Kemira Oyj issues a EUR 200 million bond

Stock Exchange Release

May 18, 2017 at 5.05 pm (CET+1)

Kemira Oyj issues a EUR 200 million bond

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, HONG KONG, JAPAN, NEW ZEALAND, SOUTH AFRICA OR SUCH OTHER COUNTRIES OR OTHERWISE IN SUCH CIRCUMSTANCES IN WHICH THE OFFERING OF THE NOTES OR THE RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

Kemira issues a senior unsecured bond of EUR 200 million. The seven-year bond matures on May 30, 2024 and it carries a fixed annual interest of 1.750 percent. The offering was allocated to approximately 60 investors.

Kemira will submit an application to have the bond listed on Nasdaq Helsinki Ltd. The proceeds from the bond offering will be used for the partial repurchase of the existing notes due 2019 and for general corporate purposes.

Nordea Bank AB (publ) and OP Corporate Bank plc act as joint lead managers for the issue of the bond.

For more information, please contact:

Kemira Oyj

Pauliina Paatelma, Vice President, Group Treasurer

Tel. +358 40 572 5014

Olli Turunen, Vice President, Investor Relations

Tel. +358 10 862 1255

Kemira is a global chemicals company serving customers in water-intensive industries. We provide expertise, application know-how and chemicals that improve our customers' product quality, process and resource efficiency. Our focus is on pulp & paper, oil & gas, mining and water treatment. In 2016, Kemira had annual revenue of around EUR 2.4 billion and 4,800 employees. Kemira shares are listed on the Nasdaq Helsinki Ltd.

www.kemira.com

Important Information

The information contained herein is not for release, publication or distribution, in whole or in part, directly or indirectly, in or into the United States, Australia, Canada, Hong Kong, Japan, New Zealand, South Africa or such other countries or otherwise in such circumstances in which the release, publication or distribution would be unlawful. The information contained herein does not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of, the notes in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration, exemption from registration or qualification under the securities laws of any such jurisdiction.

This communication does not constitute an offer of securities for sale in the United States. The notes have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the "Securities Act") or under the applicable securities laws of any state of the United States and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons except pursuant to an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act.

This communication does not constitute an offer of notes to the public in the United Kingdom. No prospectus has been or will be approved in the United Kingdom in respect of the notes. Consequently, this communication is directed only at (i) persons who are outside the United Kingdom, (ii) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order"), (iii) high net worth entities falling within Article 49(2) of the Order and (iv) other persons to whom it may lawfully be communicated (all such persons together being referred to as "relevant persons"). In addition, this communication is, in any event only directed at persons who are "qualified investors" pursuant to the Prospectus Directive (2003/71/EC, as amended). Any investment activity to which this communication relates will only be available to, and will only be engaged with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

The issuer of this announcement warrants that they are solely responsible for the content, accuracy and originality of the information contained therein.

Source: Kemira Oyj via Globenewswire

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in Kemira | ||

|

ME7JJ2

| Ask: 3,02 | Hebel: 4,60 |

| mit moderatem Hebel |

Zum Produkt

| |

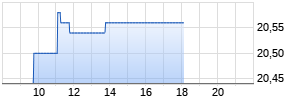

Kurse

|

Mehr Nachrichten zur Kemira Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.