partners, with Main Street funding $13.0 million in a combination of first-lien, senior secured term debt and direct equity investment. In addition, Main Street and its co-investor are providing Hawk Ridge an undrawn credit facility to support its future organic and acquisition growth initiatives and working capital needs.

Headquartered in Mountain View, California, and founded in 1996, Hawk Ridge (www.hawkridgesys.com) is one of the largest and most respected VARs of SolidWorks' CAD, CAM and CAE software solutions and 3D Systems' 3D printing solutions. The Company serves over 26,000 customers from its 16 office locations spanning the western United States and Canada.

ABOUT MAIN STREET CAPITAL CORPORATION

Main Street (www.mainstcapital.com) is a principal investment firm that provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies. Main Street's portfolio investments are typically made to support management buyouts, recapitalizations, growth financings, refinancings and acquisitions of companies that operate in diverse industry sectors. Main Street seeks to partner with entrepreneurs, business owners and management teams and generally provides "one stop" financing alternatives within its lower middle market portfolio. Main Street's lower middle market companies generally have annual revenues between $10 million and $150 million. Main Street's middle market debt investments are made in businesses that are generally larger in size than its lower middle market portfolio companies.

Main Street's common stock trades on the New York Stock Exchange ("NYSE") under the symbol "MAIN." In addition, Main Street has outstanding 6.125% Notes due 2023, which trade on the NYSE under the symbol "MSCA."

Contacts:

Main Street Capital Corporation

Dwayne L. Hyzak, President & COO, dhyzak@mainstcapital.com

Brent D. Smith, CFO, bsmith@mainstcapital.com

713-350-6000

Dennard • Lascar Associates

Ken Dennard | ken@dennardlascar.com

Mark Roberson | mroberson@dennardlascar.com

713-529-6600

ARIVA.DE Börsen-Geflüster

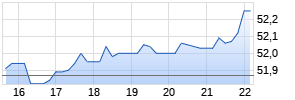

Kurse

|

|

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/main-street-announces-new-portfolio-investment-300374086.html

SOURCE Main Street Capital Corporation

Mehr Nachrichten zur Main Street Capital Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.