International Paper to Reduce Pension Liabilities by $1.3 Billion

PR Newswire

MEMPHIS, Tenn., Oct. 2, 2017

MEMPHIS, Tenn., Oct. 2, 2017 /PRNewswire/ -- International Paper (NYSE: IP) today announced it has entered into an agreement with The Prudential Insurance Company of America (NYSE: PRU) to purchase a group annuity contract and transfer approximately $1.3 billion of International Paper's U.S. qualified pension plan projected benefit obligations.

The transaction will be funded with pension plan assets, and at the end of 2017, Prudential will assume responsibility for pension benefits and annuity administration for approximately 45,000 former employees or their beneficiaries receiving less than $450 in monthly benefit payments from the plan. The transaction is expected to close on October 3, 2017, subject to customary closing conditions.

There will be no change to the pension benefits for any plan participants as a result of the transaction. Retirees and beneficiaries who will be covered by this transaction will be receiving individualized information packages with further details and answers to frequently asked questions.

"First and foremost we are committed to ensuring our retirees' benefits are secure and maintained. This transaction achieves that goal, while at the same time enabling International Paper to better manage future costs associated with our pension plan," said Glenn R. Landau, Senior Vice President and Chief Financial Officer. "We have carefully selected a highly-rated, experienced retirement benefits provider, and our retirees should feel good about this transaction."

As a result of the transaction, the Company expects to recognize a non-cash pension settlement charge of approximately $400 million before tax ($247 million after tax) in the fourth quarter of 2017.

ABOUT INTERNATIONAL PAPER

International Paper (NYSE: IP) is a leading global producer of renewable fiber-based packaging, pulp and paper products with manufacturing operations in North America, Latin America, Europe, North Africa and Russia. We produce packaging products that protect and promote goods, and enable world-wide commerce; pulp for diapers, tissue and other personal hygiene products that promote health and Wellness; papers that facilitate education and communication; and paper bags, cups and food containers that provide convenience and portability. We are headquartered in Memphis, Tenn., and employ approximately 55,000 colleagues located in more than 24 countries. Net sales for 2016 were $21 billion. For more information about International Paper, our products and global citizenship efforts, please visit internationalpaper.com.

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Prudential Financial Inc. | ||

|

ME4D05

| Ask: 2,37 | Hebel: 4,26 |

| mit moderatem Hebel |

Zum Produkt

| |

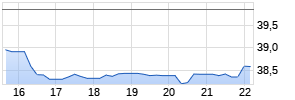

Kurse

|

|

Certain statements in this press release are or may be considered forward-looking statements, such as statements relating to the financial impact of the transactions contemplated by the Agreement. These statements reflect Company management's current views and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these statements. Factors which could cause actual results to differ include but are not limited to (i) the successful fulfillment or waiver of all closing conditions contained in the Agreement without unexpected delays or conditions; (ii) the successful closing of the transactions contemplated by the Agreement within the estimated timeframe; (iii) the failure to realize the expected benefits from the transaction or delay in realization thereof; (iv) the amount and timing of the expected settlement charge; and (v) other factors that can be found in the Company's press releases and Securities and Exchange Commission filings. The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

View original content:http://www.prnewswire.com/news-releases/international-paper-to-reduce-pension-liabilities-by-13-billion-300528492.html

SOURCE International Paper

Mehr Nachrichten zur International Paper Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.