Global Study: The Next Five Years Will See Dramatic Increase of Factor Strategy Usage Among Institutional Investors

PR Newswire

ATLANTA, Nov. 28, 2016

ATLANTA, Nov. 28, 2016 /PRNewswire/ -- According to a new independent global study on factor investing, demand and adoption of factor-based strategies will continue on an upward trend. Specifically, the study found that demand is likely to surge in the next five years, with 71% of respondents expecting to increase factor allocations [figure 1]. Over two thirds of respondents (70%) already use factors in portfolio construction, with risk reduction as the primary driver, followed by increased alpha, a measure of risk-adjusted performance, [figure 2], and half of non-user respondents are considering factor capabilities.

The qualitative and quantitative research was gathered from in-person interviews with global pension funds, insurers, sovereign wealth funds, asset consultants and private banks.* The study was commissioned by Invesco, a leading global investment firm.

Many respondents explained that they had made small allocations as part of an initial trial period for factor investing, but plan to increase these allocations. Growth is expected particularly in multi-factor quantitative strategies, internal factor models and fixed income and liquid alternative products, as investors continue to seek alternative sources of returns in a sustained low-yield environment of low interest rates and stock market volatility.

For institutional investors: a tailored, strategic approach to factors is key

There is strong belief in the rationale behind factor investing, with 83% of respondents agreeing that factors help explain outperformance. However, the research reveals that investors' focus is less on off-the-shelf factor capabilities and more on strategic factor models and a more holistic multi-factor approach which explains all of their factor exposures.

"Our research confirms that both popularity and desire for even greater adoption of factor investing are growing. But given the diverse nature of investors, the asset management industry needs to consciously address their clients' needs for a tailored and consultative approach towards the implementation of factor-based strategies," said Bernhard Langer, CIO of Quantitative Strategies at Invesco.

For example, while sovereign investors in Asia have been the fastest adopters of internal risk factor models, German insurers, driven by liquidity requirements and regulatory constraints, are migrating from fundamental investments to smart beta ETFs and equity factor models to improve risk adjusted returns. While in the UK, post retail distribution review (RDR), charge caps on default funds and stakeholder engagement have facilitated growth in smart beta products so that UK defined contribution pension funds are now using factor products because they offer a more cost-efficient route to diversification.

"Global trends in factor investing are resonating across the U.S. as well, with investors seeking efficient vehicles for yield and risk protection, driving flows into smart beta fixed income strategies and low volatility ETFs," said Dan Draper, Invesco's Global Head of PowerShares.

Institutions prefer internal control of strategies, but with hands-on support from asset managers

Despite a strong preference for internal control over factor models [figure 3], a lack of internal capabilities was cited as the greatest adoption barrier with a rating of 8.3 out of 10 [figure 4].

While institutions want to control their factor investments, they explicitly requested support from the wider asset management industry, citing training support and consulting advice as the two most effective industry propositions to address their concerns [figure 5].

"There is clearly a call for the asset management industry to show a greater understanding of how investors want to manage and assess factors in their portfolios, and how asset managers can help with this," said Langer. As investors and their investment service providers become more comfortable with factor capabilities, we expect greater separation between assessing and managing factors to emerge as investors realize they can retain control while outsourcing the strategy execution."

Many investors explained that consultants should be well positioned to be the natural partner—with practical application expertise—for an institution looking to develop a strategic factor-based approach, referencing their experience supporting institutions with asset liability models as an example.

According to the study, only 9% of respondents cited academic institutions as best placed to assess the role of factors within their portfolio [figure 3]. This is ultimately where asset managers can play an extended partnership role with institutional investors, bringing hands-on support and global capital markets teams to assist with trade execution and liquidity services as required.

Private banks specifically stated that the greater use of ETFs, indexing, smart beta and active quantitative products alongside fundamental active management are driving greater cost efficiencies.

"Factor strategies are opening new doors to portfolio diversification, and we've found that—along with growing investor adoption—there is increasing demand for fund providers to demonstrate their holistic understanding of clients' needs beyond product selection to also recommend practical insights for portfolio implementation," said Draper.

For more information on PowerShares Factor Investing, please visit: https://www.invesco.com/portal/site/us/financial-professional/etfs/strategies/factor-investing/.

Notes to editors

*Sample & methodology - The fieldwork for this study was conducted by NMG's strategy consulting practice. Invesco chose to engage a specialist independent firm to ensure high quality objective results. NMG conducted in-depth (typically 1 hour) face-to-face interviews with key decision makers within 66 different asset consultants (AC), insurers (INS), pension funds (PEN), sovereign wealth funds (SWF) and private banks (PB) globally.

Figure 1

Photo - http://photos.prnewswire.com/prnh/20161127/443069

Figure 2

Photo - http://photos.prnewswire.com/prnh/20161127/443068

Figure 3

Photo - http://photos.prnewswire.com/prnh/20161127/443067

Figure 4

Photo - http://photos.prnewswire.com/prnh/20161127/443066

Figure 5

Photo - http://photos.prnewswire.com/prnh/20161127/443065

Figure 6

Photo - http://photos.prnewswire.com/prnh/20161127/443064

About Invesco

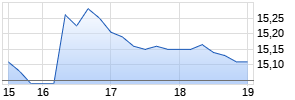

Invesco is an independent investment management firm dedicated to delivering an investment experience that helps people get more out of life. NYSE: IVZ; www.invesco.com.

About PowerShares by Invesco

PowerShares by Invesco is leading the Intelligent ETF Revolution® through its family of 140 domestic and international PowerShares exchange-traded funds (ETFs). PowerShares ETFs seek to outperform traditional benchmark indexes while providing advisors and investors access to an innovative array of focused investment opportunities. With US franchise assets exceeding $105 billion as of September 30, 2016, PowerShares ETFs trade on both US stock exchanges. For more information, please visit us at powershares.com or follow us on Twitter @PowerShares.

Risk Information

There are risks involved with investing in ETFs, including possible loss of money. Actively managed ETFs do not necessarily seek to replicate the performance of a specified index. Actively managed ETFs are subject to risks similar to stocks, including those related to short selling and margin maintenance. Ordinary brokerage commissions apply. The Fund's return may not match the return of the Index. The Fund is subject to certain other risks. Please see the current prospectus for more information regarding the risk associated with an investment in the Fund.

Factor investing is investment strategy in which securities are chosen based on attributes that have been associated with higher returns.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

Beta is a measure of risk representing how a security is expected to respond to general market movements. Smart Beta represents an alternative and selection index based methodology that seeks to outperform a benchmark or reduce portfolio risk, or both in active or passive vehicles. Smart beta funds may underperform cap-weighted benchmarks and increase portfolio risk.

Diversification does not guarantee a profit or eliminate the risk of loss.

Shares are not individually redeemable and owners of the shares may acquire those shares from the Fund and tender those shares for redemption to the Fund in Creation Unit aggregations only, typically consisting of 50,000, 75,000, 100,000 or 200,000 shares.

PowerShares® is a registered trademark of Invesco PowerShares Capital Management LLC, investment adviser. Invesco PowerShares Capital Management LLC (Invesco PowerShares) and Invesco Distributors, Inc., ETF distributor, are indirect, wholly owned subsidiaries of Invesco Ltd.

Note: Not all products available through all firms.

Before investing, investors should carefully read the prospectus/summary prospectus and carefully consider the investment objectives, risks, charges and expenses. For this and more complete information about the Fund call 800 983 0903 or visit invescopowershares.com for the prospectus/summary prospectus.

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/global-study-the-next-five-years-will-see-dramatic-increase-of-factor-strategy-usage-among-institutional-investors-300368798.html

SOURCE Invesco Ltd.

Mehr Nachrichten zur Invesco Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.