Johnson Fistel, LLP Announces Investigations of Aqua Metals, Inc., Ellie Mae Inc., PayPal Holdings, Inc., Xerox Corporation and OSI Systems, Inc.; Investors Encouraged to Contact Firm

PR Newswire

SAN DIEGO, Feb. 1, 2018

SAN DIEGO, Feb. 1, 2018 /PRNewswire/ -- Shareholder Rights Law Firm Johnson Fistel, LLP is investigating potential claims against Aqua Metals, Inc., Ellie Mae Inc., PayPal Holdings, Inc., Xerox Corporation and OSI Systems, Inc., as detailed below:

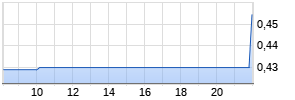

Aqua Metals, Inc.

Shareholder Rights Law Firm Johnson Fistel, LLP announces that a class action lawsuit has been filed against Aqua Metals, Inc. ("Aqua Metals") (NASDAQ: AQMS) and certain of its officers.

The class action is on behalf of all persons or entities who purchased or otherwise acquired Aqua Metals securities between May 19, 2016 and November 9, 2017 (the "Class Period"). Investors have until February 13, 2018, to apply to the Court to be appointed as lead plaintiff in the lawsuit.

The complaint alleges that, throughout the Class Period, Defendants issued materially false and misleading statements and failed to disclose that: (a) the Company was touting the business value of the Interstate Battery Partnership and the JCI Partnership; (b) the Company was aware of and ignoring material unresolved deficiencies in the AquaRefine technology and process preventing large scale development; (c) the Company was experiencing numerous execution and operational issues preventing scaling and production ramp up at its facility; and (d) the Company was unable to produce and generate revenue from its core business, therefore remaining unprofitable.

If you wish to serve as a lead plaintiff, you must move the Court no later than February 13, 2018, or if you are a long-term Aqua Metals shareholder continuously holding the stock since before May 19, 2016, and are interested in learning more about your legal rights and remedies, please contact Jim Baker (jimb@johnsonandweaver.com) at 619-814-4471. If you email, please include your phone number.

Ellie Mae Inc.

ARIVA.DE Börsen-Geflüster

Kurse

|

|

|

|

|

Johnson Fistel, LLP is investigating potential violations of the federal securities laws by Ellie Mae Inc. (NYSE: ELLI) ("Ellie Mae" or the "Company") and certain of its officers.

On July 27, 2017, Ellie Mae reported its second quarter 2017 financial results for the period ended June 30, 2017. Revenue came in at $104.1 million, well below guidance. Additionally, Ellie Mae slashed its FY17 sales forecast and disclosed that FY17 adjusted income would come in almost 40% lower than the range that Ellie Mae had previously provided. Following the news, Ellie Mae common stock plummeted. In the months preceding the July 27, 2017 announcement, many of the Company's senior executives and directors sold stock.

Specifically, Johnson Fistel's investigation seeks to determine if a securities violation was committed by the Company and certain of its officers when it made specific representations about the company's business, operations, and financial prospects.

If you have information that could assist in this investigation, including former employees and others, or if you are an Ellie Mae shareholder and are interested in learning more about the investigation or your legal rights and remedies, please contact Jim Baker (jimb@johnsonfistel.com) by email or by phone at 619-814-4471. If you email, please include your phone number.

PayPal Holdings, Inc.

Shareholder Rights Law Firm Johnson Fistel, LLP announces that a class action lawsuit has been filed against PayPal Holdings, Inc. ("PayPal") (NASDAQ: PYPL) and certain of its officers.

The class action is on behalf of all persons or entities who purchased or otherwise acquired PayPal securities between securities between February 14, 2017 and December 1, 2017 (the "Class Period"). Investors have until February 5, 2018, to apply to the Court to be appointed as lead plaintiff in the lawsuit.

According to the complaint, throughout the Class Period, the Company issued materially false and misleading statements and/or failed to disclose that: (1) TIO's data security program was inadequate to safeguard the personally identifiable information of its users; (2) the vulnerabilities threatened continued operation of TIO's platform; (3) PayPal's revenues derived from its TIO services were thus unsustainable; (4) consequently, PayPal had overstated the benefits of the TIO Acquisition; and (5) as a result, PayPal's public statements were materially false and misleading at all relevant times. On November 10, 2017, PayPal suspended its TIO services, pending a security review, stating that it had discovered security vulnerabilities on the TIO platform and that the TIO data security program did not meet PayPal's standards. Then on December 1, 2017, PayPal disclosed that personal information for roughly 1.6 million TIO users had potentially been compromised as a result of the previously announced security vulnerabilities.

If you wish to serve as a lead plaintiff, you must move the Court no later than February 5, 2018, or if you are a long-term PayPal shareholder continuously holding the stock since before February 14, 2017, and are interested in learning more about your legal rights and remedies, please contact Jim Baker (jimb@johnsonandweaver.com) at 619-814-4471. If you email, please include your phone number.

Xerox Corporation

Shareholder rights law firm Johnson Fistel, LLP has launched an investigation into whether the board members of Xerox Corporation (NYSE: XRX) ("Xerox") breached their fiduciary duties in connection with the proposed sale of the Company to FUJIFILM Holdings Corporation.

On February 1, 2018, Xerox announced that it had signed a definitive merger agreement with FUJIFILM. Under the terms of the agreement, Xerox shareholders will receive a $2.5 billion special cash dividend, or approximately $9.80 per share, funded from the combined Company's balance sheet, and own 49.9% of the combined company at closing. FUJIFILM will own 50.1% of the combined Company.

The investigation concerns whether the Xerox board failed to satisfy its duties to the Company shareholders, including whether the board adequately pursued alternatives to the acquisition and whether the board obtained the best price possible for Xerox shares of common stock.

If you are a shareholder of Xerox and believe the proposed buyout price is too low or you're interested in learning more about the investigation or your legal rights and remedies, please contact lead analyst Jim Baker (jimb@johnsonfistel.com) at 619-814-4471. If emailing, please include a phone number.

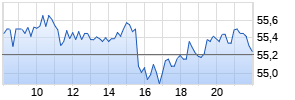

OSI Systems, Inc.

Shareholder rights law firm Johnson Fistel, LLP is investigating potential violations of the federal securities laws by OSI Systems, Inc. ("OSI") (NASDAQ: OSIS) and certain of its officers.

On February 1, 2018, OSI revealed that following a recent report alleging that OSI had engaged in bribery and accounting improprieties, the U.S. Securities and Exchange Commission (SEC) commenced an investigation into "the Company's compliance with the Foreign Corrupt Practices Act." OSI further disclosed that the U.S. Department of Justice "has also said it intends to request information regarding FCPA compliance matters." OSI stated the regulators were acting in response to a short seller, as the firm Muddy Waters has alleged the company has relied on bribes to win a major contract in Albania.

Following this news, the Company's stock plummeted 17%, in after-hours trading on February 1, 2018.

If you have information that could assist in this investigation, or if you are an OSI shareholder and are interested in learning more about the investigation or your legal rights and remedies, please contact Jim Baker (jimb@johnsonfistel.com) at 619-814-4471. If emailing, please include a phone number.

About Johnson Fistel, LLP:

Johnson Fistel, LLP is a nationally recognized shareholder rights law firm with offices in California, New York and Georgia. The firm represents individual and institutional investors in shareholder derivative and securities class action lawsuits. For more information about the firm and its attorneys, please visit http://www.johnsonfistel.com. Attorney advertising. Past results do not guarantee future outcomes.

Contact:

Johnson Fistel, LLP

Jim Baker, 619-814-4471

jimb@johnsonfistel.com

SOURCE Johnson Fistel, LLP

Mehr Nachrichten zur Xerox Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.