Leading Tech Analyst Previews Earnings for Atmel, JDS Uniphase, Microchip Technology, Arrow Electronics, and O2 Micro

PR Newswire

PRINCETON, N.J., April 30, 2013

PRINCETON, N.J., April 30, 2013 /PRNewswire/ -- Next Inning Technology Research (http://www.nextinning.com), an online investment newsletter focused on technology stocks, has issued updated outlooks for Atmel (Nasdaq: ATML), JDS Uniphase (Nasdaq: JDSU), Microchip Technology (Nasdaq: MCHP), Arrow Electronics (NYSE: ARW), and O2 Micro (Nasdaq: OIIM).

During 2012, Next Inning editor, Paul McWilliams predicted both the spring and fall corrections as well as the rally that started in November and carried through the first quarter of 2013. On the day the November rally started, he advised readers it would lift the NASDAQ by as much at 18% by the end of March 2013. As we know now, that is exactly what happened.

To keep Next Inning readers ahead of the curve, Next Inning is now publishing McWilliams' highly acclaimed earnings previews. These reports outline McWilliams' outlook for the second quarter and provide readers with deep insight into the world's leading tech companies. McWilliams also shares his opinions as to which of these companies investors should buy and which should be avoided.

Trial subscribers will also receive McWilliams' 167-page State of Tech report, which includes 35 detailed tables and graphs, for free, no strings attached. This report is a must read for investors and analysts focusing on technology in 2013.

Already in 2013, McWilliams suggested buying several including Cree (up 62% year to date), Micron (up 49% year to date), Marvell (up 45% year to date), and SanDisk (up 24% year to date). Stocks he suggested avoiding/selling include Netlist (down 28% year to date), Fairchild (down 13% year to date) and Cypress (down 8% year to date). McWilliams' new earnings previews outline which stocks investors will want to own and which they should avoid.

To get ahead of the Wall Street curve and receive McWilliams' Q1 2013 State or Tech report, you are invited to take a free, 21-day, no obligation trial with Next Inning. For full details on this offer, please visit the following link:

ARIVA.DE Börsen-Geflüster

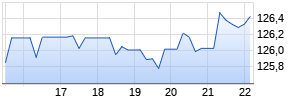

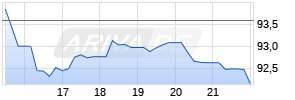

Kurse

|

|

|

|

|

Topics discussed in the latest reports include:

-- Atmel: It was just over one year ago when McWilliams strongly suggested selling Atmel at its then current price of $9.12. Following that, the price of Atmel fell like a rock and in October 2012 McWilliams suggested it was time to buy again at $4.76. Has Atmel made the right moves by selling its serial Flash product line last year, subsequently acquiring IDT's smart meter group, and shifting to a broader market strategy rather than focusing on touch screen technology? What is McWilliams' outlook for Atmel in 2013?

-- JDS Uniphase: What differentiates JDS Uniphase from other companies in the fiber optics sector and why might it drive an upside for JDS Uniphase relative to other companies in the sector? What factors support a positive view of the fiber optics sector right now? Does McWilliams think JDS Uniphase is losing market share in the critical ROADM and WSS markets? What strategies does McWilliams see as valid ways for investors to cover the fiber optics sector?

-- Microchip: Could closer ties between Taiwan Semiconductor Manufacturing and Renesas, and Texas Instruments' intense focus on embedded processor markets be disruptive to Microchip's business model? What other changes occurred during 2012 in the embedded processor sector that could present new competitive challenges for Microchip? How has Microchip adapted to these changes and increased its exposure to the hot automotive markets?

-- Arrow: McWilliams advised readers to buy Arrow and its rival, Avnet when the stocks were bottoming in the fall of 2012. What is McWilliams' view of Arrow heading into its upcoming earnings report? Does McWilliams prefer Arrow over rival Avnet? What valuation penalty does Wall Street tend to apply to mega-distributors like Arrow and why is that likely to continue?

-- O2Micro: With O2Micro continuing to trade below the level of its balance sheet value, should investors consider it a bargain buy, or are there reasons to steer clear?

Founded in September 2002, Next Inning's model portfolio has returned 241% since its inception versus 74% for the S&P 500.

About Next Inning:

Next Inning is a subscription-based investment newsletter that provides regular coverage on more than 150 technology and semiconductor stocks. Subscribers receive intra-day analysis, commentary and recommendations, as well as access to monthly semiconductor sales analysis, regular Special Reports, and the Next Inning model portfolio. Editor Paul McWilliams is a 30+ year semiconductor industry veteran.

NOTE: This release was published by Indie Research Advisors, LLC, a registered investment advisor with CRD #131926. Interested parties may visit adviserinfo.sec.gov for additional information. Past performance does not guarantee future results. Investors should always research companies and securities before making any investments. Nothing herein should be construed as an offer or solicitation to buy or sell any security.

CONTACT: Marcia Martin, Next Inning Technology Research, +1-888-278-5515

SOURCE Indie Research Advisors, LLC

Mehr Nachrichten zur Atmel Corporation Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.