Golar LNG Limited Preliminary Fourth Quarter and Financial Year 2016 Results

Highlights

- Net income improved from a loss of $23.9 million in 3Q to a loss of $13.7 million in 4Q. EBITDA* and Operating Loss in the quarter reported a loss of $15.9 million and $32.7 million respectively compared to a 3Q loss of $11.3 million and $28.3 million.

- Ophir and OneLNG agreed to form a joint venture to commercialise the 2.6Tcf Fortuna reserves in Equatorial Guinea using FLNG technology.

- Golar Power reached a Final Investment Decision ("FID") on its Sergipe power project, signed a 25-year FSRU agreement and entered into a long-term sale and purchase agreement for the supply of LNG.

- The Incentive Distribution Rights ("IDRs") in Golar LNG Partners ("Golar Partners" or "the Partnership") were reset. Golar LNG received 3.8 million new units including earn-out units as consideration.

- Raised $170 million net of fees in new equity through the issue of 7.5 million new shares and received commitment for a $150 million margin loan. March 2017 maturing convertible bond fully funded.

Subsequent Events

- Fortuna joint venture secures signed financing term-sheet and makes substantial progress toward obtaining necessary governmental approvals.

- Issued a $402.5 million 2.75% 5-year unsecured convertible bond with a capped call that gives an effective conversion price of $48.86.

Financial Review

Business Performance

| 2016 | 2016 | |||

| (in thousands of $) | Oct-Dec | Jul-Sep | ||

| Total operating revenues | 23,063 | 22,267 | ||

| Vessel operating expenses | (11,424 | ) | (12,102 | ) |

| Voyage, charterhire & commission expenses | (7,918 | ) | (8,031 | ) |

| Voyage, charterhire & commission expenses - collaborative arrangements | (4,715 | ) | (3,621 | ) |

| Administrative expenses | (14,887 | ) | (9,808 | ) |

| EBITDA* | (15,881 | ) | (11,295 | ) |

| Depreciation and amortization | (16,826 | ) | (16,997 | ) |

| Operating loss | (32,707 | ) | (28,292 | ) |

* EBITDA is defined as operating loss before interest, tax, depreciation and amortization. EBITDA is a non-GAAP financial measure. A non-GAAP financial measure is generally defined by the Securities and Exchange Commission as one that purports to measure historical or future financial performance, financial position or cash flows, but excludes or includes amounts that would not be so adjusted in the most comparable U.S. GAAP measure. We have presented EBITDA as we believe it provides useful information to investors because it is a basis upon which we measure our operations and efficiency. EBITDA is not a measure of our financial performance under U.S. GAAP and should not be construed as an alternative to net income (loss) or other financial measures presented in accordance with U.S. GAAP.

Golar reports today a 4Q 2016 operating loss of $32.7 million as compared to a 3Q loss of $28.3 million. As stated in the 3Q report, the observed improvements in shipping rates and activity levels during the final weeks of 4Q will not translate into improved net revenues until 1Q 2017. Utilisation and voyage expenses during 4Q remained relatively stable at 39% and $12.6 million respectively (versus 37% and $11.7 million in 3Q). Included in voyage, charter-hire and commission expenses is $4.9 million in respect of the cost of chartering the Golar Grand from Golar Partners.

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Golar LNG | ||

|

MB81BU

| Ask: 0,60 | Hebel: 7,88 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

Vessel operating expenses decreased a further $0.7 million to $11.4 million in 4Q following settlement of a 2014 insurance claim in respect of the Golar Viking. Administration costs on the other hand reflected a $5.1 million increase over 3Q to $14.9 million in 4Q. Increases in non-cash share option charges following the awards made in November 2016 and project costs due to increased project development activity make up the majority of the movement from 3Q. Depreciation and amortisation at $16.8 million is in line with 3Q.

Relative to 3Q the above resulted in a $4.6 million increase in EBITDA* losses from a loss of $11.3 million in 3Q to a loss of $15.9 million in 4Q and a $4.4 million increase in operating losses from a loss of $28.3 million in 3Q to a loss of $32.7 million in 4Q.

Net Income Summary

| 2016 | 2016 | |||

| (in thousands of $) | Oct-Dec | Jul-Sep | ||

| Operating loss | (32,707 | ) | (28,292 | ) |

| Interest income | 528 | 436 | ||

| Interest expense | (15,455 | ) | (15,564 | ) |

| Other financial items | 20,832 | 22,772 | ||

| Loss on disposal | 3,701 | (12,184 | ) | |

| Other non-operating expenses | (132 | ) | - | |

| Taxes | (450 | ) | (246 | ) |

| Equity in net earnings of affiliates | 15,457 | 15,681 | ||

| Net income attributable to non-controlling interests | (5,453 | ) | (6,546 | ) |

| Net loss attributable to Golar LNG Ltd | (13,679 | ) | (23,943 | ) |

In 4Q the Company generated a net loss of $13.7 million. Notable contributors to this are summarised as follows:

- Interest income, expense and other financial items are each in line with the prior quarter.

- A $3.7 million adjustment was made in 4Q to reduce the provisional 3Q $12.2 million non-cash loss recognised on disposal of Golar Power.

- Golar accounts for its interests in Golar Partners and Golar Power using the equity method of accounting and reports their contribution under equity in net earnings of affiliates. The $15.5 million 4Q equity in net earnings of affiliates is primarily comprised of a $9.1 million loss in respect of Golar's 50% share in Golar Power and net earnings of $25.0 million from the Company's stake in Golar Partners. Distributions received from the Partnership amounted to $15.1 million during the quarter.

The reported financial results contained herein for the fourth quarter of 2016 are preliminary in particular in relation to two outstanding items as explained further below

Golar Power -Status of affiliate's valuation exercise

In October 2016, the Company's affiliate, Golar Power elected to buy out the project developer's, Genpower, 50% equity interest in the entity which holds the investment in the Sergipe project company. Accordingly, Golar Power has accounted for this step acquisition as a business combination. The initial accounting requires a valuation exercise to be performed in order to reflect all identifiable assets and liabilities acquired at fair value. This valuation exercise is in progress and is expected to be finalized by the time the Company's Form 20-F is filed. Adjustments arising from this valuation, which are expected to result in a gain, will impact the following line items in the financial statements, "investments in affiliate" and "Equity in net earnings in affiliates" in the Company's balance sheet and income statement, respectively. There will be no impact on the Company's reported net cashflows. The Company's preliminary fourth quarter results presented herein exclude all fair value adjustments arising from this transaction and the valuation exercise.

IDR Reset

In October 2016, the Company received 3.7 million common units and 0.1 million general partner units (inclusive of 0.8 million earn-out units) in exchange for enabling Golar Partners to reset its IDRs. The accounting for this transaction is complex. As a result the Company is still in the process of completing its assessment as to the appropriate accounting treatment under US GAAP for this transaction. With regard to the Company's preliminary fourth quarter results, no gain or loss has been recognized in the Company's statement of income in respect of this transaction and the Company has presented all interests exchanged in Golar Partners on a historical carrying value basis. The alternative accounting treatment would be to recognize this transaction on a fair value basis. Accordingly, the potential impact, once the final accounting has been determined may be quantitatively material to the Company's income statement and balance sheet. However, this would not impact the Company's reported net cash flows. Any adjustment to reflect the final conclusion will be made in the financial statements included when the form 20-F is filed.

Commercial Review

LNG Shipping

LNG chartering activity was light for the first half of the quarter. Into December fixing activity increased as stronger Asian demand coincided with supply outages at Gorgon T1 and Brunei. Asian LNG prices quickly responded rising steeply toward $10mmbtu. This widened the export spread for US cargoes, many of which were redirected from their more proximate markets of South America, Europe, the Middle East and India toward the Far East. The resultant increase in ton miles combined with thin tonnage availability resulted in a step-up in rates for available Atlantic based vessels. The increase in ton miles was also sufficient to negate the negative impact of supply outages in the Pacific basin where rates also responded to firming expectations.

Into January, a cold snap in Europe saw European LNG prices ramp up to equalise with Eastern indices. Inter-basin arbitrage opportunities closed and spot LNG prices in both basins subsequently declined in lock-step as Gorgon production resumed and European temperatures rose. Vessel rate expectations have since eased back.

Seasonal fluctuations and supply outages aside, new production continues to deliver with T9 of Malaysia LNG, Petronas FLNG1 and train 2 operations of Gorgon and Sabine Pass now in ramp-up mode. Gorgon T3 and Sabine Pass T3 & 4 together with Wheatstone are all on track for start-up this year. Consensus estimates indicate that approximately 35 million tons of new LNG will reach the market in 2017, more than twice the new production delivered in 2016. It is however important to note that a material portion (approximately 24 million tons) of the new 2017 production is due to commence in the second half of the year and that this will not therefore influence the shipping balance until the end of the year. All in, approximately 125 million tonnes of new production equivalent to 47% of current LNG production is expected to deliver between now and 1Q 2021.

Although the market remains long, prompt available shipping is approximately half what it was in January 2016. Increased activity in the market for short to medium term charter arrangements from the major operators has been noted.

Golar Partners

The existing fleet of six operating FSRUs, all of which reside within Golar Partners but are managed by the Company, have maintained operational excellence achieving 100% availability during scheduled 4Q operations.

On December 23, Golar Partners received notice of Petrobras' intention to terminate the FSRU Golar Spirit charter in June 2017, 14 months ahead of schedule. Current rainfall is supporting reliable hydro power in Brazil which in turn has facilitated Petrobras' inclusion of its nearest expiring FSRU contract in its cost savings program. The Partnership will receive a termination fee approximately equivalent to 62% of EBITDA* which would have otherwise been earned between June 2017 and August 2018. Golar Spirit is now being actively marketed for new opportunities with particular focus on smaller scale developments.

The FSRU Golar Tundra remains at anchor off the coast of Ghana. Charterer, West Africa Gas Limited ("WAGL") received parliamentary approval for their gas sales agreement in October and have commenced some works but the major construction works of a connecting pipeline, jetty and breakwater are yet to be completed. Until this infrastructure is in place the FSRU cannot commence operations. While Golar remains in dialogue with WAGL regarding an alteration of the existing charter agreement, including a later start-up and an extension of the charter period, we are actively protecting our legal right with regard to collection of amounts due under the charter. In order to mitigate the consequences of non-payment, Golar has requested and awaits WAGLs permission to trade the ship in the short term market.

Golar Partners right to put the vessel back to Golar expires in late May. In view of the current situation, if a mutually agreeable alternative arrangement cannot be found there is a risk that the vessel will be put back. This being the case, the Company will assume legal ownership of the vessel and repay approximately $107 million to the Partnership.

Downstream - Golar Power

On October 17, CELSE, a project company 50% owned by Golar Power and 50% by Ebrasil, reached a FID on its 25 year Brazilian FSRU-to-power project. CELSE subsequently entered into two agreements:

1) A lump-sum turn-key EPC agreement with General Electric to build, maintain and operate a 1.5GW combined cycle power station, and

2) A flexible Sale and Purchase Agreement with Ocean LNG Limited, an affiliate of Qatar Petroleum and ExxonMobil to provide the power station with LNG.

All-in capital expenditure for the power station and supporting infrastructure is expected to be BRL4.3 billion. After deducting the cost of chartering in the FSRU and assuming no dispatch of power, the Sergipe project is expected to generate a projected annual EBITDA* of BRL1.1 billion. Additional returns can be earned if the power station is called upon to dispatch.

Good development progress is now being made and the project remains on track to distribute power to its 26 committed off takers from January 2020. Site groundworks and offshore engineering together with procurement, licencing, logistic and permitting activities necessary to bring the 90+ large modules to site and import the new build FSRU Nanook are all underway.

When called upon to dispatch, the FSRU Nanook will be approximately 35% utilised. Remaining capacity can be used for an expansion of the Sergipe power complex. This is actively being developed to be offered into future energy auctions. Structures for commercialising the remaining FSRU capacity via its integration into the Brazilian grid are also being independently pursued by Golar Power and CELSE. Any returns generated from this will be additional to the FSRUs 25-year $39 million annual EBITDA*, all of which accrues to Golar Power.

Long-lead items for Golar Power's first FSRU conversion were ordered in January. This enables Golar Power to commit to provide an FSRU for a project start-up as early as May 2018. Several commercial leads with the potential to crystallise into time charters by mid-2017 are in the pipeline.

LNG prices remain competitive on a burn parity basis even after seasonal uplifts. The scale of new production soon to arrive can be expected to place a de-facto lid on LNG prices until new markets have been opened up to absorb the uncontracted length. Inexpensive LNG can therefore be expected to remain very supportive of the FSRU business for at least the next 2-3-years. Golar Power is actively pursuing several specific integrated LNG to power opportunities globally.

FLNG

The FLNG Hilli conversion is proceeding to plan and remains under budget. During recent months approximately 4,500 contractors have been working on the vessel. Testing and pre-commissioning has commenced and will continue in Singapore until the vessel is scheduled for redelivery from the yard in May. Commissioning and production are scheduled to start by the end of September. Perenco are on track with their scope of works in Cameroon and SNH are firmly committed to their stake in the project. The Government is also supportive of opportunities to draw upon neighbouring stranded gas reserves to increase utilisation of the FLNG Hilli, recently renamed Hilli Episeyo.

Upstream - OneLNG

On November 10, OneLNG signed a binding Shareholders Agreement with Ophir Holdings and Ventures Limited to establish a joint venture to commercialise Ophir's 2.6Tcf Fortuna gas reserves, offshore Equatorial Guinea. The joint venture, 66.2% and 33.8% owned by OneLNG and Ophir respectively, will own both Ophir's share of the Block R licence and the FLNG vessel Gandria which are collectively expected to produce between 2.2-2.5mtpa of LNG over 15-20 years.

A signed term-sheet with a syndicate of Far Eastern banks has been received and documentation is now progressing. Good progress toward securing the requisite governmental approvals has also been made. As previously communicated, FID is expected to be taken within the first half of 2017 and the Gandria is now positioning to Keppel shipyard where refurbishment work will be initiated.

Including upstream and midstream development CAPEX, the project is expected to cost $2.0 billion to develop. Of this, approximately $1.5 billion will be used to convert the FLNG Gandria and $0.5 billion will cover upstream work necessary to bring gas from ground to vessel. After Ophir's injection of up to $150 million and assuming debt of $1.2 billion, OneLNG will be expected to contribute approximately $650 million. With respect to its $332 million share, Golar can expect to receive credit for the LNG carrier Gandria and associated down payments already made to Keppel. Any credit receivable with respect to the Company's intellectual property contribution and guarantees provided will likely be reflected in a greater than 51% share of OneLNG's 66.2% stake in the joint venture accruing to Golar. The national gas company of Equatorial Guinea, Sonagas, has also expressed interest in taking a stake in the midstream FLNG Gandria. Although this would not change the ownership structure of the joint venture, it would reduce its stake in the FLNG Gandria. Investment by Sonagas would further improve stakeholder alignment and reduce the above equity contributions required from OneLNG and Ophir.

OneLNG is working actively on 4-5 additional projects, each involving 1 or more FLNG unit. The structures of these opportunities range from fully integrated projects where OneLNG will also be reserve holders to projects where FLNG units are rented on a tariff basis to major gas companies.

Financing Review

Liquidity

Golar's unrestricted cash position as at December 31, 2016 was $224.2 million. Subsequent to February's convertible bond issue, the cash position is approximately $543 million today. Of the outstanding $250 million March maturing convertible bond, $30 million was purchased prior to year-end. The $220 million balance will be serviced by the undrawn $150 million margin loan and proceeds raised from other financing activities.

FLNG Hilli Episeyo financing

As at December 31, 2016, $678 million has been spent on the Hilli Episeyo conversion ($732 million including capitalised interest) and $250 million has been drawn against the $960 million CSSCL facility. A further $34.5 million of restricted cash associated with the Perenco Letter of Credit was released to liquidity in 4Q reducing the restricted cash tied up in this facility to $232 million as at December 31.

Convertible financing

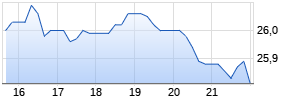

On February 17 the Company closed a new $402.5 million senior unsecured 5-year 2.75% convertible bond. The conversion rate for the bonds will initially equal 26.5308 common shares per $1,000 principle amount of the bonds. This is equivalent to an initial conversion price of $37.69 per common share or a 35% premium on the February 13 closing share price of $27.92. The conversion price is subject to adjustment for dividends paid. To mitigate the dilution risk of conversion to common equity, the Company also entered into capped call transactions costing approximately $31.2 million. The capped call transactions cover approximately 10,678,647 common shares, have an initial strike price of $37.69 and an initial cap price of $48.86. The cap price of $48.86, which is a proxy for the revised conversion price, represents a 75% premium to the February 13 closing price. Including the $31.2 million cost of the capped call the all-in cost of the bond is approximately 4.3%. Bond proceeds net of fees and the cost of the capped call amount to $360.2 million.

Proceeds from the convertible bond will be used to fund the Company's initial equity participation in the Fortuna FLNG project, to meet its commitments to Golar Power and for general corporate purposes.

Concluding the new convertible bond affords Golar the flexibility to manage timing differences between investment commitments and the release of other identified sources of funding without being exposed to the risk of delays, unsupportive market conditions or working capital shortfalls.

The Company anticipates that significant cash will be released during the first year following start-up of Hilli Episeyo. Major components of this include $160 million equity released from the final loan draw-down, $87 million released from the letter or credit in favour of Perenco and $170 million in expected EBITDA* from operations.

Corporate and Other Matters

As at December 31 there are 101 million shares outstanding including 3.0 million Total Return Swap ("TRS") shares that have an average price of $42.03 per share. There are also 3.8 million outstanding stock options in issue.

The dividend will remain unchanged at $0.05 per share for the quarter.

Outlook

The Company now has access to the capital it needs to support its legacy shipping business, deliver FLNG Hilli Episeyo, meet its share of Golar Power's equity contribution to the Sergipe project and take a Final Investment Decision on the Fortuna FLNG project without further recourse to equity markets. Having recovered its 'equity currency', the Partnership successfully completed in February an underwritten public offering raising gross proceeds of approximately $119.4 million. Golar Partners now has the capital it needs to contemplate the acquisition of a share of the FLNG Hilli Episeyo. A further $107 million will be available to Golar Partners should the FSRU Tundra be put back at the end of May. This share in Hilli Episeyo could therefore be increased. Golar and the Partnership are continuing their discussions with regard to the Hilli deal structure and valuation and expect to make a decision later this year.

The results of the shipping business are expected to show some improvement in Q1 2017 relative to Q4 2016. Any major improvement in shipping rates should not however be expected before 2H 2017 when a further 24 million tons of new LNG are expected to reach the market.

Although the immediate priority of Golar is firmly on delivering and commissioning the FLNG Hilli Episeyo on time and on budget, the Board is pleased that the Company is now on track to become a fully integrated clean energy well to grid company in 2020.

Forward Looking Statements

This press release contains forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended) which reflects management's current expectations, estimates and projections about its operations. All statements, other than statements of historical facts, that address activities and events that will, should, could or may occur in the future are forward-looking statements. Words such as "may," "could," "should," "would," "expect," "plan," "anticipate," "intend," "forecast," "believe," "estimate," "predict," "propose," "potential," "continue," or the negative of these terms and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Unless legally required, Golar undertakes no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise.

Among the important factors that could cause actual results to differ materially from those in the forward-looking statements are: changes in LNG carriers, FSRU and floating LNG vessel market trends, including charter rates, ship values and technological advancements; changes in the supply and demand for LNG; changes in trading patterns that affect the opportunities for the profitable operation of LNG carriers, FSRUs; and floating LNG vessels; changes in Golar's ability to retrofit vessels as FSRUs and floating LNG vessels, Golar's ability to obtain financing for such retrofitting on acceptable terms or at all and the timing of the delivery and acceptance of such retrofitted vessels; increases in costs; changes in the availability of vessels to purchase, the time it takes to construct new vessels, or the vessels' useful lives; changes in the ability of Golar to obtain additional financing; changes in Golar's relationships with major chartering parties; changes in Golar's ability to sell vessels to Golar LNG Partners LP; Golar's ability to integrate and realize the benefits of acquisitions; changes in rules and regulations applicable to LNG carriers, FSRUs and floating LNG vessels; changes in domestic and international political conditions, particularly where Golar operates; accounting adjustments relating to Golar's ownership in Golar Power; accounting adjustments relating to the accounting treatment of general partner units Golar holds in Golar LNG Partners LP; as well as other factors discussed in Golar's most recent Form 20-F filed with the Securities and Exchange Commission. In particular, there is no guarantee that any expectations set forth in "Golar Power - Status of affiliate's valuation exercise" and "IDR Reset" will have the impact on our balance sheet or income statement described therein. Unpredictable or unknown factors also could have material adverse effects on forward-looking statements.

As a result, you are cautioned not to rely on any forward-looking statements. Actual results may differ materially from those expressed or implied by such forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise unless required by law.

February 28, 2017

The Board of Directors

Golar LNG Limited

Hamilton, Bermuda

Questions should be directed to:

Golar Management Limited - +44 207 063 7900

Oscar Spieler - Chief Executive Officer

Brian Tienzo - Chief Financial Officer

Stuart Buchanan - Head of Investor Relations

The issuer of this announcement warrants that they are solely responsible for the content, accuracy and originality of the information contained therein.

Source: Golar LNG via Globenewswire

Mehr Nachrichten zur Golar LNG Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.