Huntington Bank Reports Record Loan Volume As Nation's Second Largest SBA Lender For Third Consecutive Year

PR Newswire

COLUMBUS, Ohio, Oct. 5, 2017

COLUMBUS, Ohio, Oct. 5, 2017 /PRNewswire/ -- Huntington Bank is the nation's second largest originator of Small Business Administration (SBA) 7(a) loans during SBA fiscal year 2017, maintaining its ranking for total 7(a) loans nationwide, and ranking as the top 7(a) lender for total loans and dollars lent within its eight-state core footprint. Huntington has ranked as a top-three national SBA 7(a) lender since 2011 and the premier 7(a) lender in its core footprint since 2008.

In a concentrated effort to expand SBA lending and deepen customer relationships across all markets over fiscal year 2017, Huntington increased dollars lent by 25 percent to its highest ever loan volume of $793.6 million via 4,065 7(a) loans. This included establishing a strong foothold in Illinois and Wisconsin with marked increases of $48 million and $32 million, respectively.

"Small businesses continued to grow and thrive across the greater Midwest during fiscal year 2017 with SBA loans as a smart strategic advantage," said Huntington Business Banking Director Michael Wamsganz. "An overwhelming number of businesses can benefit from SBA loans, and we continue to find new and better ways to help owners capitalize on the program to grow their businesses."

Huntington's SBA lending for business acquisitions trended up for the second consecutive year, totaling $302 million for a 21 percent increase over fiscal year 2016.

"We continued to see a large percentage of Baby Boomers finding SBA loans a smart move for help in passing along their businesses to the next generation," said Maggie Ference, SBA Group Manager at Huntington.

Huntington now employs 35 SBA sales and leadership colleagues across its footprint, with an emphasis on building lending relationships. The number of businesses Huntington's SBA lending helped in each state during fiscal year 2017 includes:

- Ohio: 1,946 loans totaling $ 347.5 million

- Michigan: 1,158 loans totaling $ 174.9 million

- Indiana: 298 loans totaling $ 69.7 million

- Illinois: 156 loans totaling $ 53.8 million

- Western Pennsylvania: 219 loans totaling $44.2 million

- Wisconsin: 74 loans totaling $34 million

- Florida: 61 loans totaling $24.2 million

- Kentucky: 83 loans totaling $22.2 million

- West Virginia: 57 loans totaling $7.7 million

The SBA 7(a) lending program provides government backing, enabling small business lenders to extend credit to business owners who are not yet able to access conventional bank financing with reduced lender risk. For more information, visit www.huntington.com/SmallBusiness/loans/sba-guarantee-business-loans.

About Huntington

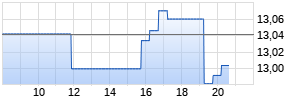

Huntington Bancshares Incorporated (NASDAQ: HBAN) is a regional bank holding company headquartered in Columbus, Ohio, with $101 billion of assets and a network of 996 branches and 1,860 ATMs across eight Midwestern states. Founded in 1866, The Huntington National Bank and its affiliates provide consumer, small business, commercial, treasury management, wealth management, brokerage, trust, and insurance services. Huntington also provides auto dealer, equipment finance, national settlement and capital market services that extend beyond its core states. Visit huntington.com for more information.

View original content with multimedia:http://www.prnewswire.com/news-releases/huntington-bank-reports-record-loan-volume-as-nations-second-largest-sba-lender-for-third-consecutive-year-300532076.html

SOURCE Huntington Bank

Mehr Nachrichten zur Huntington Bancshares Inc. Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.