LiCo Energy Metals to Acquire Ontario Cobalt Property from Glencore plc

PR Newswire

VANCOUVER, British Columbia, Sept. 5, 2017

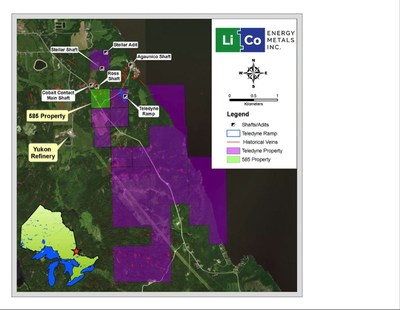

VANCOUVER, British Columbia, Sept. 5, 2017 /PRNewswire/ -- LiCo Energy Metals Inc. ("the Company "or" LiCo") (TSX-V: LIC) (OTCQB: WCTXF) is pleased to announce that it has entered into a property Purchase Agreement effective August 31st, 2017 with Glencore Canada Corporation (subsidiary of Glencore plc) ("Glencore") of Baar Switzerland, (LSE: GLEN) to acquire a 100% interest in mining rights patent #585 (the "Glencore property") situated in Bucke Township, 6 km east-northeast of Cobalt, Ontario. The Purchase Agreement includes a back-in provision, production royalty and an off-take agreement in favor of Glencore.

Glencore is one of the world's largest producers of cobalt as a result of by-products created from its copper assets in the DRC and nickel assets in Australia, Canada and Norway.

"We are very excited to acquire this strategic Canadian property from Glencore. The property is conveniently located adjacent to our current Teledyne Cobalt property, and this purchase agreement allows LiCo to expand upon one of Glencore's longstanding Canadian cobalt assets. If all goes as planned, we could be selling all our cobalt produced back to Glencore in the future. It is a property sale, but we have also found a significant future customer," states Tim Fernback, LiCo's President & CEO.

Strategically, the Glencore property consists of 16.2 hectares and sits along the west boundary of LiCo's Teledyne Cobalt Project that covers the southern extension of the former producing 15 Vein on the past-producing Agaunico Mine Property. Historically, the Agaunico Mine produced 4,350,000 lbs. of cobalt and 980,000 oz. of silver during the mining boom of the early 1900's (Cunningham-Dunlop, 1979).

In the early 80's the Glencore property was explored by 36 surface diamond drill holes totaling 3,323 m. The drilling program outlined two separate vein systems hosting significant cobalt and silver values. The two zones are known as the Main Zone, measuring 152.4 m in length, and the Northwest Zone, measuring 70.0 m in length. The Main Zone had a north-south strike, which is hypothesized as the southern extension of the #3 vein from the Cobalt Contact Mine located immediately to the north of lease #585 (Bresee, 1982). Additional work was recommended but never completed due to a downturn in cobalt prices at the time.

On LiCo's adjacent Teledyne property, historical drilling also encountered two zones of cobalt/silver mineralization extending from the boundary of mined zones at the Agaunico Mine in a north-south direction. In 1980, Teledyne completed a 700 m long production decline to reach the mineralization encountered in their surface drill program. Both the surface and underground drilling programs confirmed the extension of the Agaunico cobalt zones onto the Teledyne property for a strike length of 152.4 m. In addition, the drill program encountered a second zone with a strike length of 137.2 m. The most significant results included 0.644% Co over 16.9 m, 0.74% Co over 8.7m, and 2.59% Co over 2.4 m (Bresee, 1981).

"We are delighted to add this Glencore property to our land position in Canada. By adding drill indicated cobalt mineralization from the Glencore property with similar mineralization as that found at our nearby Teledyne property, we have greatly enhanced LiCo's potential for finding an economic cobalt deposit. I am looking forward with great interest to seeing the results of the upcoming drill programs scheduled for both the Glencore and Teledyne properties this fall," commented Mr. Dwayne Melrose, Director and Head of the Technical Advisory Board of LiCo.

Terms of the Acquisition:

Purchase Price -The Purchaser shall pay to the Vendor the sum of $150,000 on the Approval Date; and pay to the Vendor the sum of $350,000 within 6 months after the date of the Agreement (the "Closing Date"). In addition, prior to the Closing Date during the Acquisition Period, the Purchaser shall incur $250,000 in Exploration Expenditures on the Property.

Offtake Agreement - Prior to the commencement of Commercial Production, the Purchaser shall enter into an off-take agreement with the Vendor for all ores and/or concentrates produced from the Property and/or the Teledyne Property. The off-take agreement shall be on such terms and conditions as are commercially reasonable and at prevailing market prices;

Production Royalty - The Royalty will consist of a 3.5% of Net Smelter Return calculated on a quarterly basis on all Products extracted from, processed and sold that originate from mining operations on the Property from and after Commercial Production. One-half (1/2) of the Royalty can be purchased for $1,000,000 payable to the Vendor or its assignee;

Back-In Option – from and after the Closing Date, subject to Glencore or an affiliate, determining that a discovery of one or more ore bodies having a minimum aggregate in-situ value of $100M or more from which minerals can be feasibly extracted, the Purchaser grants to the Vendor or its nominated affiliate an irrevocable, sole and exclusive right and option to acquire from the Purchaser a 51% interest in the Property and all Property Rights, free and clear of all burdens of any nature or kind. Once the Back-in Option is exercised a joint venture will be formed and a management committee established with representatives of both companies.

About Glencore

Glencore plc is a leading integrated commodity producer and trader, operating worldwide with diversified operations comprising around 150 mining and metallurgical, oil production and agricultural assets. Glencore's industrial and marketing activities are supported by a global network of more than 90 offices located in over 50 countries where they employ around 155,000 people, including contractors. Glencore trades in and distribute physical commodities sourced from third party producers as well as their own production. The company also provide financing, processing, storage, logistics and other services to commodity producers and consumers.

About LiCo Energy Metals:

LiCo Energy Metals Inc. is a well-funded Canadian based exploration company whose primary listing is on the TSX Venture Exchange. The Company's focus is directed towards exploration for high value metals integral to the manufacture of lithium ion batteries. The Company currently maintains the following portfolio of exploration properties:

Purickuta Lithium Project, Chile: The Purickuta Project is located within Salar de Atacama, a salt flat encompassing 3,000 km2, being about 100 km long, 80 km wide and home to approximately 37% of the worlds Lithium production. The salar possesses a very high grade of both Lithium (1,840mg/l) and Potassium (22,630mg/l and is close to power, labour, communications, transportation and other infrastructure. The property of 160 hectares is enveloped by a concession owned by Sociedad Quimica y Minera ("SQM") and lies, significantly, within a few kilometers of the property of CORFO (the Chilean Economic Development Agency) where its leases to both SQM and Albermarle's Rockwood Lithium Corp Together these two companies have combined production of over 62,000 tonnes of LCE (Lithium Carbonate Equivalent) annually making up 100% of Chile's current lithium output. The unique characteristics of Salar de Atacama make finished lithium carbonate easier and cheaper to produce than any of its peer group globally.

Purickuta is a smaller exploitation concession rather than a large exploration concession thereby accelerating the task of taking the project to production once a measured reserve can be established. Currently, the Chilean government retains ownership of lithium separate from other minerals and thus production can only proceed upon receipt of a special lithium operation contract know as a "CEOL". In the future, it will be necessary for LiCo and partner to negotiate a production contract with CORFO concurrently with completing any positive feasibility study. "Chile, which has one of the world's most plentiful supplies of lithium, is pushing ahead with new policies to develop those reserves". (Reuters Jan2, 2017).

Teledyne Cobalt Project, Cobalt, Ontario: The Company has an option to earn 100% ownership, subject to a royalty, in the Teledyne Project located near Cobalt. Ontario. The Property adjoins the south and west boundaries of claims that hosted the Agaunico Mine. From 1905 through to 1961, the Agaunico Mine produced a total of 4,350,000 lbs. of cobalt and 980,000 oz. of silver. A significant portion of the cobalt that was produced at the Agaunico Mine located along structures that extended southward onto property currently under option to LiCo Energy Metals.

Dixie Valley Lithium Project, Nevada: The Company has an option to acquire a 100% interest, subject to a 3% NSR, on a large lithium exploration project at the Humboldt Salt Marsh in Dixie Valley, Nevada. The geologic setting and presence of lithium in active geothermal fluids and surface salts in Dixie Valley match characteristics of producing lithium brine deposits at Clayton Valley, Nevada and in South America.

Black Rock Desert Lithium Project, Nevada: The Company has entered into an option agreement whereby the Company may earn an undivided 70% interest, subject to a 3% Net Smelter Return Royalty, in the Black Rock Desert Lithium Project that consists of 128 placer claims (2,560 acres/ 1,036 hectares) in southwest Black Rock Desert, Washoe County, Nevada.

The Company is planning an exploration programs on a number of its properties over the next several months. The technical content of this news release has been reviewed and approved Joerg Kleinboeck, P.Geo. an independent consulting geologist and a qualified person as defined in NI 43-101.

On Behalf of the Board of Directors

Tim Fernback, President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information:

This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements.

Phone : (236) 521-0207

LiCoEnergyMetals.com

View original content with multimedia:http://www.prnewswire.com/news-releases/lico-energy-metals-to-acquire-ontario-cobalt-property-from-glencore-plc-300513676.html

SOURCE LiCo Energy Metals Inc.

Mehr Nachrichten zur LiCo Energy Metals Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.