Great Basin Gold Provides Update

PR Newswire

VANCOUVER, Dec. 24, 2012

VANCOUVER, Dec. 24, 2012 /PRNewswire/ - Great Basin Gold Ltd. ("Great Basin Gold" or the "Company") initiated creditor protection proceedings under CCAA in Canada in September 2012 and provides this general situation update. Under the CCAA proceedings, the stay of any potential creditor lawsuits was extended until January 14, 2013. As previously announced, the Company's executive officers are now provided by a professional restructuring services firm which was appointed by agreement with the bank lenders who are the Company's principal creditors.

The third fiscal quarter's management's discussion and analysis ("MD&A") filed November 14, 2012 at www.sedar.com discloses that the Company will require additional funding by mid-January 2013 in order to allow the planned sales and/or recapitalization process for its two principal mining projects (Hollister in Nevada, Burnstone in South Africa). While discussions with the lenders about securing additional funding are ongoing, no assurances can be given that the required funding will be obtained. The third quarter MD&A also stated that reviews of the lowered Hollister reserve and resource estimates were also ongoing (the Company recognizes reserves at Hollister for Canadian but not US purposes). Based on ongoing analyses, in-house staff now estimates a further reduction in Hollister resources and reserves is appropriate which implies a 3 year mine life based on the current reserve estimate at current production rates versus the 6 years previously estimated. Engineering and geological staff believe this life could potentially be extended by further developmental drilling which the Company has not been in a position to fund. The Company has initiated preparation of a NI 43-101 technical report to be filed within 45 days which will provide data and analyses to support these tentative conclusions and to serve as a basis to determine if an impairment charge from the approximately $90 million carrying value of Hollister is now warranted.

The revised mineral resource estimates reflect changes in geological modeling adopted for the purposes of stringent grade control for the mineral reserve estimation process based on trial mining experience. The mineral resources are comprised of epithermal vein and disseminated Tertiary mineralization. At a 0.15 gold ounce per ton ("opt") cutoff grade Measured and Indicated Resources have been reduced to 545,000 gold equivalent ounces1 ("Au eqv oz") in 0.49 Mt grading 0.918 opt Au and 5.7 opt Ag. The estimate also includes 254,000 Au eqv oz in Inferred Mineral Resources. Re-estimated Proven and Probable Mineral Reserves total 187,000 Au eqv oz in 0.29 Mt grading 0.590 opt Au and 2.7 opt Ag2. Additional detail is shown in the tables appended to this release.

A limited underground drilling program that has continued over the past 18 months has focused on increasing confidence in the estimates of mineral resources and reserves to allow for improved mine planning and forecasting. The outcome of this drilling has been a considerable tightening up of the geological vein modeling, which resulted in a higher-grade lower-tonnage resource model being used for the purposes of mine planning and mineral reserve estimation. Critical to the sustainability of the project will be the funding and completion of underground development necessary to access the mineral resources and reserves, with the objective of extending the current 3-year life of the project. Future work should include phases of surface drilling to test targets peripheral to the current underground infrastructure. The revised mineral resources and reserves also reflect depletion from trial mining in excess of 370,000 tons which yielded approximately 400,000 Au eqv oz since commencement in 2008.

There has been a downgrading in the estimate of reserves primarily because of the lower volume vein resource model used and the exclusion of reserves previously estimated for the Tertiary material. The Tertiary mineralization occurs in broad pod-like zones of low-grade gold concentration that are generally developed around very high-grade, narrow structures that are sometimes linked to underlying epithermal veins. There is a need for continued underground development and drilling before reserve status can be assigned to this material. The trial mining operation continues to extract ore from zones of the Tertiary mineralization as there is a very significant upside mineralized component to these areas. During 2012, trial mining of a number of Tertiary zones has realized 12,915 Au eqv oz from 13,200 tons grading 0.897 opt Au and 3.747 opt Ag. It is believed that considerable upside exists through further refinement and development of the Tertiary material through a combination of maximizing access and stoping options from the trackless infrastructure afforded by the spiral ramp, and optimization of pillar/backfill designs to maximize profitable extraction.

The epithermal vein mineral resource and reserve estimates were completed by Hollister staff and reviewed by specialists at Deswik Mining Consultants PTY Ltd, an international consulting firm based in South Africa. The Tertiary mineral resource estimate was completed by Deswik. The work was done under the supervision of Phil Bentley, Pr.Sci.Nat., Great Basin Gold's Vice President: Geology & Exploration and Dana Roets, FSAIMM, Great Basin Gold's Chief Operating Officer, both of whom are Qualified Persons as defined by Canadian National Instrument 43-101 (Disclosure Standards for Mineral Projects), both of whom have reviewed and approved the technical information in this news release.

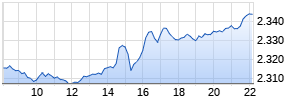

Great Basin Gold (NYSE MKT: GBG, JSE: GBG) is applying to voluntarily delist its common shares from the JSE and NYSE MKT effective immediately. Notwithstanding that the Company will apply to delist its securities, it will continue to comply with its continuous disclosure obligations.

Information Concerning Estimates of Measured, Indicated and Inferred Resources

This news release also uses the terms "measured resources", "indicated resources" and "inferred resources". The Company advises investors that although these terms are recognized and required by Canadian regulations (under National Instrument 43-101 Standards of Disclosure for Mineral Projects), the U.S. Securities and Exchange Commission does not recognize them. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into SEC-recognised reserves. Similarly proved and probable reserves which may be recognized under Canadian standards may not be recognized as such under SEC standards.

Cautionary and Forward Looking Statement Information

This document contains "forward-looking statements" that were based on Great Basin's expectations, estimates and projections as of the dates as of which those statements were made. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "outlook", "anticipate", "project", "target", "believe", "estimate", "expect", "intend", "should" and similar expressions. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the Company's actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. These include but are not limited to:

- uncertainties related to the Company's liquidity challenges and need for near term financing

- uncertainties and costs related to the Company's exploration and development activities, such as those associated with determining whether mineral resources or reserves exist on a property;

- uncertainties related to feasibility studies that provide estimates of expected or anticipated costs, expenditures and economic returns from a mining project; uncertainties related to expected production rates, timing of production and the cash and total costs of production and milling;

- uncertainties related to the ability to obtain necessary licenses, permits, electricity, surface rights and title for development projects;

- operating and technical difficulties in connection with mining development activities;

- uncertainties related to the accuracy of our mineral reserve and mineral resource estimates and our estimates of future production and future cash and total costs of production, and the geotechnical or hydrogeological nature of ore deposits, and diminishing quantities or grades of mineral reserves;

- uncertainties related to unexpected judicial or regulatory proceedings;

- changes in, and the effects of, the laws, regulations and government policies affecting our mining operations, particularly laws, regulations and policies relating to

- mine expansions, environmental protection and associated compliance costs arising from exploration, mine development, mine operations and mine closures;

- expected effective future tax rates in jurisdictions in which our operations are located;

- the protection of the health and safety of mine workers; and

- mineral rights ownership in countries where our mineral deposits are located, including the effect of the Mineral and Petroleum Resources Development Act (South Africa);

- changes in general economic conditions, the financial markets and in the demand and market price for gold, silver and other minerals and commodities, such as diesel fuel, coal, petroleum coke, steel, concrete, electricity and other forms of energy, mining equipment, and fluctuations in exchange rates, particularly with respect to the value of the U.S. dollar, Canadian dollar and South African rand;

- unusual or unexpected formation, cave-ins, flooding, pressures, and precious metals losses (and the risk of inadequate insurance or inability to obtain insurance to cover these risks);

- changes in accounting policies and methods we use to report our financial condition, including uncertainties associated with critical accounting assumptions and estimates;

- environmental issues and liabilities associated with mining including processing and stock piling ore;

- geopolitical uncertainty and political and economic instability in countries which we operate; and

- labour strikes, work stoppages, or other interruptions to, or difficulties in, the employment of labour in markets in which we operate mines, or environmental hazards, industrial accidents or other events or occurrences, including third party interference that interrupt the production of minerals in our mines.

For further information on Great Basin Gold, investors should review the Company's annual Form 40-F filing with the United States Securities and Exchange Commission www.sec.gov and home jurisdiction filings that are available at www.sedar.com.

Mineral Resources

| Classification | Cut-Off opt | Tonnes (000) | Tons (000) | Au opt | Au g/t | Ag opt | Ag g/t | Au Oz (000) | Ag Oz (000) | Au Eqv Oz (000) |

| Measured Indicated | 0.15 0.15 | 166 280 | 183 308 | 1.119 0.914 | 38.37 31.33 | 6.8 4.9 | 234 167 | 205 282 | 1,248 1,500 | 231 314 |

| Measured & Indicated | 0.15 | 446 | 491 | 0.990 | 33.95 | 5.6 | 192 | 487 | 2,748 | 545 |

| Inferred | 0.15 | 433 | 477 | 0.489 | 16.76 | 2.0 | 69 | 233 | 954 | 254 |

Notes:

1 Gold equivalent ounces (Au eqv oz) were calculated by using the following metal prices: US$1400/oz for Au and US$30/oz for Ag. Metallurgical recoveries are not applied to resource values; contained metal estimates assume 100% recoveries.

2 Parameters for Measured = 50 feet (1/2 range), minimum number of informing samples 12; Indicated = 100 feet (1 x range), minimum number of informing samples 8; Inferred = 750 feet (7.5 x range), minimum number of informing samples 4.

3 Mineral resources that are not mineral reserves do not have demonstrated economic viability.

5 Effective date June 2012; depleted to September 30 2012.

Mineral Reserves

| Classification | Cut-off (oz/t) | Tonnes (000) | Tons (000) | Au opt | Au g/t | Au oz (000) | Ag (oz/t) | Ag (g/t) | Ag oz (000) | Au Eqv Oz (000) |

| Proven Probable | 0.25 0.25 | 101 161 | 111 178 | 0.602 0.582 | 20.62 19.97 | 67 104 | 2.7 2.7 | 91 94 | 296 488 | 73 114 |

| Proven & Probable | 0.25 | 262 | 289 | 0.590 | 20.22 | 170 | 2.7 | 93 | 785 | 187 |

Notes:

1 Mineral reserves are fully diluted, and grades adjusted for metallurgical recoveries of Au (92%) and Ag (75%).

2 Metal prices of US$1,400 Au and US$30 Ag have been applied.

3 The mineral reserves are included in the mineral resources above.

4 Effective date June 2012; depleted to September 30 2012.

_____________________________

1 Au eqv oz is calculated by using the following metal prices: US$1400/oz for Au and US$30/oz for Ag. Metallurgical recoveries are not applied to resource values; contained metal estimates assume 100% recoveries.

2 Mineral reserves are fully diluted, and grades adjusted for metallurgical recoveries of Au (92%) and Ag (75%) and stated at a 0.25 opt cut-off grade. The cut-off is based on an analysis of fully-diluted pay limit (breakeven) grades which incorporate a gold and silver price of US$1400/oz and US$30/oz, respectively, and estimated costs for mining, ore transport, milling, and royalties.

SOURCE Great Basin Gold Ltd.

Mehr Nachrichten zum Gold-Preis kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.