KBC Group: Third-quarter result of 697 million euros

Press Release

Outside trading hours - Regulated information*

Brussels, 12 November 2020 (07.00 a.m. CET)

KBC Group: Third-quarter result of 697 million euros

During the third consecutive quarter of facing up to the challenges of the pandemic, the harsh reality that coronavirus is still far from being eradicated has become very clear. It is still causing human suffering all over the world and unprecedented economic upheaval. However, the various government relief measures should help control the overall impact going forward. Obviously, the long-term impact of the coronavirus crisis on society will be significant. It will also depend on the number and intensity of any new outbreaks, as well as on the timing of developing and distributing a vaccine or cure.

Meanwhile, we have been working hard with government agencies to support all customers impacted by coronavirus, by efficiently implementing various relief measures, including loan deferrals. In our six home countries combined, we have granted a total of 13.7 billion euros in loan payment deferrals by the end of September 2020 (according to the EBA definition) and have also granted 0.6 billion euros’ worth of loans under public corona guarantee schemes. At the same time, we have continued providing a high level of service to our customers in all our core markets, thanks to the expertise and commitment of our employees, in combination with the efforts and investments we have made over the past few years on the digital transformation front. Given that the pandemic has accelerated the trend to digitalisation, we are clearly benefiting from our digital transformation efforts. We will continue to work on solutions to proactively make life easier for our customers, thanks in part to the extensive use of artificial intelligence and data analysis. We will be communicating on this and other topics in more depth during a separate strategy session today, with the accompanying press release being issued at 1 p.m. CET.

As regards our financial results, we generated a net profit of 697 million euros in the third quarter of 2020, leading to a return on equity of 15% in the third quarter of 2020 (when bank taxes are spread evenly throughout the year). The third quarter profit is well above the 210 million euros recorded in the previous quarter, which had included 746 million euros in collective impairment charges for the coronavirus crisis. Our net interest income went up quarter-on-quarter, while our trading and fair value result fared well too, though it was down on the exceptionally high level recorded in the previous quarter. In the current lower-for-longer interest rate environment, this quarterly result is also clearly benefiting from the diversification achieved through KBC’s integrated bank-insurance model. This was reflected in a strong non-life result (good premium growth and an excellent combined ratio of 83% year-to-date), as well as higher net fee and commission income. Costs remained clearly under control. Adding the result for this quarter to the one for the first half of the year brings our net profit for the first nine months of 2020 to 902 million euros.

Our solvency position remained very strong, with a common equity ratio of 16.6% on a fully loaded basis, well above the current minimum capital requirement of 7.95%. Our liquidity position remained solid too, with an LCR of 142% and an NSFR of 146% at the end of September 2020. Consequently, our current capital and liquidity buffers allow us to face today's challenges with confidence.

In closing, I would like to take this opportunity to explicitly thank all stakeholders who have continued to put their trust in us. I also wish to express my sincere thanks to all colleagues who have expended huge efforts to serve our customers and support the sound functioning of the group in these challenging times.

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in KBC Groep | ||

|

UK9591

| Ask: 0,73 | Hebel: 6,47 |

| mit moderatem Hebel |

Zum Produkt

| |

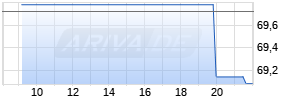

Kurse

|

Johan Thijs,

Chief Executive Officer

Full press release attached

Attachments

Mehr Nachrichten zur KBC Groep Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.