Launch Of TCP DLF VIII ICAV On The DMS Loan Origination QIAF

PR Newswire

DUBLIN, Feb. 2, 2018

DUBLIN, Feb. 2, 2018 /PRNewswire/ -- DMS Governance ("DMS"), the world's leading fund governance + risk + compliance firm, together with Tennenbaum Capital Partners, LLC ("TCP"), a leading U.S. alternative investment manager, is delighted to announce the launch of the TCP DLF VIII ICAV ("the ICAV"), a closed-ended, Irish collective asset-management vehicle authorised by the Central Bank of Ireland as a loan origination QIAIF (L-QIAIF). Advised by Irish leading legal advisor Dillon Eustace, the ICAV's investment objective is to achieve high risk-adjusted returns produced primarily from current income generated by investing primarily in performing senior secured debt issued by U.S.-based middle-market companies.

L-QIAIFs are subject to specific requirements as laid out by the Central Bank of Ireland which require that L-QIAIFs have in place a number of procedures, policies, and processes including collateral management and credit monitoring, which DMS can prepare and monitor on an ongoing basis through its independent risk management capability. By reason of DMS acting as alternative investment fund manager to the ICAV operating under the Alternative Investment Fund Managers Directive (AIFMD), the L-QIAIF can also avail of the AIFMD marketing passport.

Conor MacGuinness, Managing Director at DMS commented, "as our AIFM Management Company services and particularly direct lending strategies continue to grow, it has been exciting to launch one of the first L-QIAIFs in Ireland which is another achievement and testament to the confidence investment managers have in DMS. We continue to see a continued interest in this type of structure and look forward to welcoming TCP as a client."

Lee R. Landrum, Managing Partner of TCP said, "Since our firm's first institutional fund in 1999, we have invested approximately $19Bn in more than 500 companies. As a result, we have a demonstrated track record of delivering strong risk-adjusted returns to our investors across market cycles. We are extremely pleased with the response to our DLF VIII fundraise that included a wide variety of global institutional investors and investment consultants. The strong demand for our fund in a competitive market illustrates the confidence our investors place in TCP's longstanding execution of its middle-market Direct Lending strategy. We want to thank all new and existing investors for their trust and confidence in our Firm and express our appreciation for the valuable assistance and expertise of professional service firm partners including MVision Private Equity Advisers, DMS Governance, Dillon Eustace and Skadden, Arps, Slate, Meagher & Flom LLP."

Etain de Valera, Partner at Dillon Eustace, "We are proud to have been selected by TCP and DMS to advise them on legal and regulatory issues, and help them establish their first L-QIAIF in Ireland. We at Dillon Eustace, have been able to capitalize on our extensive experience in advising fund managers, in particular those employing credit strategies in order to assist in bringing this product to market. As one of the first L-QIAIFs in Ireland, we believe that the stage is now firmly set for Dillon Eustace to assist other managers in establishing similar funds employing similar strategies. This product represents a definite advantage for asset managers looking to market their loan origination strategy both inside and outside the EU, particularly in the context of uncertainty around Brexit."

About DMS

DMS Governance is the worldwide leader in fund governance + risk + compliance representing leading investment funds and managers with assets under management exceeding $350Bn. DMS is a global institutional firm that excels in delivering high-quality services across a diverse range of investment fund structures and strategies. We are proud to be the leading independent provider of AIFM, UCITS Management Company and MiFID services to many of the largest institutional investors and asset managers globally. For more information, please visit www.dmsgovernance.com.

About Tennenbaum Capital Partners, LLC

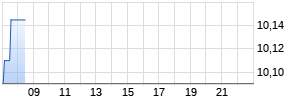

Tennenbaum Capital Partners, LLC ("TCP") is an alternative investment management firm with approximately $9 billion of committed capital focused on direct lending and special situations for middle-market companies. TCP manages funds and accounts on behalf of global institutional investors. It also manages a publicly-traded business development company, TCP Capital Corp. (NASDAQ: TCPC). Since its founding in 1999, TCP has invested approximately $19 billion in over 500 companies. TCP is headquartered in Los Angeles with additional offices in Atlanta, New York and San Francisco. For more information, please visit: www.tennenbaumcapital.com and www.tcpcapital.com.

About MVision Private Equity Advisers

MVision Private Equity Advisers is widely recognized as one of the world's leading independent international alternative assets advisory firms, raising capital for private equity, credit, real estate, real assets and direct transactions globally. With offices globally and a team of over 50 professionals, MVision has a long-standing reputation for identifying and working with current and future market leaders around the world, assisting clients with the ongoing task of funding and growing their businesses effectively, and helping them to ensure optimal positioning, growth and performance. For more information, visit www.mvision.com.

About Dillon Eustace

Dillon Eustace is one of Ireland's leading law firms focusing on financial services, corporate and M&A, insurance, litigation and dispute resolution, real estate and taxation. The firm which is the leading legal advisor to Irish domiciled funds has developed a dynamic team of lawyers who represent a broad spectrum of individuals and companies which include: banks, corporates, insurers, government & supranational bodies, fund and asset management industry participants; as well as newspapers, pharmaceutical firms, aviation & maritime industry participants and real estate developers.

Media Contact

Alison Sims

Marketing Manager

DMS Governance

(p) +1.345.749.2514 (c) +1.345.325.1776

E:asims@dmsgovernance.com

Mehr Nachrichten zur BlackRock TCP Capital Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.