Gray Reports Record Operating Results

PR Newswire

ATLANTA, Aug. 8, 2017

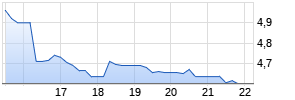

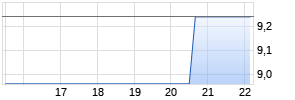

ATLANTA, Aug. 8, 2017 /PRNewswire/ -- Gray Television, Inc. ("Gray," "we," "us" or "our") (NYSE: GTN and GTN.A) today announces record-setting results of operations for the period ended June 30, 2017, including record revenue, record net income and record Broadcast Cash Flow.

We experienced accelerating market trends throughout the second quarter of 2017. As a result, our operating revenue and political advertising revenue significantly exceeded the high end of the guidance ranges that we had provided for this period. We also succeeded in recording broadcast and corporate and administrative expenses below the low end of our guidance. This performance, plus the gain on disposal of two licenses through our participation in the FCC reverse auction for broadcast spectrum produced fully diluted net income per share of $0.97 in the second quarter of 2017.

Looking forward, on a Combined Historical Basis, we anticipate that aggregate local and national advertising revenue, excluding approximately $8.2 million of advertising revenue attributable to the broadcast of the 2016 Summer Olympics, will increase in the low to mid-single digit percentage range in the third quarter of 2017 compared to the third quarter of 2016.

Financial Highlights:

- Record Revenue - The following table presents certain of our record results on an As-Reported and Combined Historical Basis for the second quarter of 2017 and the respective percentage change from the second quarter of 2016 (dollars in millions):

| | | | | | | | | |

| | | | | | | | | |

| | | Three Months Ended June 30, 2017 | ||||||

| | | | | % | | Combined | | % |

| | | As-Reported | | Change | | Historical | | Change |

| Revenue (less agency commissions): | | | ||||||

| Local (including internet/digital/mobile) | | $ 117.9 | | 13 % | | $ 119.8 | | 0 % |

| National | | 31.0 | | 19 % | | 31.9 | | 2 % |

| Political | | 3.7 | | (62)% | | 3.7 | | (67)% |

| Retransmission consent | | 69.4 | | 37 % | | 69.9 | | 25 % |

| Other | | 4.7 | | (17)% | | 4.0 | | 1 % |

| Total | | $ 226.7 | | 15 % | | $ 229.3 | | 3 % |

- Record Net Income, Broadcast Cash Flow and Free Cash Flow - Our net income was $70.6 million for the second quarter of 2017. Our Broadcast Cash Flow was $93.2 million for the second quarter of 2017 ($94.0 million on a Combined Historical Basis). Our Free Cash Flow was $55.9 million for the second quarter of 2017 ($57.2 million on a Combined Historical Basis).

- Total Leverage Ratio - As of June 30, 2017, our Total Leverage Ratio, Net of all Cash (as defined below) was 5.41 times on a trailing eight-quarter basis. On August 7, 2017 we received approximately $90.8 million in proceeds from the reverse auction for broadcast spectrum (the "FCC Spectrum Auction") that was conducted by the Federal Communications Commission ("FCC"). Adjusting for the subsequent receipt of the FCC Spectrum Auction proceeds, as of June 30, 2017 our Total Leverage Ratio, Net of all Cash and Net of Auction Proceeds was 5.14 times on a trailing eight-quarter basis.

Other Highlights and Recent Developments:

- On May 1, 2017, we completed the acquisition of television stations WDTV-TV (CBS) and WVFX-TV (FOX/CW), a legal duopoly in the Clarksburg-Weston, West Virginia market (DMA 169) (the "Clarksburg Acquisition") for $26.5 million. We had operated these stations under a local marketing agreement ("LMA") since June 1, 2016, and the LMA expired upon completion of the acquisition.

- On May 1, 2017, we completed the acquisition of television stations WABI-TV (CBS/CW) in the Bangor, Maine market (DMA 156) and WCJB-TV (ABC/CW) in the Gainesville, Florida market (DMA 161) (collectively, the "Diversified Acquisition") for $85.0 million. We had operated these stations under an LMA since April 1, 2017, and the LMA expired upon completion of the acquisition.

- On May 4, 2017, we announced that we entered into an agreement to acquire WCAX-TV (CBS) in the Burlington, Vermont - Plattsburgh, New York market (DMA 97) for $29.0 million (the "Vermont Acquisition"). We completed the acquisition on August 1, 2017. We had operated this station under an LMA since June 1, 2017, and the LMA expired upon completion of the acquisition.

Effects of Acquisitions and Divestitures on Our Results of Operations

From October 31, 2013 through June 30, 2017, we completed 23 acquisition transactions and three divestiture transactions. As more fully described in our Form 10-Q to be filed with the Securities and Exchange Commission today and in our prior disclosures, these transactions added a net total of 50 television stations in 30 television markets, including 25 new television markets, to our operations.

We refer to the seven stations acquired (excluding the stations acquired in the Clarksburg Acquisition) during the first six-months of 2017 and the stations we commenced operating under an LMA during that period as the "2017 Acquisitions." We refer to the 13 stations acquired in 2016, and that we retained in those transactions, as well as the stations in the Clarksburg Acquisition that we commenced operating under an LMA on June 1, 2016, as the "2016 Acquisitions." During 2015, we completed six acquisitions, which collectively added seven television stations in six markets (four new markets) to our operations, and we refer to those stations as the "2015 Acquisitions." Unless the context of the following discussion requires otherwise, we refer to the stations acquired in the 2017 Acquisitions, the 2016 Acquisitions and the 2015 Acquisitions, collectively, as the "Acquired Stations."

Due to the significant effect that our acquisitions and divestitures have had on our results of operations, and in order to provide more meaningful period over period comparisons, we present herein certain financial information on a "Combined Historical Basis." Unless otherwise defined, Combined Historical Basis reflects financial results that have been compiled by adding Gray's historical revenue and broadcast expenses to the historical revenue and broadcast expenses of the Acquired Stations and removing the historical revenues and historical broadcast expenses of divested stations as if they had been acquired or divested, respectively, on January 1, 2015 (the beginning of the earliest period presented). In addition, our Combined Historical Basis non-GAAP terms "Broadcast Cash Flow," "Broadcast Cash Flow Less Cash Corporate Expenses," "Operating Cash Flow as Defined in our 2017 Senior Credit Facility," "Free Cash Flow" and "Total Leverage Ratio, Net of All Cash" give effect to the financings related to the acquisition of the Acquired Stations as if these financings occurred on January 1, 2015, and certain anticipated net expense savings resulting from the completed acquisitions. Free Cash Flow presented on a Combined Historical Basis also includes adjustments for the purchase of property and equipment and income taxes paid, net of refunds, as if the acquisition of the Acquired Stations occurred on January 1, 2015. Combined Historical Basis financial information does not reflect all purchase accounting and other adjustments required, and includes certain other amounts not included, in pro forma financial statements prepared in accordance with Regulation S-X.

| Selected Operating Data on As-Reported Basis (unaudited): | | | | | | | |||

| | | | | | | | | | |

| | Three Months Ended June 30, | ||||||||

| | | | | | % Change | | | | % Change |

| | | | | | 2017 to | | | | 2017 to |

| | 2017 | | 2016 | | 2016 | | 2015 | | 2015 |

| | (dollars in thousands) | ||||||||

| Revenue (less agency commissions): | | | | | | | | | |

| Total | $ 226,681 | | $ 196,633 | | 15 % | | $ 143,464 | | 58 % |

| Political | $ 3,708 | | $ 9,649 | | (62)% | | $ 2,197 | | 69 % |

| | | | | | | | | | |

| Operating expenses (1): | | | | | | | | | |

| Broadcast | $ 133,545 | | $ 117,335 | | 14 % | | $ 86,445 | | 54 % |

| Corporate and administrative | $ 8,409 | | $ 8,524 | | (1)% | | $ 6,444 | | 30 % |

| | | | | | | | | | |

| Net income | $ 70,561 | | $ 17,662 | | 300 % | | $ 12,110 | | 483 % |

| | | | | | | | | | |

| Non-GAAP cash flow (2): | | | | | | | | | |

| Broadcast Cash Flow Werbung Mehr Nachrichten zur Gray Television A Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||||