Innodata Reports Third Quarter 2016 Results

![]()

NEW YORK - November 1, 2016 - INNODATA INC. (NASDAQ: INOD) today reported results for the third quarter and the nine months ended September 30, 2016.

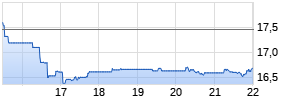

- Total revenue was $16.1 million in the third quarter of 2016, a 3% increase from $15.6 million in the second quarter of 2016. Total revenue was $15.1 million in the third quarter of 2015.

- In the third quarter of 2016 the Company incurred a net loss of $2.8 million, or $(0.11) per diluted share, compared to a net loss of $1.8 million, or $(0.07) per diluted share, in the second quarter of 2016. Net income in the third quarter of 2015 was $0.4 million, or $0.02 per diluted share. The third quarter 2016 results were impacted by $1.6 million in one-time costs and charges, consisting of a $1.0 million charge for an amendment to potential supplemental purchase price payments under the MediaMiser share purchase agreement, $220,000 in costs associated with an internal investigation by the Company's audit committee that was reported by the Company in its Form 10-Q for the second quarter, and $360,000 in costs associated with the reorganization and integration of Agility within the Company's Media Intelligence Solutions segment. Third quarter revenue was benefited by $240,000 of one-time revenue that relates to the acquisition of Agility.

- For the first nine months of 2016, total revenue was $47.4 million, an increase of 10% from $43.0 million in the first nine months of 2015. Net loss was $4.5 million, or $(0.18) per diluted share, in the first nine months of 2016, compared to a net loss of $2.2 million, or $(0.09) per diluted share, for the same period in 2015.

- Adjusted EBITDA (as defined below) was $(0.4) million in the third quarter of 2016, compared to $(0.7) million in the second quarter of 2016. Adjusted EBITDA was $1.7 million in the third quarter of 2015.

- Cash, cash equivalents and investments were $17.3 million at September 30, 2016 compared to $24.9 million at December 31, 2015. Cash used in the third quarter includes $4.1 million paid for the acquisition of Agility.

Jack Abuhoff, Chairman and CEO, said, "Revenue for our Digital Data Solutions (formerly Content Services) segment was $12.1 million compared to $13.2 million in the second quarter, primarily as a result of a key client for our eBook services reducing its requirements for certain eBook services and pricing concessions extended to another key client. In our IADS Synodex business, we commenced production for an additional insurance company. Revenue for the entire segment was $1 million compared to $1,170,000 last quarter primarily on account of a $160,000 decrease in docGenix revenue. Revenue in our Media Intelligence Solutions (MIS) segment was $3 million in the third quarter, of which $1.8 million is attributable to Agility.

"We achieved our targeted 10% Adjusted EBITDA this quarter in MIS before considering one-time integration and restructuring costs, and are combining the Agility and MediaMiser businesses in order to compete in the estimated $1 billion combined market for media contact management and media monitoring solutions. Except for $240,000 of revenue that relates to the acquisition of Agiity, we regard almost all of the revenue in our MIS business as recurring. In this quarter we regard approximately 80% of our total revenue as recurring."

Abuhoff concluded, "We anticipate third quarter revenue to be in the range of $14.7 - $15.8 million, consisting of DDS revenue in the range of $11.3 - $12.0 million, IADS revenue in the range of $1.0 - $1.2 million and MIS revenue in the range of $2.4 - $2.6 million."

Non-GAAP Financial Measures

This press release and the accompanying tables include references to Adjusted EBITDA, which is a non-GAAP financial measure. We define Adjusted EBITDA as net income (loss) attributable to Innodata Inc. and subsidiaries in accordance with GAAP before income taxes, depreciation, amortization of intangible assets, changes in fair value of contingent consideration, stock-based compensation, loss attributable to non-controlling interests and interest income (expense). We believe Adjusted EBITDA is useful to our management and investors in evaluating our operating performance and for financial and operational decision-making purposes. In particular, it facilitates comparisons of the core operating performance of our company from period to period on a consistent basis and helps us identify underlying trends in our business. We believe it provides useful information about our operating results, enhances the overall understanding of our past performance and future prospects, and allows for greater transparency with respect to key metrics used by management in our financial and operational decision making. We use this measure to establish operational goals for managing our business and evaluating our performance.

Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for results reported under GAAP. Some of these limitations are:

- Adjusted EBITDA does not reflect tax payments, and such payments reflect a reduction in cash available to us;

- Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs or for our cash expenditures or future requirements for capital expenditures or contractual commitments;

- Adjusted EBITDA excludes the potential dilutive impact of stock-based compensation expense related to our workforce, interest income (expense) and net loss attributable to non-controlling interests, and these items may represent a reduction or increase in cash available to us;

- Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; and

- Other companies, including companies in our own industry, may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, Adjusted EBITDA should be considered alongside other financial performance measures, including various cash flow metrics, net income (loss) and our other GAAP results.

A reconciliation from net loss to Adjusted EBITDA is attached to this release.

Timing of Conference Call with Q&A

Innodata will conduct an earnings conference call, including a question-and-answer period, at 11:00 AM eastern time today. You can participate in this call by dialing the following call-in numbers:

The call-in numbers for the conference call are:

1-800-894-5910 (Domestic)

1-785-424-1052 (International)

1-888-203-1112 (Domestic Replay)

1-719-457-0820 (International Replay)

Pass code on both: 6808319

Investors are also invited to access a live Webcast of the conference call at the Investor Relations section of www.innodata.com. Please note that the Webcast feature will be in listen-only mode.

Call-in or Webcast replay will be available for 30 days following the conference call.

About Innodata

Innodata (NASDAQ: INOD) is a global digital services and solutions company. Innodata's technology and services power leading information products and online retail destinations around the world. Innodata's solutions help prestigious enterprises harness the power of digital data to re-imagine how they operate and drive performance. Innodata serves publishers, media and information companies, digital retailers, banks, insurance companies, government agencies and many other industries.

Founded in 1988, Innodata comprises a team of 5,000 diverse people in 8 countries who are dedicated to delivering services and solutions that help the world's businesses make better decisions.

Recent Innodata honors include EContent Magazine's EContent 100, KMWorld Magazine's 100 Companies That Matter in Knowledge Management, the International Association of Outsourcing Professionals' (IAOP) Global Outsourcing Top 100, D&B India's Leading ITeS and BPO Companies and the Black Book of Outsourcing's Top List of Leading Outsourcing Providers to the Printing and Publishing Business.

Forward Looking Statement

This release contains forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words "project," "head start," "believe," "expect," "should," "anticipate," "indicate," "point to," "forecast," "likely," "goals," "optimistic," "foster" and other similar expressions generally identify forward-looking statements, which speak only as of their dates.

These forward-looking statements are based largely on our current expectations and are subject to a number of risks and uncertainties, including without limitation, that contracts may be terminated by clients; projected or committed volumes of work may not materialize; our Innodata Advanced Data Solutions ("IADS") segment is a venture formed in 2011 that has incurred losses since inception and has recorded impairment charges for all of its fixed assets; we currently intend to continue to invest in IADS; the primarily at-will nature of contracts with our Digital Data Solutions clients and the ability of these clients to reduce, delay or cancel projects; continuing Digital Data Solutions segment revenue concentration in a limited number of clients; continuing Digital Data Solutions segment reliance on project-based work; inability to replace projects that are completed, canceled or reduced; difficulty in integrating and deriving synergies from acquisitions, joint venture and strategic investments; potential undiscovered liabilities of companies and businesses that we may acquire; depressed market conditions; changes in external market factors; the ability and willingness of our clients and prospective clients to execute business plans which give rise to requirements for our services; changes in our business or growth strategy; the emergence of new or growing competitors; various other competitive and technological factors; and other risks and uncertainties indicated from time to time in our filings with the Securities and Exchange Commission.

Our actual results could differ materially from the results referred to in the forward-looking statements. In light of these risks and uncertainties, there can be no assurance that the results referred to in the forward-looking statements will occur.

We undertake no obligation to update or review any guidance or other forward-looking information, whether as a result of new information, future developments or otherwise.

Company Contact

Raj Jain

Vice President

Innodata Inc.

rjain@innodata.com

(201) 371-8024

INNODATA INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE LOSS

(Unaudited)

(In thousands, except per-share amounts)

| Three Months Ended | Nine Months Ended | |||||||

| September 30, | September 30, | |||||||

| 2016 | 2015 | 2016 | 2015 | |||||

| Revenues | $ 16,060 | $ 15,135 | $ 47,400 | $ 43,000 | ||||

| Operating costs and expenses: | ||||||||

| Direct operating costs | 12,422 | 10,452 | 35,572 | 32,567 | ||||

| Selling and administrative expenses | 5,105 | 3,941 | 14,469 | 12,354 | ||||

| Change in fair value of contingent consideration | 1,038 | | 1,038 | | ||||

| Interest expense (income), net | 15 | 6 | 44 | (39) | ||||

| Totals | 18,580 | 14,399 | 51,123 | 44,882 | ||||

| Income (loss) before income taxes | (2,520) | 736 | (3,723) | (1,882) | ||||

| Provision for income taxes | 352 | 462 | 1,128 | 763 | ||||

| Net income (loss) | (2,872) | 274 | (4,851) | (2,645) | ||||

| Loss attributable to non-controlling interests | 106 | 132 | 310 | 412 | ||||

| Net income (loss) attributable to Innodata Inc. and Subsidiaries | $ (2,766) | $ 406 | $ (4,541) | $ (2,233) | ||||

| Income (loss) per share attributable to Innodata Inc. and Subsidiaries: | ||||||||

| Basic and Diluted | $ (0.11) | $ 0.02 | $ (0.18) | $ (0.09) | ||||

| Weighted average shares outstanding: | ||||||||

| Basic and Diluted | 25,651 | 25,455 | 25,514 | 25,377 | ||||

| Comprehensive loss: | ||||||||

| Net income (loss) | $ (2,872) | $ 274 | $ (4,851) | $ (2,645) | ||||

| Pension liability adjustment, net of taxes | (83) | 10 | (247) | 30 | ||||

| Change in fair values of derivatives, net of taxes | (39) | (426) | 207 | 57 | ||||

| Foreign currency translation adjustment, net of taxes | (118) | (393) | 246 | (813) | ||||

| Other Comprehensive income (loss) | (240) | (809) | 206 | (726) | ||||

| Total Comprehensive loss | (3,112) | (535) | (4,645) | (3,371) | ||||

| Comprehensive loss attributed to non-controlling interest | 106 | 132 | 310 | 412 | ||||

| Comprehensive loss attributable to Innodata Inc. and Subsidiaries | $ (3,006) | $ (403) | $ (4,335) | $ (2,959) | ||||

| Supplemental Financial Data: | |||||||

| Adjusted EBITDA | $ (384) | $ 1,660 | $ 288 | $ 992 |

INNODATA INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(Dollars in thousands)

| September 30, | December 31, | |||

| 2016 | 2015 | |||

| ASSETS | ||||

| Current assets: | ||||

| Cash and cash equivalents | $ 17,277 | $ 24,908 | ||

| Accounts receivable, net | 9,695 | 9,249 | ||

| Prepaid expenses and other current assets | 3,081 | 2,900 | ||

| Deferred income taxes | 418 | 282 | ||

| Total current assets | 30,471 | 37,339 | ||

| Property and equipment, net | 5,384 | 4,723 | ||

| Other assets | 2,349 | 2,330 | ||

| Deferred income taxes | 1,379 | 1,382 | ||

| Intangibles, net | 8,582 | 3,987 | ||

| Goodwill | 2,748 | 1,476 | ||

| Total assets | $ 50,913 | $ 51,237 | ||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||

| Current liabilities: | ||||

| Accounts payable and accrued expenses | $ 6,248 | $ 4,562 | ||

| Accrued salaries, wages and related benefits | 5,955 | 4,905 | ||

| Income and other taxes | 1,320 | 1,255 | ||

| Current portion of long term obligations | 1,421 | 1,582 | ||

| Deferred income taxes | | 76 | ||

| Total current liabilities | 14,944 | 12,380 | ||

| Deferred income taxes | 701 | 716 | ||

| Long term obligations | 4,045 | 3,436 | ||

| Non-controlling interests | (3,557) | (3,507) | ||

| STOCKHOLDERS' EQUITY: | 34,780 | 38,212 | ||

| Total liabilities and stockholders' equity | $ 50,913 | $ 51,237 | ||

INNODATA INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Unaudited)

(Dollars in thousands)

| Adjusted EBITDA | ||||||||

| Three Months Ended | Nine Months Ended | |||||||

| September 30, | September 30, | |||||||

| 2016 | 2015 | 2016 | 2015 | |||||

| Net income (loss) attributable to Innodata Inc. and Subsidiaries | $ (2,766) | $ 406 | $ (4,541) | $ (2,233) | ||||

| Depreciation and amortization | 876 | 677 | 2,200 | 2,113 | ||||

| Stock-based compensation | 207 | 241 | 729 | 800 | ||||

| Provision for income taxes | 352 | 462 | 1,128 | 763 | ||||

| Change in fair value of contingent consideration | 1,038 | - | 1,038 | - | ||||

| Interest expense (income), net | 15 | 6 | 44 | (39) | ||||

| Non-controlling interests | (106) | (132) | (310) | (412) | ||||

| Adjusted EBITDA | $ (384) | $ 1,660 | $ 288 | $ 992 | ||||

| Adjusted EBITDA (by segment) | ||||||||

| Three Months Ended | Nine Months Ended | |||||||

| September 30, | September 30, | |||||||

| 2016 | 2015 | 2016 | 2015 | |||||

| Digital Data Solutions | $ (40) | $ 2,675 | $ 2,461 | $ 4,196 | ||||

| IADS | (551) | (856) | (1,610) | (2,759) | ||||

| MIS | 207 | (159) | (563) | (445) | ||||

| Adjusted EBITDA | $ (384) | $ 1,660 | $ 288 | $ 992 | ||||

The issuer of this announcement warrants that they are solely responsible for the content, accuracy and originality of the information contained therein.

Source: Innodata Inc. via Globenewswire

Mehr Nachrichten zur Innodata Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.